Crypto Market Faces Headwinds: Analyzing the Macro Signals Driving the Dip

Generated Title: Bitcoin's Silent Standoff: Why a Sideways Market Masks a Brewing Storm

The chatter has died down. The manic "Uptober" narrative, which saw traders forecasting a straight shot to new all-time highs, has given way to a nervous, sideways shuffle. Bitcoin is currently oscillating in a tight range around $110,000, a price that feels less like a confident plateau and more like a statistical purgatory. Community sentiment, a qualitative data set I always watch, has pivoted to "Red October," and the handoff into November feels weak.

On the surface, this is a picture of indecision. As reported in Crypto Prices Slip Ahead of US Jobs Data as Bessent Flags Rate Risks, traders are digesting warnings from Treasury Secretary Bessent about economic strain and parsing every word from Fed Chair Powell for clues on rate cuts. The result is a market that’s holding its breath, with Bitcoin dominance firm—a classic signal of risk aversion as capital retreats from more speculative alt-coins.

But beneath this quiet surface, two powerful and opposing forces are building pressure. One is a macro-driven fear of economic slowdown. The other is a structural, almost bureaucratic, shift in the U.S. regulatory landscape that few seem to be pricing in correctly. This isn't a calm market. It’s a standoff.

The Technical Coil and the Macro Weight

Let’s start with the chart, because that’s where the tension is most visible. Bitcoin’s price action has formed a near-perfect symmetrical triangle, a classic technical pattern indicating consolidation and contracting volatility. Support is holding along an ascending trendline near $106,375, while resistance is capping every rally attempt at $111,675. This is the textbook definition of equilibrium between buyers and sellers.

This technical picture is being weighted down by a heavy macro blanket. Bessent’s comments that restrictive Fed policy may have pushed housing into a recession have traders spooked. The prospect of rate cuts, normally a bullish signal for risk assets, is now being viewed through a darker lens: are they cuts made from a position of strength (a soft landing) or a position of panic (a weakening economy)? Friday’s upcoming jobs report is the next major data point that will tip the scales.

The market is behaving like a patient monitoring their own vital signs. On-chain data from Glassnode confirms the bearish pressure, noting that Bitcoin has failed for three weeks to reclaim the short-term holders’ cost basis near $113,000. This level, which acted as a floor for six months, has now become the ceiling. It’s a clean, data-driven visualization of fading demand at these prices. The whole setup feels like a coiled spring being compressed from above by macroeconomic gravity. We can measure the tension, but predicting the exact moment it snaps—and in which direction—is another matter entirely.

A Regulatory Door Kicked Open

While everyone is glued to the Fed and the 4-hour chart, a far more significant, structural event is unfolding in the background. October was supposed to be ETF month, but the U.S. government shutdown put the SEC’s decision-making process on ice. The market sighed and moved on, leading some to speculate that Crypto ETFs: November Could Be the New October for U.S. After Shutdown Delays SEC Decisions. It shouldn't have.

Issuers, in a clever bit of procedural maneuvering, found a workaround. By filing updated S-1 registration statements with "no delaying amendment" language, they effectively started a 20-day countdown timer. If the paralyzed SEC doesn't actively intervene to stop it, the filing automatically becomes effective. This isn't a loophole; it's a feature of securities law being used as a battering ram against regulatory inertia. And it worked. Four crypto ETFs—two from Canary Capital, one from Bitwise, and one from Grayscale—went live just this week.

And this is the part of the story I find genuinely puzzling. The market’s reaction has been muted, at best. The success of this strategy has already triggered a new wave of filings. Fidelity just refiled for its spot Solana ETF. Canary Capital did the same for an XRP ETF. If the SEC remains on its current passive track, we could see a spot XRP fund trading in the U.S. as soon as November 13.

Of course, there are caveats. As Bloomberg analyst James Seyffart noted, this strategy is most likely to work for funds where the SEC has already provided some feedback on their prospectuses. Filings for assets like XRP, which have received less SEC engagement, might still get blocked. But the precedent has been set. So, the key questions are these: Is the market so singularly focused on short-term interest rate policy that it’s ignoring the opening of a massive new channel for capital inflows? Or is the potential impact of these initial ETFs simply a rounding error compared to the trillions swayed by Fed decisions?

This brings us to the celebrity fear-mongers. Robert Kiyosaki, author of Rich Dad Poor Dad, recently warned his followers of a "massive crash" that would "wipe out millions." His post reached a substantial audience (seen by 4.6 million users on X), yet the market’s response was a collective shrug. Bitcoin held its support. This isn’t the behavior of a market on the verge of panic. It’s the behavior of a market waiting for a real signal, tired of the noise. The total crypto market cap is about $3.7 trillion—to be more exact, $3.69 trillion as of Monday's open—and it seems it will take more than a tweet to trigger a cascade.

A Discrepancy in Search of a Catalyst

My analysis suggests the current market is defined by a profound discrepancy. The short-term technical and macro data point to extreme caution, justifying the sideways price action. Yet the medium-term structural data—specifically the successful ETF workaround—points to a significant, under-appreciated bullish catalyst. The market can’t look in both directions at once, so it has chosen to stand still.

This equilibrium is fragile and, frankly, unsustainable. The symmetrical triangle will break. A decisive close above $111,700 could quickly target $116,000 and higher. A breakdown below $106,000 could see a swift correction toward the $103,500 level.

The current standoff isn't a sign of stability. It’s the market equivalent of a silent, high-stakes poker game where two players have compelling hands. One is betting on a global economic slowdown, the other is betting on a flood of new, regulated U.S. capital. The price chart is just the dealer, waiting to turn over the next card. And while macro fear is a powerful sedative, my view is that the opening of the American ETF market is a permanent, structural change. Fear is cyclical; access is forever.

