Super Micro's Stock Slide: What the Data Reveals About the Plunge and Its Outlook

It’s always the small tremors that precede the earthquake. For months, the market narrative around AI hardware has been one of unflinching, vertical ascent. A handful of companies, fueled by insatiable demand for processing power, have been treated not as businesses subject to gravity, but as laws of physics unto themselves. Valuations have stretched beyond traditional metrics, buoyed by a story of inevitable, flawless execution.

Then, a tremor. Super Micro Computer (SMCI), one of the high-fliers in this rarefied atmosphere, announced it would miss its first-quarter revenue guidance. Not by a little. The company, which had projected revenues between $6 billion and $7 billion, now expects to report $5 billion. This isn’t a rounding error; it’s a billion-dollar discrepancy that serves as the first significant data point contradicting the market’s prevailing AI narrative.

The immediate price action—a drop of over 6% (Super Micro Stock Is Sliding Thursday: Here's Why)—is the headline, but it’s not the story. The real story is what this revision represents: a critical stress test for a sector that has been priced for perfection.

Anatomy of an AI Darling

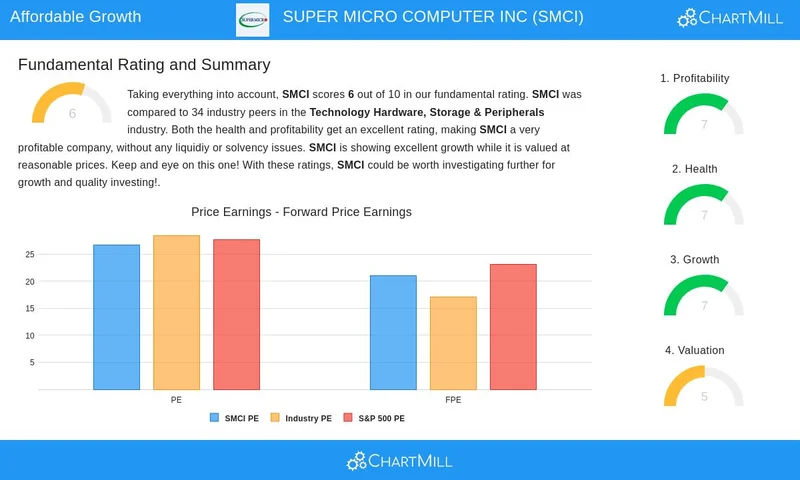

To understand the significance of Super Micro’s stumble, one has to appreciate the altitude from which it fell. Just last year, analysts were already sounding alarms about the concentration of market gains in a few select names (Nvidia, Palantir, Super Micro Computer: High-flying stocks could stall soon). The S&P 500’s strength was deceptive, disproportionately fueled by AI and semiconductor stocks whose valuations had reached, in the words of analyst David Jaffe, "euphoric, and frankly, unsustainable levels."

Super Micro was a poster child for this phenomenon. The stock’s performance was staggering (a year-to-date gain of over 80% before this recent turbulence), driven entirely by its proximity to the AI gold rush. Yet, even as the stock soared, skeptical observers pointed to cracks in the foundation. Christian Harris of Investing.co.uk called the company an "over-rated growth star," citing falling margins and mounting inventory as potential risks. Jaffe’s assessment was even more pointed: while SMCI is a real company with real earnings, "its valuation has reached a level that prices in decades of flawless execution."

I've looked at hundreds of these hyper-growth filings over the years, and this pattern is a classic. The market latches onto a simple, powerful story—in this case, "AI needs servers, SMCI makes servers"—and ignores the messy operational details. The valuation becomes a function of the narrative, not the underlying financial mechanics. But narratives don't generate cash flow. Eventually, the numbers have to support the story, or the story collapses.

The warnings were there, but they were qualitative. They were opinions from analysts looking at the same public data as everyone else. What the market lacked was a catalyst—a hard, quantitative event that would force investors to reconsider their assumptions. Super Micro just provided one.

Deconstructing the Discrepancy

The company's explanation for the revenue miss is, on its face, optimistic. Management states that recent design wins of more than $12 billion have pushed some expected revenue into the second quarter. They speak of "robust demand" and "outstanding levels of customer engagements." CEO Charles Liang even reiterated a long-term revenue target of at least $33 billion for fiscal year 2026, insisting the company is gaining AI market share.

