Zcash: The Data Behind the Price Surge and What Reddit Gets Wrong

The recent performance of the Zcash coin (ZEC) was, by any quantitative measure, an extreme outlier. Watching an asset rally nearly 500% in a single month while the broader market bleeds is the kind of event that forces you to recalibrate your assumptions. For many, it looked like the explosive arrival of a long-overlooked asset. Retail traders, fueled by a potent mix of celebrity endorsements and FOMO, piled in, chasing a vertical price chart.

But when you strip away the social media noise and look at the underlying mechanics, the picture changes. The Zcash crypto rally in October wasn't a signal of newfound fundamental strength. It was a textbook short squeeze, artificially inflated by a handful of high-profile Twitter accounts and sustained by a feedback loop of liquidations. It was a spectacle, to be sure, but a deeply misleading one. And for anyone trying to build a durable portfolio, this kind of volatility isn't an opportunity; it's a flashing red warning light.

Deconstructing the October Anomaly

Let’s be precise about what happened. The rally began after a few influential figures made some audacious price calls. Naval Ravikant, Arthur Hayes, Mert Mumtaz—these names carry weight, and their posts acted as the initial catalyst. This is functionally identical to the Dogecoin phenomenon in 2021, where Elon Musk’s tweets could manufacture tens of billions in market cap out of thin air. It’s a powerful mechanism for generating short-term momentum, but it has nothing to do with long-term value accrual.

This initial spark landed on a pile of dry tinder: a heavily shorted asset. As the price began to tick up, traders betting against ZEC were forced to close their positions. In the futures market, closing a short position means buying the underlying asset, which pushes the price up further, which in turn forces more shorts to close. This is a classic squeeze. The data shows nearly $65 million in cumulative liquidations in just two weeks (with over half coming from shorts). Watching the liquidation feed during that period was like watching a domino chain reaction in real-time.

I've analyzed dozens of these squeezes across equities and crypto, and the mechanics here are textbook. But the celebrity endorsement layer adds a particularly modern, and frankly, unstable variable. It creates a self-fulfilling prophecy that is completely detached from the asset's utility or adoption metrics. The entire event was a technical and social cascade, not an economic one. And just as quickly as it formed, the technicals began to scream caution. The price action formed a rising wedge pattern—a classic bearish reversal signal—while the Relative Strength Index (RSI) showed a bearish divergence. The data was clearly signaling that the buying pressure was manufactured and, more importantly, exhausting itself. A 30% correction—or to be more exact, a drop toward the $260-$270 support zone—wasn't just possible; it was probable.

