Cryptocurrency Analysis: The Unstoppable Future.

Generated Title: Bitcoin's Back! How Trump's Crypto-Friendly Policies Ignited a New Bull Run

Okay, buckle up, folks, because things are moving fast. I'm seeing a seismic shift in the crypto landscape, and honestly, it's the kind of thing that makes you want to shout from the rooftops. We're not just talking about a minor price bump; we're talking about a fundamental change in how the world views—and regulates—digital assets. And it’s all thanks to a perfect storm of policy shifts and market momentum.

The Trump Effect: From Skeptic to Savior?

Remember when crypto felt like a constant uphill battle against regulatory uncertainty? Well, those days are fading fast.

Global Crypto Policy Review Outlook 2025/26

The Global Crypto Policy Review Outlook 2025/26 Report is screaming one thing: Clarity is king, and it's unlocking massive institutional adoption. The report highlights that in 2025, about 80% of reviewed jurisdictions saw financial institutions announce new digital asset initiatives. Think about that—eighty percent! That's not a wave; that's a tsunami of traditional finance embracing crypto.

US Policy and the PWG Report

And at the heart of this? The US under the Trump administration. I know, I know, some of you might be raising an eyebrow, but hear me out. His administration's pro-innovation stance—emphasizing innovation, rejecting a retail CBDC, and establishing a President’s Working Group on Digital Asset Markets (PWG)—has been a shot in the arm for the entire industry. The PWG's report, a 163-page roadmap, is the most detailed whole-of-government framework to date, mapping coordinated action on market structure, stablecoins, payments, AML/CFT safeguards, and banking integration. It's like they finally handed the crypto industry the instruction manual it always needed!

The Need for Global Consistency

This isn't just about the US, though. The report emphasizes the need for global consistency in crypto regulation to prevent regulatory arbitrage. International bodies like the Financial Action Task Force (FATF) and the Financial Stability Board (FSB) are echoing this sentiment, pushing for consistent standards across jurisdictions. This is crucial because crypto's borderless nature means that gaps in regulation can be exploited by illicit actors.

North Korea's Bybit Hack

Consider North Korea's record-breaking hack on Bybit in early 2025. The attackers laundered proceeds through unlicensed over-the-counter (OTC) brokers, cross-chain bridges, and decentralized exchanges—infrastructure largely outside existing regulatory perimeters. This incident underscored the need for better cross-jurisdictional coordination and real-time information sharing between compliant VASPs and law enforcement.

Landmark Legislation: GENIUS and CLARITY Acts

And it's not just talk. The GENIUS Act, a landmark piece of legislation on stablecoins, has passed, establishing a federal regime for issuance, reserves, audits, and oversight. The House has also passed the CLARITY Act, a market structure bill that divides jurisdiction between the SEC and CFTC, defines when tokens may transition from securities to commodities, and creates a registration pathway for platforms.

Stablecoins Take Center Stage

It’s like the dam has finally broken, and the pent-up energy of innovation is flooding the market. Stablecoins, in particular, are taking center stage. With stablecoins reaching a record high in 2025, over 70% of jurisdictions reviewed advanced new stablecoin regulatory frameworks. From the US’ GENIUS Act to the EU’s MiCA rollout and new regimes making progress in Hong Kong, Japan, Singapore, and the UAE, regulators are finally articulating standards in key areas like issuance, reserves, and redemption.

Institutional Adoption and Regulatory Clarity

This regulatory clarity is creating major tailwinds for institutional adoption, with financial institutions in about 80% of jurisdictions announcing new digital asset initiatives. Markets with clear, innovation-friendly regulation — such as the US, EU, and parts of Asia — have become catalysts for global institutional participation. I mean, think about it: institutions need rules they can follow. And now they're getting them.

Regulation and Illicit Finance

Remember all the hand-wringing about illicit finance in crypto? Well, the report shows that virtual asset service providers (VASPs), the most widely regulated segment of the crypto ecosystem, have significantly lower rates of illicit activity than the overall ecosystem. Regulation isn't just stifling innovation; it's making the space safer and more sustainable.

Bitcoin Treasury Companies Rebound

But what does all this mean for Bitcoin, the OG of crypto? Well, the renewed regulatory clarity and institutional interest is breathing new life into the Bitcoin treasury company model. These companies, which hold large amounts of Bitcoin as part of their corporate treasury, are now seeing their equity valuations rebound as investor confidence returns. Even after a significant downturn, the prospect of Bitcoin hitting new all-time highs is reigniting interest in these leveraged plays on BTC exposure.

