The Zcash 380% Rally: A Data-Driven Look at the 'Privacy Revival' Thesis

An asset left for dead doesn’t typically surge 380% in a month. Yet, here we are with Zcash (ZEC), a relic of the 2016 cypherpunk era, suddenly rocketing from obscurity back into the top 25 cryptocurrencies by market cap. The price chart looks less like a healthy uptrend and more like a cardiac monitor during a defibrillator shock, blasting from a low of $54 to a three-year high of over $370.

The noise surrounding this rally is deafening. On one side, you have a chorus of prominent voices—from BitMEX co-founder Arthur Hayes to Helius CEO Mert Mumtaz—heralding a "privacy renaissance." They frame this as a long-overdue repricing of an asset that offers something akin to an encrypted Bitcoin, a digital safe haven in an age of increasing financial surveillance. On the other, you have the raw, unmistakable signature of speculative fever, driven by a powerful market narrative that, upon closer inspection, appears to be built on a foundation of sand.

The question isn't whether Zcash is moving. The data is clear on that. The question is why, and whether the reasons can sustain a $5.8 billion valuation.

Deconstructing the Hype Machine

Every speculative mania needs a catalyst, and Zcash appears to have a perfect storm of them. The renewed debate around digital privacy, fueled by government initiatives like the UK's Digital IDs, has provided the ideological tailwind. Traders, rotating out of sideways-moving majors like Bitcoin and Ethereum, are looking for conviction plays, and "privacy" is a simple, powerful theme. Endorsements from respected figures have provided the social proof, turning a dormant asset into a trending topic on X for the first time in years.

But the primary engine of this rally, repeated across countless trading chats and market analyses, has been the upcoming Zcash halving, supposedly scheduled for November 2025. This event, which slashes miner rewards in half, is a powerful scarcity narrative—a direct echo of the Bitcoin halvings that have historically preceded bull markets. It’s an easy story to sell.

There’s just one problem: it isn’t true.

According to on-chain data and blockchain explorers, the last Zcash halving occurred in November 2024. The next isn’t due until late 2028. The entire premise of an imminent supply shock that has traders front-running the event is a fiction. This isn't a minor discrepancy; it's a fundamental error in the most widely cited bullish thesis. If the market is betting on an event that isn't on the calendar, what exactly is it pricing in? Is it possible for a collective delusion to drive a multi-billion dollar repricing?

The answer, it seems, is a resounding yes. The halving myth appears to have been the spark, but the fuel is pure momentum. We've seen nearly $2 million in short positions liquidated in a matter of weeks, creating a violent squeeze that punishes anyone betting against the trend. Google search interest for "Zcash" has spiked to five-year highs, signaling a wave of retail attention that often arrives untethered from fundamental realities. The narrative has become self-fulfilling, even if its premise is flawed.

Searching for a Fundamental Floor

This is the part of the analysis that I find genuinely puzzling. Stripping away the phantom halving, we have to ask if there's a real, data-driven justification for this move. Is there a signal amidst the noise?