The Structural Ceiling on Zcash

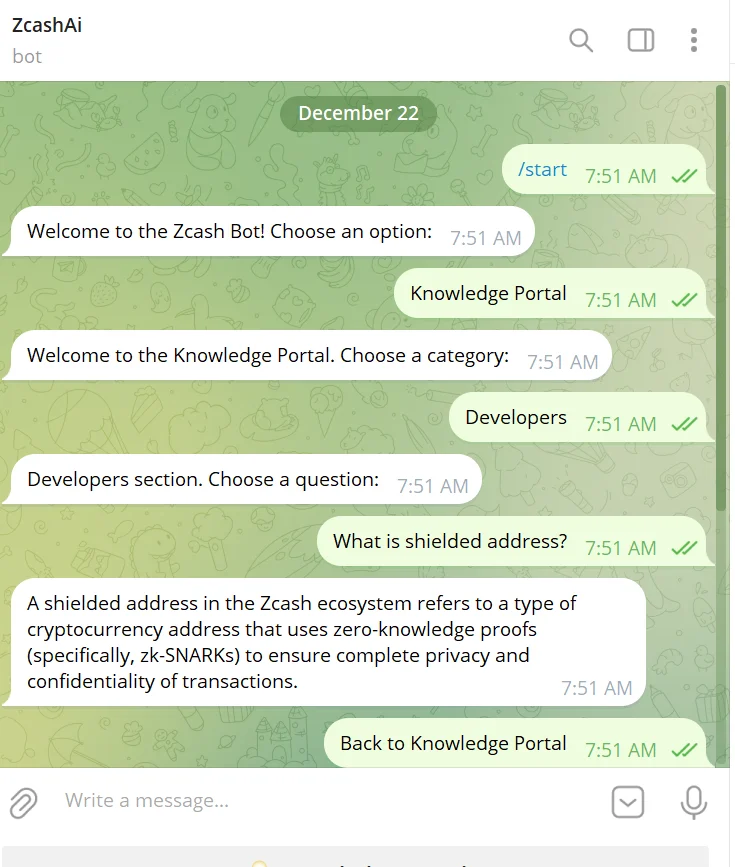

Once the noise of the October rally fades, you’re left with the asset’s core dilemma, which the pump did nothing to solve. In fact, it only served to highlight it. Zcash’s entire value proposition is privacy, enabled by a sophisticated cryptographic method called zk-SNARKs. It’s a genuinely impressive piece of technology that allows for shielded transactions, a feature Bitcoin (BTC) does not and cannot offer.

But here is the cold, hard reality for investors: financial regulators despise privacy. They view it not as a feature but as a vector for illicit activity. This isn't a theoretical risk; it's a clear and escalating global trend. Major exchanges like Coinbase have faced immense pressure over listing privacy coins. Jurisdictions like South Korea and Japan have either banned them or badgered exchanges into delisting them. Most critically, the European Union's new anti-money laundering regulations are on track to effectively ban privacy coins from exchanges by mid-2027.

This creates a structural ceiling for Zcash. How can an asset achieve widespread adoption if the on-ramps for capital are systematically being dismantled? It could certainly capture a niche market of users who absolutely require financial privacy, but its path to becoming a globally recognized store of value is fraught with regulatory roadblocks.

Contrast this with the trajectory of Bitcoin. While Zcash fights for exchange listings, Bitcoin is being integrated into the heart of the traditional financial system. The approval of spot Bitcoin ETFs in January 2024 wasn't just a minor win; it was a paradigm shift. It made BTC accessible to brokerage and retirement accounts, unlocking a vast ocean of institutional capital. Regulators, once hostile, now largely view Bitcoin as a commodity, a legitimate store of value. While Zcash’s world is shrinking due to its core feature, Bitcoin’s is expanding for the very same reason: its transparency is regulator-friendly. Both assets share a scarcity model with a 21-million-coin cap, but only one has a clear path to institutional legitimacy.

The Data Points to a Dead End

The October ZEC rally wasn't a sign of life; it was a symptom of the asset's core weakness. It demonstrated that its price is highly susceptible to sentiment-driven manipulation, not institutional-grade demand. It’s an asset that can generate incredible short-term hype but fundamentally lacks the regulatory green lights necessary for long-term, stable growth. An investment in Zcash today isn't just a bet on privacy technology; it's a bet against a powerful and unyielding global regulatory current. Bitcoin offers the same core scarcity principle without the attached regulatory time bomb. For an investor focused on the numbers, the choice in the Better Cryptocurrency Buy: Bitcoin vs. Zcash debate isn't just clear—it's already been made.

Related Articles

Zcash's Big Price Pump: What It Is, Why Everyone's Suddenly Talking, and If You Should Care

So, the ghost in the machine is twitching again. Zcash (ZEC), the crypto world’s Schrödinger's cat o...

The Zcash 380% Rally: A Data-Driven Look at the 'Privacy Revival' Thesis

An asset left for dead doesn’t typically surge 380% in a month. Yet, here we are with Zcash (ZEC), a...

Zcash Surge: Privacy's Back, Baby?

Zcash's Privacy Push: Is It a Real Revolution, or Just Another Crypto Pump-and-Dump? Alright, let's...

Zcash Hits New Highs: A Data-Driven Look at the 'Privacy Revival' Narrative

The recent price action in Zcash (ZEC) is a textbook case study in market dynamics, a near-perfect c...

Zcash's Breakthrough: Why It's Surging and What the Community Thinks Is Next

I have to be honest with you. For the past few years, watching the Zcash (ZEC) chart has felt like w...