Uber's Stock Jump: The Nvidia Hype vs. the Lyft Reality

So, Uber's Tying the Knot With Nvidia. Don't Pop the Champagne Just Yet.

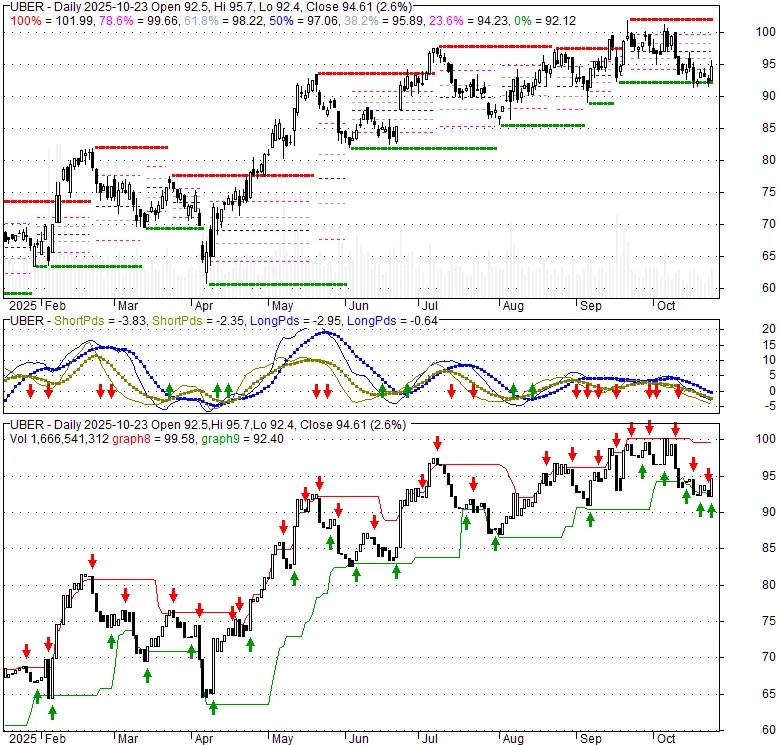

Let’s get one thing straight. The moment a company like Uber announces a "strategic partnership" with Nvidia, the script is already written. The algorithms fire, the headlines flash (case in point: 'Uber stock surges after Nvidia partnership announcement'), and the `uber stock price` gets a nice little 3.5% bump. Everyone on Wall Street pats each other on the back, convinced they've just witnessed the birth of the next big thing.

Give me a break.

What we saw wasn't a revolution. It was a press release. A very, very expensive and well-timed press release designed to do exactly what it did: make the line go up. Uber is feeding its massive trove of real-world driving data into Nvidia's DGX Cloud to train some "Cosmos World Foundation Models." It all sounds incredibly important, doesn't it? They're talking about improving AV simulation, accelerating machine learning, and tackling "rare edge-case scenarios."

My cynical translation? They're admitting their old way wasn't working. "Edge cases" are just a sanitized corporate term for "that time a plastic bag floated across the street and the car's brain short-circuited." This whole spectacle is like a couple that, after a messy public breakup, decides to get back together—not because they've solved their problems, but because they realized it's cheaper to share the rent. Uber already tried to build its own self-driving car empire and ended up selling the whole division. Now they're back, but this time they're just leasing the engine from the most popular kid in school, `NVDA`.

Does anyone seriously believe this is the magic bullet? Are we supposed to think that just because the `nvidia stock` ticker is involved, the fundamental, impossibly complex problems of autonomous driving will suddenly melt away?

A High-Stakes Game of Follow the Leader

Let's be real. This isn't about innovation; it's about survival and perception. Uber is a logistics behemoth, no doubt. With 180 million active users and gross bookings swelling to over $45 billion a quarter, they’re a monster. They're sitting on $8.6 billion in cash. They're buying back stock by the truckload—a cool $20 billion authorized just a couple of months ago. They're even in the S&P 100.

But they have an Achilles' heel the size of a Ford F-150: they don't make anything. Their entire empire is built on an app and a network of contractors. For years, the promise was that autonomous vehicles would eliminate their biggest cost—the drivers—and turn the company into a true cash-printing machine. That dream died, or at least went into a medically induced coma.

Now, they see what’s happening with `tesla stock` (TSLA) and the endless hype around Full Self-Driving. They see legacy automakers and tech giants like `Google` and `Apple` pouring billions into their own AV projects. Uber can't afford to look like it's been left in the dust. So what do they do? They write a massive check to Nvidia.

