TTD Earnings: A Marginal Beat vs. Cautious Guidance

The Trade Desk's Wild Ride: Are We There Yet?

The Trade Desk (TTD) just released its Q3 earnings, and the market's reaction was… well, let's call it volatile. The stock initially surged 13% after the numbers dropped, only to give up those gains and dip into negative territory shortly after. This kind of whipsaw action isn't exactly a sign of investor confidence. Trade Desk reports marginal beat for Q3 earnings; shares seesaw (TTD:NASDAQ)

So, what's the real story? Let's dig into the numbers.

The Headline Numbers vs. The Underlying Story

The headline numbers were decent. Earnings per share (EPS) came in at $0.45, a hair above the consensus estimate of $0.44. Revenue also beat expectations, clocking in at $739.43 million against an expected $718 million. On the surface, that's a solid beat. But the devil, as always, is in the details. Revenue increased from the year-ago revenues of $628.02 million, but the stock has still lost about 59.4% since the beginning of the year versus the S&P 500's gain of 15.6%. That's a massive underperformance, and it suggests deeper issues than just one quarter's results.

Columbia Threadneedle Investments, in their Q3 2025 investor letter, pointed to "cautious guidance, concerns about impacts of tariff on large-brand spending and rising competition from Amazon, along with the departure of the CFO" as reasons for concern. The CFO departure is always a red flag. (It's rarely just about "pursuing other opportunities.") The other points are valid, but let's look at the guidance issue.

What exactly does "cautious guidance" mean in this context? It suggests that while Q3 was okay, the company isn't confident about the future. This could be due to a number of factors: macroeconomic headwinds, increased competition, or internal issues. What's not clear is what changed between the close of Q3 and the earnings call to suddenly dampen expectations. Did they see a drop off in bookings?

AI and the Competition

The Columbia Threadneedle letter also mentions the company’s Kokai AI platform now powers 75% of client spending, and connected TV is the fastest-growing channel, now accounting for nearly half of total spending. That sounds impressive, but nearly every tech company is touting their AI capabilities these days. It's become marketing buzzword, not necessarily a sign of genuine innovation. The real question is: how is Trade Desk's AI actually performing compared to competitors? Are they gaining market share, or are they just keeping pace? The letter notes rising competition from Amazon. Amazon is a behemoth, and their entry into the ad-tech space is a serious threat to everyone else.

I've looked at hundreds of these filings, and the repeated emphasis on AI without concrete metrics always makes me nervous. It feels like they are trying to distract from some other problem.

The fact that The Trade Desk is not on the list of 30 Most Popular Stocks Among Hedge Funds is also telling. 60 hedge fund portfolios held The Trade Desk, Inc. (NASDAQ:TTD) at the end of the second quarter, which was 61 in the previous quarter. That's hardly a ringing endorsement. Hedge funds, for all their faults, tend to be pretty good at spotting trends and avoiding losers.

The Market's Verdict: Still Undecided

The market's seesaw reaction to the earnings report speaks volumes. The initial jump suggests that some investors were expecting even worse news. The subsequent sell-off indicates that those same investors took a closer look and didn't like what they saw. It's a classic case of "buy the rumor, sell the news."

The Trade Desk operates in a rapidly evolving industry. The rise of connected TV, the increasing importance of data privacy, and the ever-present threat of competition from tech giants like Amazon all create a challenging environment.

One thing is clear: The Trade Desk needs to prove that it can not only survive but thrive in this new landscape. The company needs to show that its AI investments are paying off, that it can maintain its market share, and that it has a clear plan for navigating the challenges ahead. Until then, the stock is likely to remain volatile.

So, What's the Real Story?

The numbers paint a mixed picture, and the market's reaction confirms that uncertainty. The Trade Desk beat expectations, but the cautious guidance and competitive pressures suggest that the future is far from certain. The stock's wild ride reflects this ambiguity. It's not a disaster, but it's not a clear win either. I'm staying on the sidelines until there's more clarity.

Related Articles

GMA's Deals and Steals: A Surprising Glimpse into the Future of Retail

I want you to look past the popcorn tins and the splatter guards for a moment. On October 11th, a se...

Target's Big Reset: The Hidden Signal for a Smarter Future of Retail

Imagine the silence. One moment, you’re a corporate employee at Target’s sprawling Minneapolis headq...

Spotify's AI Music Initiative: The Strategy, Industry Impact, and What 'Responsible AI' Really Means

Spotify's AI Alliance Isn't About Ethics. It's About Building a Moat. The press releases read like a...

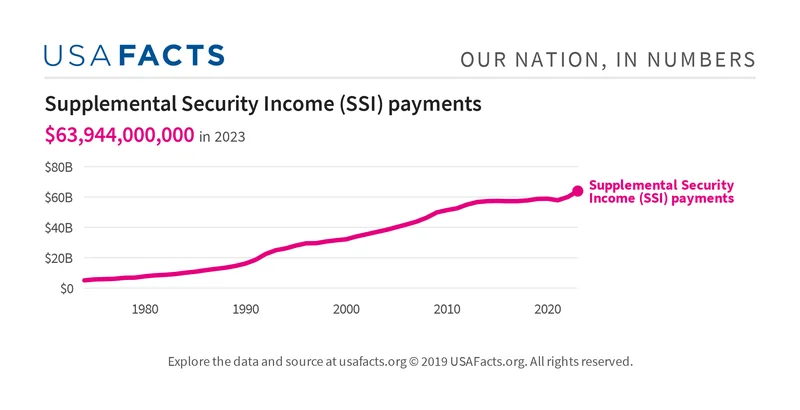

The Astonishing Resilience of SSI: Why Your November Payment is Secure and What It Means for the Future

The headlines are screaming again. Washington is at a standstill, a city of monuments frozen by argu...

PGE's Landmark Solar Investment: What It Means for Europe's Green Future

Why a Small Polish Solar Project is a Glimpse of Our Real Energy Future You probably scrolled right...

Meta Stock Slides: Why a $16B Tax Hit and Future Spending Spooked Investors

It’s a familiar script on Wall Street, particularly in the lead-up to Big Tech earnings. Analysts li...