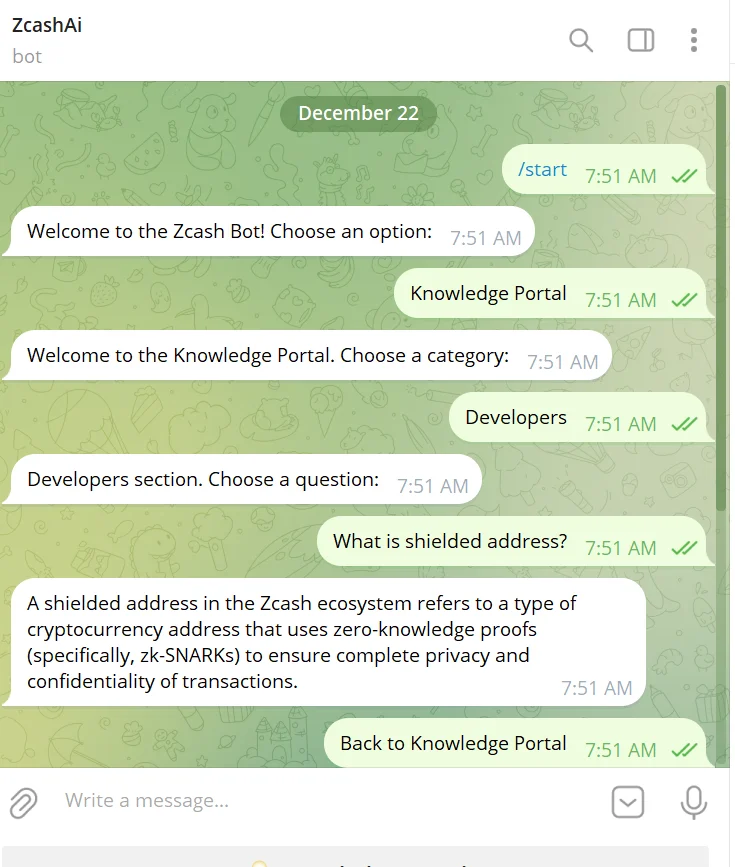

The most compelling bullish metric is the growth in Zcash's "shielded supply." This refers to the amount of ZEC held in private addresses, where transactions are obscured using zero-knowledge proofs. It’s a measure of actual, intentional usage of the network’s core privacy feature. That figure has climbed to 4.5 million ZEC. This is significant because it's an opt-in action; users must consciously move their funds into the shielded pool, signaling trust and a desire for confidentiality. A growing shielded supply strengthens the anonymity set for all users, reinforcing the network's value proposition.

However, a closer look reveals a critical divergence. While the stock of shielded coins has grown, some analysts, like Shivam Thakral of BuyUCoin, have noted that the flow of new shielded transactions hasn’t seen a corresponding explosion. Growth in total supply has been steady, but it doesn't seem to match the near-vertical trajectory of the price. The price has appreciated by about 7x—to be more exact, a 688% gain from its low—while the underlying utility metric, though positive, has grown at a far more pedestrian pace.

This divergence between a stock metric (total shielded supply) and a flow metric (new shielded transactions) is a classic indicator of a sentiment-driven move outpacing adoption. It suggests that while long-term believers are steadily increasing their private holdings, the recent price action is being driven by a different class of participant entirely—speculators trading on public exchanges who may never touch the shielded pool.

There are, of course, other legitimate fundamental developments. The project recently released a public alpha for a new zero-knowledge architecture, and integrations are bringing wrapped (though not natively private) ZEC to high-speed chains like Solana. Zcash News: Restoring Privacy to ZEC on Solana via Encifher is technically impressive. But are these incremental, under-the-hood improvements enough to justify a 380% monthly gain? It seems unlikely.

A Rally in Search of a Reason

Ultimately, the Zcash surge of 2025 is a fascinating case study in market psychology. It’s a rally ignited by a false premise, sustained by momentum, and now desperately in search of a fundamental justification to keep it from collapsing under its own weight. The ideological argument for privacy is valid, and the slow-but-steady growth in shielded supply is real. But neither of these factors accounts for the sheer velocity of the recent price action.

The market has priced Zcash not for what it is today, but for what it represents: a contrarian bet against a future of total financial transparency. The critical question is whether the actual usage of its privacy technology can catch up to its soaring valuation. For now, holding ZEC is less an investment in applied cryptography and more a high-stakes wager on a story—a story that, for the moment, has proven more powerful than the facts.

Related Articles

Zcash Surge: Privacy's Back, Baby?

Zcash's Privacy Push: Is It a Real Revolution, or Just Another Crypto Pump-and-Dump? Alright, let's...

Zcash: The Data Behind the Price Surge and What Reddit Gets Wrong

The recent performance of the Zcash coin (ZEC) was, by any quantitative measure, an extreme outlier....

Zcash's Breakthrough: Why It's Surging and What the Community Thinks Is Next

I have to be honest with you. For the past few years, watching the Zcash (ZEC) chart has felt like w...

Zcash's Big Price Pump: What It Is, Why Everyone's Suddenly Talking, and If You Should Care

So, the ghost in the machine is twitching again. Zcash (ZEC), the crypto world’s Schrödinger's cat o...

Zcash Hits New Highs: A Data-Driven Look at the 'Privacy Revival' Narrative

The recent price action in Zcash (ZEC) is a textbook case study in market dynamics, a near-perfect c...