eth price: analysis and trader losses

Ethereum's $3,700 Cliff: Is This Just a Dip, or the Start of a Real Slide?

ETH's Rocky Road: Data Dive

Ethereum's facing some headwinds, no doubt. We saw it struggle to hold above $4,000, and now it's testing lower supports. The immediate concern? That $3,700 level. A break below that, and we're likely looking at a sweep of sell-side liquidity – a fancy way of saying more downward pressure.

The $3,500-$3,300 range is the crucial zone. That's where the 200-day moving average sits (around $3,300, to be exact), and it also marks the lower boundary of this descending channel we've been watching. Lose that, and the bears will be gunning for $3,000. A drop to the $3,400-$3,500 demand zone looks probable in the short term. Whether it holds is the million-dollar question, or rather, the multi-billion-dollar question, considering the market cap at stake.

And here's the part of the analysis that I find genuinely concerning: the Coinbase Premium Index. A deeply negative reading suggests US-based buyers, typically a strong source of demand, are sitting on the sidelines. Extended periods of this negativity have historically coincided with distribution phases – where large holders sell off their positions – or at least deeper pullbacks. Are we seeing the start of a similar pattern? It's tough to say definitively, but the correlation is there.

Liquidation Cascade & Market Sentiment

We're also seeing significant liquidations. Over $300 million in Ethereum positions were wiped out. Historically, these big liquidation clusters can signal capitulation, a "washout" that sets the stage for a short-term bounce. But it's a double-edged sword. The pain has to be felt before the healing can begin. BTC, ETH, XRP , SOL News: Traders Lose Over $1B in 24 Hours as Longs Get Crushed - CoinDesk

Traders are also clearly jittery ahead of the Federal Reserve’s upcoming rate decision. Uncertainty always breeds volatility, and crypto is no stranger to that. The sentiment shift is palpable. You see it in the comment sections, the Telegram groups – a general air of unease. People are talking about a potential "crypto winter" again. While online sentiment shouldn't be taken as gospel, it does reflect the current mood – a mood increasingly driven by fear rather than FOMO.

The question is, how reliable are these sentiment readings? Most of the online discourse is happening in echo chambers. Are these fears overblown because people are only listening to other people who are afraid, or is there a genuine fundamental shift in the market? It's hard to get a clear signal.

A breakdown below this area could lead to a 10% decline, potentially reaching $3,000.

Data Doesn't Lie: Panic is Setting In

The data paints a clear picture: Ethereum is at a critical juncture. The negative Coinbase Premium Index, coupled with the liquidation cascade and the broader market unease, suggests the path of least resistance is currently downward. While a short-term bounce is always possible, the underlying fundamentals need to improve before we can confidently say this is just a dip. Right now, the data suggests something more concerning.

Related Articles

Solana's Bull Party is Over: What Happened?

Okay, so Solana crapped the bed yesterday. Broke below some "upward trendline" from April, and now e...

The Food Safety System That Worked: Inside the Egg Recall and the Tech That Stopped a Crisis

This Egg Recall Exposes a Flaw in Our Reality—And the Tech That Will Fix It You probably saw the hea...

B&M Recalls Harvest Mug: Why Your 'Cozy' Fall Mug Might Just Explode

So let me get this straight. The primary, singular, unassailable function of a mug is to hold hot li...

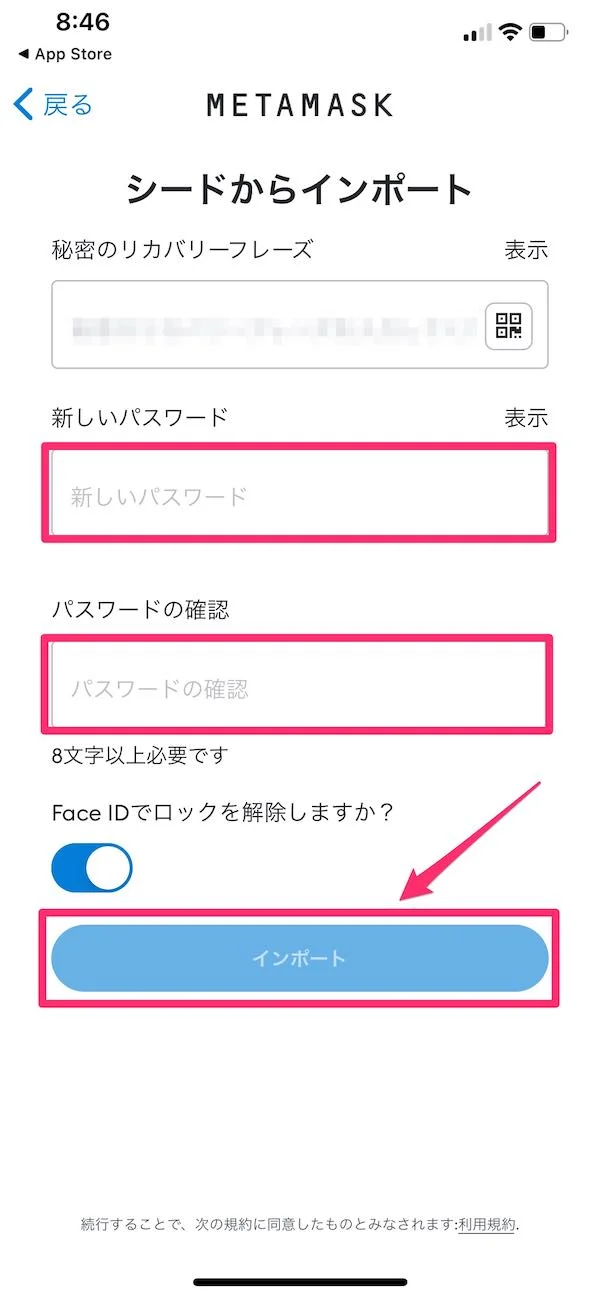

MetaMask: What It Is, How It Works, and Why It's Your Key to Web3

For years, we’ve thought of MetaMask as a key. A simple, indispensable tool. It’s the friendly fox i...

Polymarket Rebound: What's Driving the Surge?

The Rise of Polymarket: How Shayne Coplan is Betting on the Future—and Winning Shayne Coplan. Rememb...

Aster Trade's Wild Ride: CZ's Investment, DEX Upgrade, and Token Volatility

Dr. Thorne: Can CZ's "Unlucky Charm" Actually Be Crypto's Lucky Break? Okay, folks, buckle up becaus...