Solar Incentives: What's Next and Why It Matters

Hawaiʻi's Solar Crisis: A Make-or-Break Moment for Clean Energy

Okay, folks, let's talk about something vital, something that hits close to home—literally, if you're in Hawaiʻi. It's about solar power, and a perfect storm of policy changes that could either catapult the Aloha State into a clean energy utopia or send it spiraling back into the clutches of fossil fuels.

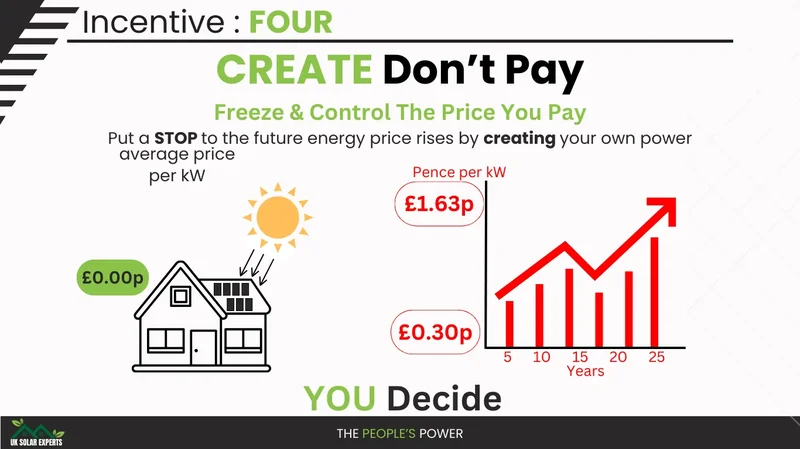

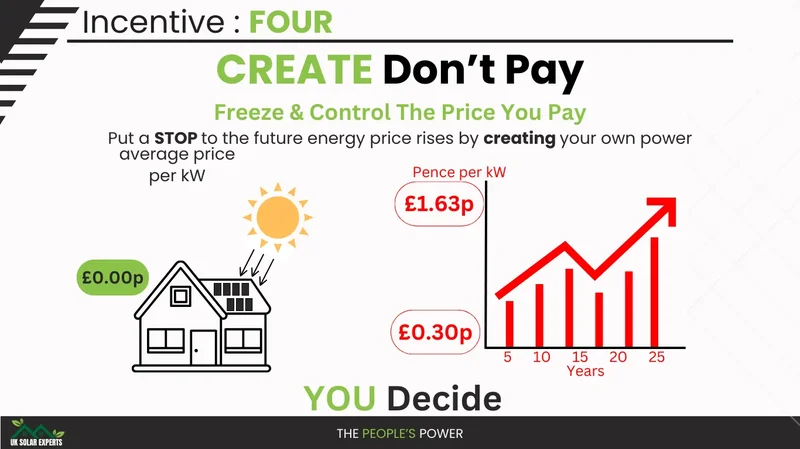

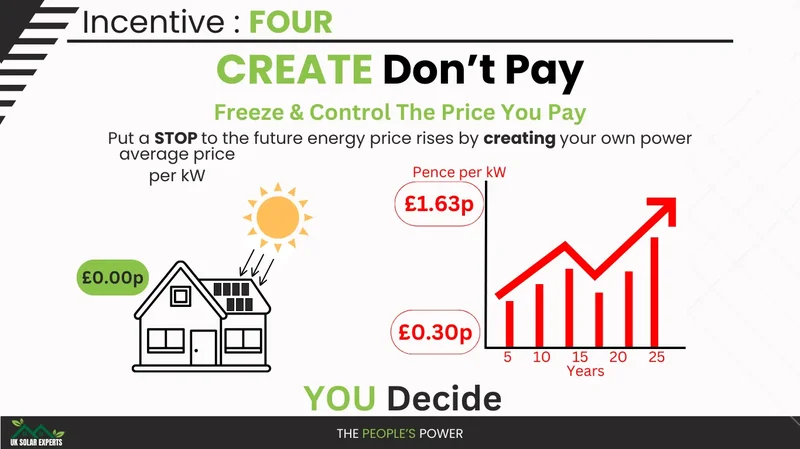

Here's the deal: Trump's decision to prematurely end the 30% federal solar tax credit has thrown a major wrench into Hawaiʻi's ambitious renewable energy goals. I mean, Hawaiʻi already faces some of the highest electricity rates in the nation—we're talking 43 cents per kilowatt hour on Oʻahu, compared to a national average of 16 cents! Solar has been a lifeline, an escape hatch for families struggling with those crushing costs. Now, with the federal credit gone, a typical solar system will cost homeowners thousands more, a 75% increase in out-of-pocket expenses starting in 2026. This isn't just about numbers; it’s about real people, real families, and their ability to breathe a little easier.

