QQQ's Cash Flow Crisis: What's Happening?

QQQ's Afternoon Hiccup: Is Allsopp Right About the Overvaluation?

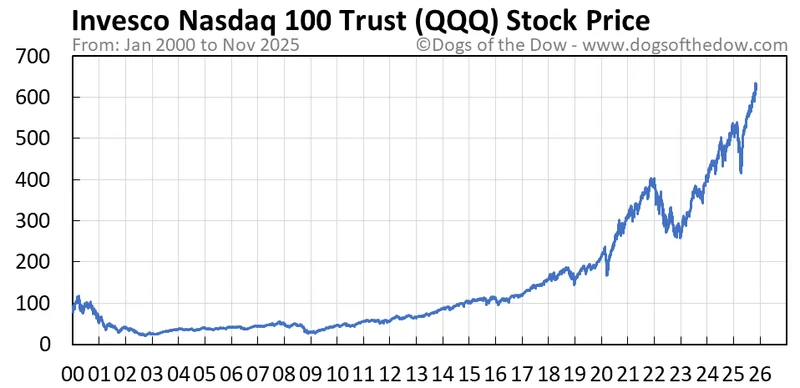

The Invesco QQQ Trust ETF (QQQ), a bellwether for the tech-heavy Nasdaq 100, experienced a minor dip on November 6, 2025, closing down 0.32% at $609.74. It’s the after-hours bounce to $612.14 (a 0.39% increase) that's raising eyebrows, especially in light of Stuart Allsopp's recent Seeking Alpha article. Allsopp's thesis? The QQQ is significantly overvalued and ripe for a correction.

The Nasdaq 100 itself mirrored this performance, closing at 25,059.81, down 0.28%. These aren't earth-shattering moves, but they occur against a backdrop that demands scrutiny. Allsopp’s argument isn’t just some unfounded bearish rant; it's rooted in a claim about inflated profit margins.

He points to the Nasdaq 100's current P/E ratio of 39x based on reported profit margins. However, Allsopp contends that investors are effectively paying a multiple of 59x. This discrepancy, he argues, stems from the surging capital expenditures (capex) and stock-based compensation that are impacting free cash flow margins and, critically, balance sheet cash levels. It's a classic case of "profitability theater," where headline numbers mask underlying cash flow realities. And this is the part of the report that I find genuinely puzzling - why are investors ignoring these crucial cash flow metrics?

The core of Allsopp's argument is compelling: reported earnings can be manipulated (or at least, massaged) more easily than cash flow. Capex, for instance, is a real cash outflow. Stock-based compensation, while not directly impacting the income statement in the same way, dilutes existing shareholders and drains cash when employees exercise those options. Allsopp is short both NDX and QQQ, so he has skin in the game. That doesn't invalidate his analysis, but it's a crucial detail to keep in mind.

The Market's Collective Blind Spot?

The Seeking Alpha article garnered a mere 32 comments. That's a surprisingly muted response, which raises a few questions. Are investors simply complacent, blinded by the seemingly endless upward trajectory of tech stocks? Or is Allsopp's analysis too complex for the average retail investor to grasp? Perhaps the market is pricing in future growth potential that justifies the current valuations, a point Allsopp seems to dismiss.

The market often behaves like a flock of birds – reacting quickly and sometimes irrationally to perceived threats or opportunities. But what happens when the threat is a slow-burning fuse, not an immediate explosion? Allsopp's argument suggests a gradual erosion of value, not a sudden crash. It's like a leaky faucet, slowly draining the reservoir of investor capital.

The critical question is whether the market is correctly pricing in these factors. A P/E of 39x, or even Allsopp's adjusted 59x, might be justifiable if future growth is truly explosive and sustainable. But if that growth falters, or if interest rates rise, those valuations could quickly become unsustainable.

A Cold Dose of Reality

Allsopp's analysis serves as a stark reminder that reported earnings are not the whole story. Investors need to dig deeper, scrutinize cash flow statements, and understand the true cost of growth. It's not enough to simply ride the wave of market enthusiasm; you need to understand the underlying currents. The after-hours bump might just be a temporary blip, or it could be the last gasp before a more significant correction. Only time – and a closer look at the numbers – will tell.

Are We Ignoring the Man Behind the Curtain?

```

Related Articles

The QQQ ETF: A Clinical Look at Its Performance and Future Outlook

Is the 'Smartest AI ETF' Just a Tech Index in Disguise? There’s a headline making the rounds that’s...