This is a bad idea. No, 'bad' doesn't cover it—this is a desperate, high-priced Hail Mary. It's a way to rent relevance. By partnering with Nvidia, Uber gets to borrow some of that AI pixie dust that has turned Jensen Huang's company into a market-crushing titan. It’s a purely defensive move designed to reassure investors that they're still "in the game." But are they really playing to win, or just playing not to lose? And is there even a difference anymore?

The Numbers Tell a Different Story

Everyone loves the growth story. Mobility bookings up 18%, delivery up 20%. Great. But peel back one layer and you see the weirdness. A debt-to-capital ratio of 0.3 when the industry average is a measly 0.06? A P/E multiple of nearly 30 when their peers are at 23? It suggests a company priced for a future that's still completely theoretical.

They have all this cash, and what's their big move? Buying back their own stock and signing a partnership deal. It feels like they're trying to manage the stock price more than they're trying to build the future. I mean, I still can't reliably get a car on a Saturday night without a 4x surge price that makes my eyes water, but at least I know their machine learning operations are being "accelerated."

This whole partnership just feels...hollow. They're going to test some cars in Munich in 2026 with another partner, Momenta. It’s always a pilot program, always two years away, always in a city I don't live in. They expect us to believe that this time, with Nvidia's help, it's finally going to work, and honestly...

Then again, maybe I'm the crazy one. Maybe this is how it’s done now. You don’t build, you partner. You don’t innovate, you integrate. You just keep feeding the beast with good news until the `uber stock price today` looks better than it did yesterday. Offcourse, it works for the stock, but does it actually get us any closer to a world of robotaxis? I have my doubts.

They're Buying a Lottery Ticket, Not a Solution

Let's drop the pretense. This Uber-Nvidia deal isn't a technological breakthrough. It's an expensive insurance policy against irrelevance. Uber is paying a premium to slap the Nvidia logo on its AV strategy, hoping some of the AI magic rubs off and keeps investors from asking too many hard questions. They aren't building a future; they're hedging a bet. The 3.5% stock pop isn't a sign of investor confidence in a viable product. It's a sugar high, a fleeting reaction to two big names appearing in the same sentence. The real, soul-crushingly difficult work of making a car drive itself hasn't changed. And this partnership, for all its billions and buzzwords, probably won't be the thing that solves it.

Related Articles

Oklo's Next-Gen Nuclear Power: The Breakthrough Technology & Its Vision for the Future

I was listening to the financial news the other day—a habit I keep not for stock tips, but for cultu...

Gold Price Analysis: Today's Price, Key Metrics, and the Silver Correlation

Gold's Dizzying Climb to $4,000: A Sober Look at the Numbers Behind the Hype The numbers flashing ac...

primerica: What to Know – A Reality Check

Nvidia's AI Hype Train: Are We There Yet? Nvidia. The name is practically synonymous with the AI rev...

Hood Stock: What's Next?

Okay, folks, buckle up. Because what's happening with Robinhood right now isn't just about a stock p...

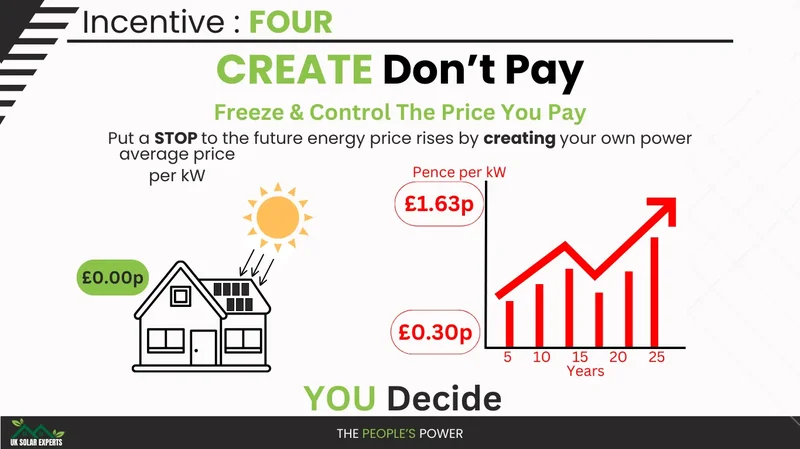

Solar Incentives: What's Next and Why It Matters

Hawaiʻi's Solar Crisis: A Make-or-Break Moment for Clean Energy Okay, folks, let's talk about someth...

The VA Loan Myth: What Everyone Gets Wrong and Who to Actually Trust

Alright, let's cut the crap. Every year, the internet vomits up another "Best Of" list for everythin...