Hood Stock: What's Next?

Okay, folks, buckle up. Because what's happening with Robinhood right now isn't just about a stock price or an earnings report. It’s about something much, much bigger: the potential dawn of truly socialized investing. And honestly, when I see the pieces aligning like this, it's the kind of thing that reminds me why I got into this field in the first place.

The chatter around Robinhood's Q3 earnings is reaching a fever pitch. We're talking about potential 90% revenue growth, a possible 200% surge in EPS, and a stock that's already skyrocketed 277% year-to-date. But here’s what really grabbed my attention: the buzz on X (formerly Twitter). It's not just about the numbers; it’s about the energy. People are genuinely excited.

The Momentum is Palpable

Analyst upgrades are raining down, with some firms projecting price targets as high as $155. But it’s not just the analysts. There's a groundswell of optimism fueled by operational improvements, upcoming product updates, and whispers of innovative moves like stock tokenization and potential partnerships. It's like watching a rocket on the launchpad, fueled and ready for liftoff.

But here's the kicker: Robinhood isn't just sitting back and watching the show. They're actively shaping the narrative with their new social media platform within the app. Now, I know what you might be thinking: "Another social media platform? Really?" But hold on. This isn't just another place to post selfies. This is about democratizing financial information, about creating a space where everyday investors can share insights, learn from each other, and collectively navigate the complexities of the market.

Think about it: for decades, access to quality financial information has been largely restricted to Wall Street insiders and institutional investors. The average person was left to fend for themselves, often relying on biased or outdated information. Robinhood's social platform has the potential to level the playing field, to empower individuals with the knowledge and tools they need to make informed investment decisions.

I've seen some folks question if this social push is a distraction from Robinhood's core business. But I see it differently. I believe it’s a stroke of genius. It's not just about user engagement; it's about building a community, a shared ecosystem where everyone benefits. This is like the printing press moment for finance—a shift in how information is disseminated that could change everything.

And the insider trading activity? Yes, it's true that insiders, including CEO Vladimir Tenev and Baiju Bhatt, have been selling shares. But let's be real: early employees and executives often have a significant portion of their wealth tied up in company stock. Selling some of those shares isn't necessarily a sign of pessimism; it can simply be a matter of diversification. What’s truly interesting is the congressional trading activity. Members of Congress have been buying $HOOD stock. Politicians are betting big on Robinhood, it seems.

Of course, with great power comes great responsibility. As we move towards a more socialized model of investing, we need to be mindful of the potential risks. The spread of misinformation, the rise of "meme stocks," and the potential for market manipulation are all real concerns. But these challenges shouldn't deter us from pursuing the incredible opportunities that lie ahead.

What does it all mean? It means we're on the cusp of something truly transformative. Imagine a world where everyone has access to the financial knowledge and tools they need to build a better future for themselves and their families. Imagine a world where investing is no longer a game for the privileged few, but a collaborative effort where everyone can participate and benefit. It's an exciting vision, and Robinhood's Q3 buzz suggests we're closer than ever to making it a reality. According to Robinhood Markets Stock (HOOD) Opinions on Q3 Earnings Expectations, the anticipation surrounding Robinhood's Q3 earnings is palpable.

A New Era of Financial Empowerment?

This isn't just about Robinhood's stock price; it's about the democratization of finance. It's about empowering individuals, fostering community, and building a more equitable financial future for all. And that, my friends, is something worth getting excited about.

Related Articles

Merrill Lynch's Wealth Playbook: Asset Growth vs. Refined Strategy

Title: Merrill Lynch's "Wealth" Redefinition: Is It Dilution or Democratization? The bull isn’t char...

Adrena: What It Is, and Why It Represents a Paradigm Shift

I spend my days looking at data, searching for the patterns that signal our future. Usually, that me...

Broadcom's OpenAI Sugar Rush: Why I'm Not Buying a Single Share

Another Monday, another multi-billion dollar AI deal that we're all supposed to applaud like trained...

American Airlines Closing? What's Really Going On and Why You Should Be Skeptical

American Airlines "Closing Rumors" Are Peak 2025 Bullshit So, American Airlines is "restructuring."...

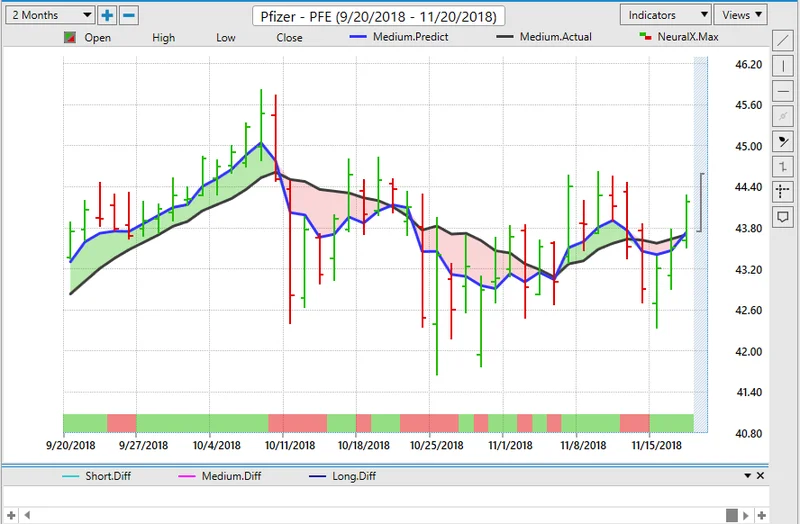

Pfizer's $10B Metsera Bet: The Strategic Rationale vs. the Market Reality

# Pfizer Didn't Outbid Novo Nordisk. It Outmaneuvered Them. The headline is simple: Pfizer wins $10...

Dan Schulman Named New Verizon CEO: What His PayPal Past Means for Verizon's Future

Verizon’s New CEO Isn’t About 5G. It’s About a Quiet Panic. The market’s reaction to the news was, i...