Previous Post:Today's Rocket Launch: How to Watch History Unfold (Live)

Next Post:macau: What's Really Going On

Related Articles

primerica: What to Know – A Reality Check

Nvidia's AI Hype Train: Are We There Yet? Nvidia. The name is practically synonymous with the AI rev...

Fifth Third Swallows Comerica for $10.9B: Why It's Happening and Why You Should Care

So, another Monday, another multi-billion dollar deal that promises to "create value" and "drive syn...

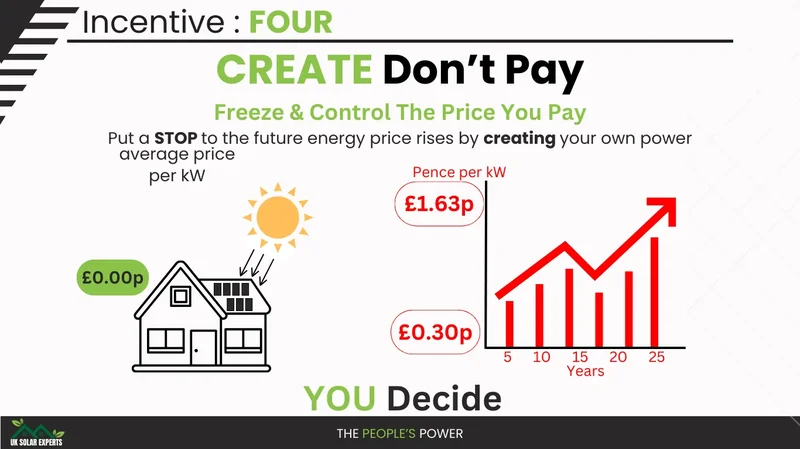

Solar Incentives: Who Benefits and What's the Catch?

Solar's "Silver Linings"? More Like Fool's Gold. Alright, let's get one thing straight: "silver lini...

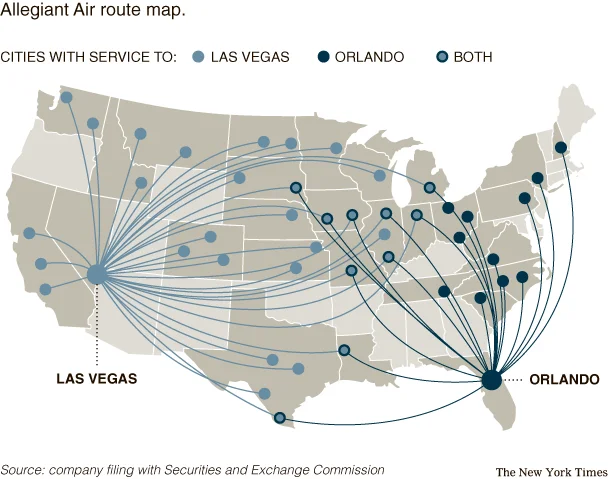

Allegiant Airlines Passenger Growth: What the 12.6% Surge Actually Means

More Passengers, Less Full Planes: Deconstructing Allegiant's Growth Paradox At first glance, news t...

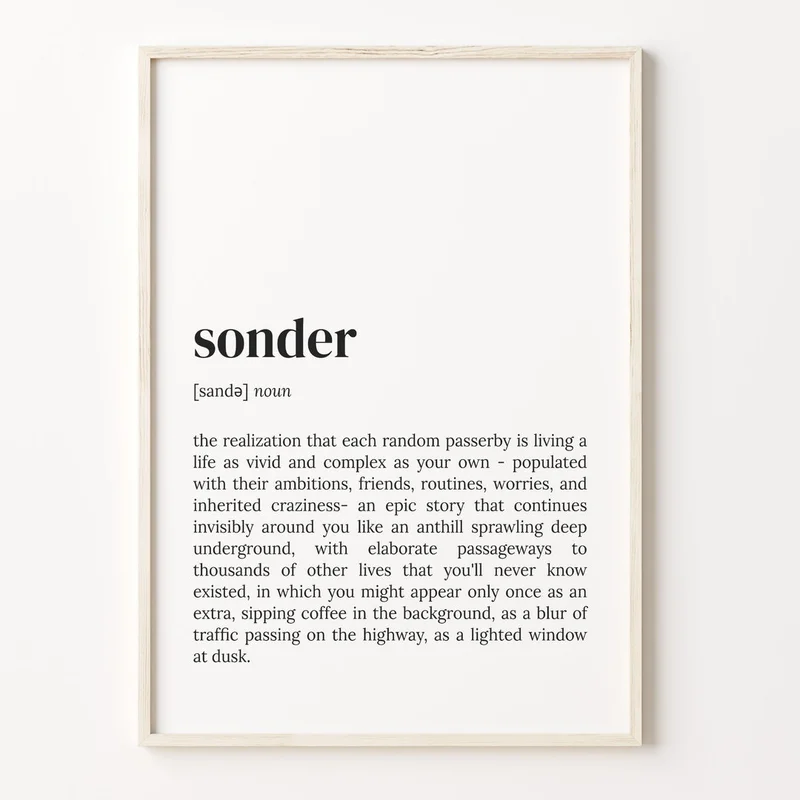

Sonder and Marriott Split: What Happened?

Marriott's Sonder Divorce: A Calculated Risk or a Costly Miscalculation? Marriott International's de...

Powell's Speech: Decoding the Market Impact and Future Rate Cuts

All eyes are on Washington, D.C. tomorrow. Not on Congress, not on the White House, but on a single...