Cross-Border Activity: What We Know – What Reddit is Saying

Alright, let's talk about cross-border investment platforms. The pitch is simple: one account, multiple countries, less hassle. But the devil, as always, is in the details. Are these platforms truly democratizing global finance, or are they just another shiny tool for the already globally mobile?

Peeling Back the Layers

The basic premise is solid. These platforms offer access to international markets, handle currency conversions, and (supposedly) navigate the regulatory minefield. They're marketed towards expats, retirees living abroad, and global professionals. The promise? A unified system that simplifies managing assets across multiple jurisdictions.

Platforms like Interactive Brokers, Charles Schwab Global Account, Fidelity International Trading, and eToro are the names you'll see tossed around. Interactive Brokers boasts access to over 160 markets. Schwab offers a familiar interface for existing customers. Fidelity integrates with their existing ecosystem. eToro throws in social features, like copy trading (something I, personally, find terrifying – blindly following someone else's trades?).

But here's where the data starts to matter. Access to 160 markets doesn't necessarily translate to meaningful diversification. How many of those markets offer genuinely uncorrelated assets? How liquid are those markets? (Liquidity being how easily you can actually buy or sell without tanking the price). And what are the trading volumes? These are the questions the marketing materials conveniently gloss over.

The core features touted are multi-currency support, tax and reporting tools, and regulatory oversight. Multi-currency support is a genuine advantage. Seamless conversion and holding multiple currencies are essential for anyone dealing with international income or expenses. But tax and reporting tools? That's where things get murky. The claim is that these platforms handle tax documentation and compliance. But how comprehensive is it, really? Does it cover every possible tax treaty and reporting requirement? Or just the most common ones? And what level of support is offered if a discrepancy arises?

The Fee Factor and Regulatory Maze

Fees are another crucial point. Trading commissions, currency conversion spreads, and account maintenance costs can eat into returns, especially for smaller portfolios. These platforms often claim to offer competitive exchange rates, but "competitive" is a relative term. What's the spread compared to interbank rates? (The rates banks use to trade with each other). A seemingly small difference can add up over time.

Regulatory oversight is paramount. Licensing, investor protections, and deposit insurance are non-negotiable. But navigating international regulations is a complex game. Different countries have different rules, and platforms operate under various jurisdictions. Understanding the specific protections offered by each platform is critical. Cross-Border Investment Platforms Guide can help in understanding these platforms.

I've looked at hundreds of these filings, and the sheer volume of disclaimers is enough to make anyone's head spin. "May be subject to local regulations," "Protections may vary," "Consult with a tax advisor." The fine print is a minefield, and the average investor is unlikely to have the expertise to navigate it.

And this is the part of the report that I find genuinely puzzling. The article highlights the importance of understanding cross-border investment but then promotes speaking to a financial advisor. If the platforms are so easy to use and handle all the complexities, why would you need an advisor? It's a contradiction that raises a red flag.

The Miami office opening by ACT Capital Advisors is a telling sign. It highlights the growing demand for cross-border M&A activity, particularly between North and Latin America. This suggests that sophisticated investors and businesses are actively seeking opportunities across borders. But it also underscores the need for expert guidance in navigating the complexities of international deals.

The U.S. & Canadian leaders' cross-border forum further emphasizes the importance of collaboration and resilience in the face of global challenges. The focus on strengthening relationships and promoting sustainable growth is commendable. However, it also highlights the potential for political and economic factors to impact cross-border investments. Tariffs, trade disputes, and regulatory changes can all create uncertainty and volatility.

So, What's the Real Story?

Cross-border investment platforms can be useful tools, but they're not a magic bullet. They offer convenience and access, but they also come with complexities and risks. The marketing often overstates the ease of use and understates the potential pitfalls. The key is to do your homework, understand the fees, scrutinize the regulatory protections, and, if necessary, consult with a qualified advisor. Don't be swayed by the promise of effortless global investing. Approach these platforms with a healthy dose of skepticism and a sharp eye for the numbers.

Related Articles

Tesla's $56 Billion Crossroads: Why Robyn Denholm's Warning Is a Defining Moment for the Future of Tech

This isn't just a headline; it's a question about the very nature of the future. When I saw the news...

Microsoft's Latest Earnings: Why Their Spending Surge is a Glimpse into Our Future

Yesterday, the tech world was buzzing with a story that felt almost too perfect for the skeptics. Mi...

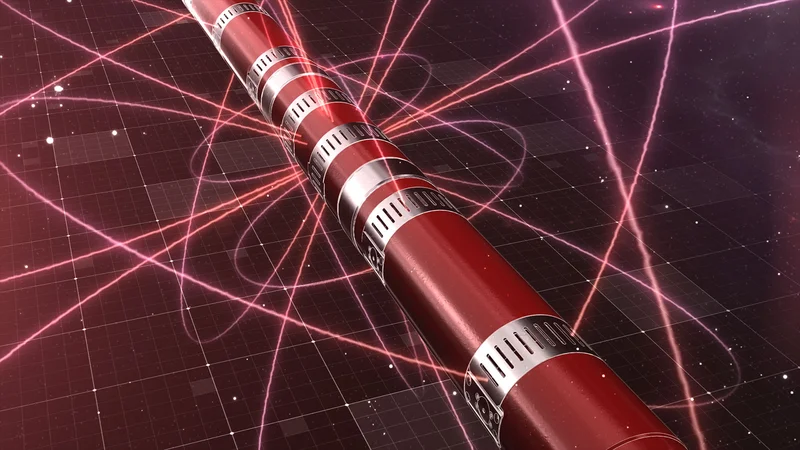

IonQ Stock Price: What's Driving the Volatility and Investor Reactions

So, IonQ's building a quantum network in Geneva. Big deal. Another press release filled with buzzwor...

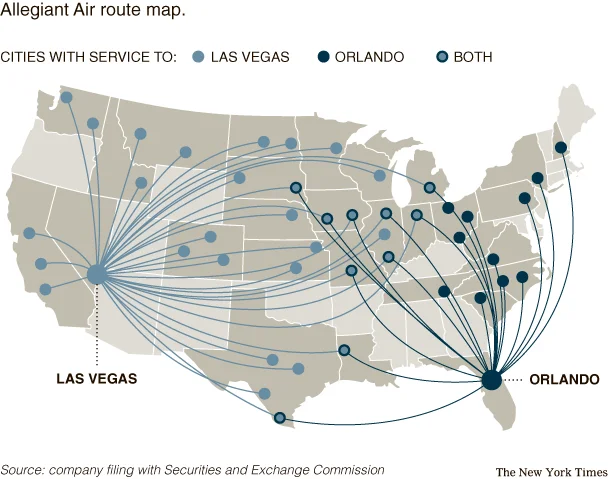

Allegiant Airlines Passenger Growth: What the 12.6% Surge Actually Means

More Passengers, Less Full Planes: Deconstructing Allegiant's Growth Paradox At first glance, news t...

primerica: What to Know – A Reality Check

Nvidia's AI Hype Train: Are We There Yet? Nvidia. The name is practically synonymous with the AI rev...

Halliburton's Automation Push: Shell's Agreement and Investor Shock – What Reddit is Saying

Halliburton's Wall Street Glow-Up: Smoke and Mirrors, or a Real Turnaround? Halliburton's been getti...