This is where a careful reading is required. The juxtaposition of a massive revenue miss with a narrative of accelerating demand is jarring. The announced miss is about 20%—to be more exact, a 16.7% shortfall from the low end of their own prior guidance. That’s a significant operational hiccup. If customer demand is truly accelerating, what does it say about the company’s ability to forecast and deliver?

This forces us to ask some uncomfortable questions that the press release doesn't answer. Is this a genuine case of blockbuster deals simply shifting by a few weeks, a positive signal disguised as a negative one? Or is it a symptom of something more systemic? Perhaps it’s a supply chain bottleneck, revealing an inability to scale as quickly as promised. Or maybe, just maybe, it’s an early indicator that the purchasing cycles of large customers are less predictable than the market assumes. Pushing revenue out isn't the same as securing it.

The technical chart data provides a fascinating snapshot of the market’s indecision. The stock’s Relative Strength Index (RSI) is currently around 52, which is essentially neutral territory. This isn't a panic sell-off; it’s a re-evaluation. The stock is trading just above its 50-day moving average (a key technical support level), suggesting investors are pausing right at the edge, waiting for more information. They’ve been jolted out of the dream of a smooth, uninterrupted climb and are now faced with the gritty reality of quarterly execution.

This single data point transforms the investment thesis for Super Micro and its peers. The question is no longer if they will benefit from the AI boom, but how smoothly they can navigate it. The "flawless execution" that was priced into the stock is now officially in doubt.

The Narrative Is Now on Trial

This isn't just about one company's quarterly report. Super Micro’s guidance revision is the first piece of hard evidence that the path to AI dominance will be paved with operational volatility. For a market that has priced a whole sub-sector on a straight-line projection, any deviation is a shock to the system.

The company's reassurances of strong future demand may very well be true. But they are asking investors to trust the long-term story over the short-term numbers. For months, the market was happy to do just that. Now, for the first time, it has a concrete reason to be skeptical. The billion-dollar question is whether this is an isolated incident or the first crack in a much larger façade. The company's full results on November 4 will be the next data point, and you can be sure the entire market will be watching. The story was compelling, but the numbers have a vote, too. And they just cast it.

Related Articles

Beyond JNJ's Stock Price: The Breakthrough Science and Future Vision Everyone is Missing

It’s easy to get lost in the noise. On any given Monday, you can watch the digital ticker tape scrol...

MP Materials Stock Analysis: The Data Behind the 'Hold' Rating

The stock chart for MP Materials (MP) over the last 90 days looks less like a valuation curve and mo...

Powell's Speech: Decoding the Market Impact and Future Rate Cuts

All eyes are on Washington, D.C. tomorrow. Not on Congress, not on the White House, but on a single...

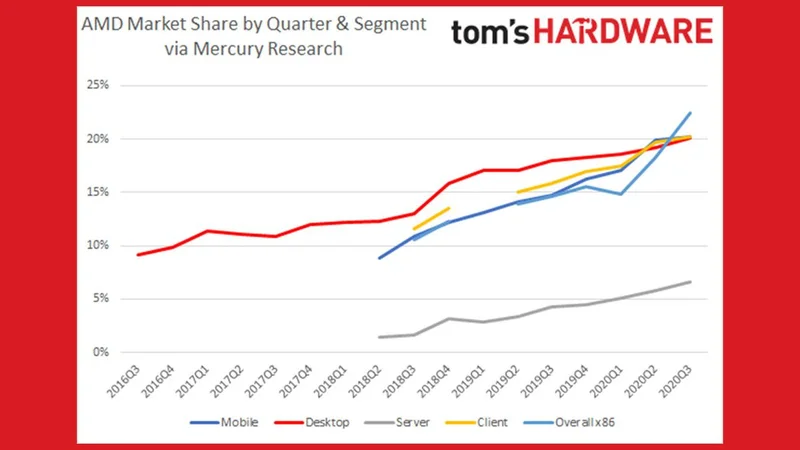

AMD's 58% Rally: Analyzing the Data vs. the Market Hype

The numbers flicker across the screen in an almost hypnotic shade of green. For anyone holding Advan...

Oklo Stock: A Sober Look at the Numbers and SMR Competition

In the quiet, methodical world of deep-tech investing, noise is an anomaly. It’s a variable that dem...

macau: What's Really Going On

Alright, let's get this straight. Macau's diversifying? Oh, really? Give me a break. It's not divers...