The impact won't stop there. We're talking about potential layoffs, business closures, and a drain of talent from Hawaiʻi’s solar industry—an industry that employs thousands of skilled local workers. Rocky Mould, executive director of the Hawaii Solar Energy Association, called it a "sledgehammer" blow and, frankly, he's spot on.

But here’s where things get interesting because Hawaiʻi isn't just sitting back and taking it. The state legislature has a chance to step up, to show the world how a small island state can lead the charge on clean energy. How? By doubling down on its own solar incentives, streamlining the permitting process, and ensuring that everyone, regardless of income, has access to affordable solar power.

The Aloha Spirit vs. Fossil Fuel Dependence

Think of it this way: Hawaiʻi is at a crossroads, like a surfer facing a massive wave. They can either wipe out and get dragged back to shore (fossil fuel dependence), or they can ride that wave to a whole new level of energy independence. The key is to act boldly and decisively.

The original article suggests three critical steps. First, the state must protect and preserve its 35% state solar tax credit, rejecting any attempts to reduce or eliminate it. Second, reinstate and expand a direct rebate program for low- and middle-income households, funded by the barrel tax. This is crucial because, unlike tax credits, rebates make solar accessible to renters and lower-income families who need relief the most. Third, streamline permitting and interconnection processes. Less red tape means lower costs and faster adoption.

These aren't just policy tweaks; they're investments in Hawaiʻi's future. Every kilowatt of solar capacity installed today is a kilowatt that won't need to be generated from expensive imported oil tomorrow. It's infrastructure development that happens at no cost to taxpayers. Imagine a Hawaiʻi where homes are powered by the sun, where energy dollars stay within the community, and where the air is cleaner and the economy is stronger.

And it's not just Hawaiʻi. Look at rural towns in Minnesota that are saving thousands of dollars by going solar. One city council member, initially against solar, now says it will "probably help pay for the pool!" That's the kind of tangible benefit that gets people excited. Rural Midwestern towns are saving huge amounts of cash by going solar: 'It'll probably help pay for the pool'

The Jewish Solar Challenge is another inspiring example, helping synagogues, schools, and camps add solar panels, preventing tons of CO2 emissions and saving grantees nearly half a million dollars in annual electricity costs. I mean, the installation of solar panels on one Jewish community center in Tikvah, Uganda, provided the community’s first consistent source of power for Shabbat. That's powerful stuff.

But what about those who can't afford to buy solar panels outright? That's where innovative solutions like EnerWealth Solutions in North Carolina come in. They're buying rooftop solar panels with tax credits still available to commercial entities and renting them to homeowners, passing along the savings. It's a clever workaround that could help keep the solar industry afloat until new policies are in place.

So, what's the real takeaway here? The sun is still shining, and the technology is there. The only thing missing is the political will to make it happen.

Hawaiʻi's Chance to Shine

This isn't just about saving money or reducing carbon emissions; it's about creating a more just and equitable society. It's about empowering communities, creating jobs, and building a future where everyone has access to clean, affordable energy. It's about harnessing the power of the sun to create a brighter tomorrow for all. When I think of the possibilities, I just get excited!

But let's be clear, with great power comes great responsibility. We must ensure that these renewable energy projects benefit all communities, not just the wealthy. We must prioritize local jobs and sustainable development practices. We must be mindful of the environmental impact of solar panel production and disposal.

The time to act is now. Hawaiʻi's legislature must seize this opportunity to create a bold, comprehensive clean energy plan that puts people and the planet first. The future of Hawaiʻi, and perhaps the future of clean energy in the United States, depends on it.

A Solar-Powered Future Beckons

Related Articles

Solar Incentives: Who Benefits and What's the Catch?

Solar's "Silver Linings"? More Like Fool's Gold. Alright, let's get one thing straight: "silver lini...

Federal Solar Incentives Are Ending: A Data-Driven Breakdown of the Financial Impact

Oregon Governor Tina Kotek is in a race against the clock. With an executive order, she has directed...