Challenges and Risks

Of course, this isn't without its challenges. As DAT’s All, Folks? What’s Next for Bitcoin Treasury Companies pointed out, the bitcoin treasury model works only as long as a company's equity trades at a premium to its BTC net asset value (NAV). When those premiums collapse, the entire flywheel reverses. We saw this happen in late 2025, when Bitcoin's price drop caused equity premiums to compress, leading to unrealized losses for many treasury companies.

A Pivotal Moment

However, with the renewed bullish momentum, these companies are now well-positioned to benefit from the next leg up. Strategy, for example, has established a $1.44 billion cash reserve to manage liquidity during periods of compressed premiums and weaker BTC prices. This proactive approach is a sign that the industry is learning from past mistakes and becoming more resilient.

I truly believe this is a pivotal moment. Bitcoin isn't just bouncing back; it's entering a new era of main

Related Articles

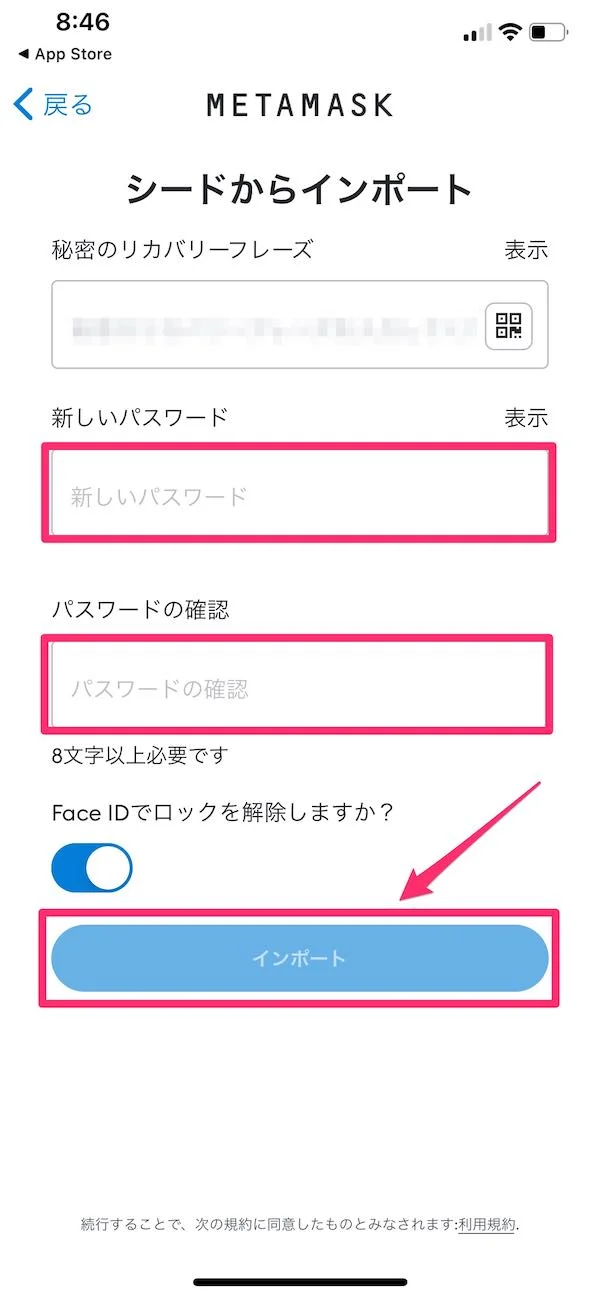

MetaMask: What It Is, How It Works, and Why It's Your Key to Web3

For years, we’ve thought of MetaMask as a key. A simple, indispensable tool. It’s the friendly fox i...

Crypto: Can the Feds Tame It?

Bots Gone Wild or Calculated Crime? Crypto Trial's Verdict Could Redefine "Fair" The Algorithm vs. t...

DeFi's 'Recovery': It's Just More Hopium. (- /r/DeFi Reacts)

Is DeFi Really "Decentralized" Finance? Initial Reactions to the DeFi Crash So, another cryp...

Balancer Hacked: $110M Moved – What We Know and the Internet's Reactions

Balancer's $110M Hack: A Wake-Up Call or DeFi's Ultimate Stress Test? Okay, folks, let's dive into t...

Plasma: What It Is, How It Saves Lives, and What Comes Next

The night sky over Wyoming split open. It wasn’t the familiar, ghostly dance of the aurora that Andr...

DeFi After the October Crash: Charting Investor Trends and 2025's Brightest Prospects

Alright, buckle up, because I'm about to tell you something that should get every tech optimist buzz...