PAX Gold: What It Is and Why You Should Be Skeptical

So, everyone’s losing their minds because gold, the world’s oldest pet rock for paranoid investors, just got a digital facelift. We’re being told that tokenized gold, like PAX Gold (PAXG), is the future. It’s the perfect marriage of ancient stability and blockchain wizardry. A $3 billion market cap! All-time highs (Gold-backed crypto tokens top $3 billion as metal hits all-time high)! Bitcoin Suisse is on board!

Give me a break.

Are we really supposed to get excited about this? It feels less like a revolution and more like putting a high-tech GPS on a horse-drawn carriage. Sure, it looks modern and you get some fancy new data, but at the end of the day, you're still just riding a horse. This isn't innovation; it's marketing. It's slapping a ".com" on something that's been sitting in vaults for 5,000 years and pretending you've invented a new form of transportation.

The narrative they’re spinning is that in an age of government shutdowns and fiat "debasement," people are flocking to safe havens. And look! Gold is at $4,000 an ounce, Bitcoin is at $126,000, even the S&P 500 is hitting records. Everything is going up. It’s the "everything bubble" all over again, and tokenized gold is just another partygoer wearing a slightly different mask. But what happens when the music stops?

The whole pitch for PAXG is that each token is backed 1:1 by a real, physical troy ounce of gold sitting in a Brink’s vault somewhere in London. It's regulated by the New York State Department of Financial Services, and you can even look up the serial number of the specific gold bar your digital token is tied to. That all sounds great, very reassuring. But it begs a fundamental question that no one seems to be asking: if the entire point of owning physical gold is to have a tangible asset that exists outside the digital and financial systems, why on earth would you want to tie it directly back into one?

Think about it. The classic gold bug fantasy involves the world going to hell, the power grid failing, and fiat currency becoming worthless toilet paper. In that scenario, your physical gold bar is king. But your PAXG token? It’s just a string of code on the Ethereum blockchain, which, by the way, probably won't be working if the world is ending. So who is this actually for? It ain't for the doomsday preppers, that's for sure.

The Suit-and-Tie Invasion

This brings us to the latest chapter in the saga: the institutional embrace. Bitcoin Suisse, a big-shot crypto bank out of Switzerland, just announced they’re offering trading and custody for PAXG (Bitcoin Suisse Announces Trading and Custody Support for PAX Gold (PAXG)). Their CEO, Peter Camenzind, dropped this little gem of corporate-speak: “At Bitcoin Suisse, we see PAXG as the perfect example of how traditional assets can be reimagined for the digital economy.”

Let me translate that for you: “We have a bunch of rich, conservative clients who are terrified of Bitcoin but suffer from severe FOMO. Gold is something they understand. By calling it 'tokenized gold,' we can sell them a crypto-adjacent product, charge them fees, and make them feel like they’re part of the future without them having to actually understand what a smart contract is.”

It’s a brilliant move, I’ll give them that. They’re building a "bridge between legacy finance and the future," as they put it. A bridge that, offcourse, comes with a toll. They’ve even opened a new office in Lugano, the "southern crypto beacon" of Switzerland, to get closer to their clients. I can just picture the scene: some wealth manager in a crisp suit, sitting across from a 70-year-old count, explaining how his family’s ancestral gold holdings can now be "unlocked for the DeFi space." The count just nods along, having no idea what any of that means, but he hears "gold" and "Swiss" and "secure," and he signs on the dotted line.

This is the real story here. This isn’t about democratizing gold ownership for the little guy. This is about financial institutions finding a new, blockchain-flavored wrapper for an old product to sell to the same old money. It's a bad idea. No, 'bad' doesn't cover it—this is a fundamentally cynical cash grab dressed up as progress. They talk about transparency and auditability, which is fine, but they conveniently ignore the new layers of risk they're introducing. You now have smart contract risk, platform risk, and the ever-present risk of someone hacking your wallet. All this, just to avoid the "hassle" of storing a physical asset? The hassle is the entire point!

And what about the crypto natives? Are they really going to trade their Bitcoin, with its asymmetric upside and truly decentralized ethos, for a digital IOU on a shiny metal that just sits there? The bitcoin/gold ratio tells the story. Even with gold outperforming Bitcoin this year, one BTC still buys over 31 ounces of gold. The real digital gold is, and always has been, Bitcoin. Everything else is just an imitation, an attempt to capture the magic without taking the risk.

Then again, maybe I'm the crazy one. Maybe there really is a massive, untapped market of people who want the price exposure of gold combined with the user experience of a crypto token. People who trust a New York trust company, the Ethereum network, and a Swiss bank all at the same time... but not the U.S. dollar. It just seems like a very, very specific and slightly contradictory person.

Same Old Shine, New Digital Chains

Let's be brutally honest. Tokenized gold is a solution in search of a problem. It takes the single best feature of physical gold—its tangible, offline, system-independent reality—and throws it out the window in exchange for the "convenience" of being a token on a blockchain. It’s a product built not for the hardened gold bug or the crypto purist, but for the investor caught in the middle: too scared for Bitcoin, too bored for bullion. It's the financial equivalent of a hybrid car—it’s not great at being a gas car, and it’s not great at being an electric one, but it lets you feel like you're doing something modern. And just like with most financial products, the only people guaranteed to win are the ones selling it.

Related Articles

eth price: analysis and trader losses

Ethereum's $3,700 Cliff: Is This Just a Dip, or the Start of a Real Slide? ETH's Rocky Road: Data Di...

Grand Canyon Shutdown: What's Actually Closing and Why It's a Total Mess

So I was trying to read an article the other day, and this pop-up slams onto my screen. A "Cookie No...

The Food Safety System That Worked: Inside the Egg Recall and the Tech That Stopped a Crisis

This Egg Recall Exposes a Flaw in Our Reality—And the Tech That Will Fix It You probably saw the hea...

Plasma: What It Is, How It Saves Lives, and What Comes Next

The night sky over Wyoming split open. It wasn’t the familiar, ghostly dance of the aurora that Andr...

ASTER Zooms on Binance's CZ Move: What's the Catch?

CZ Pumps ASTER? More Like a Slow-Motion Train Wreck So, CZ bought 2 million ASTER tokens, huh? And t...

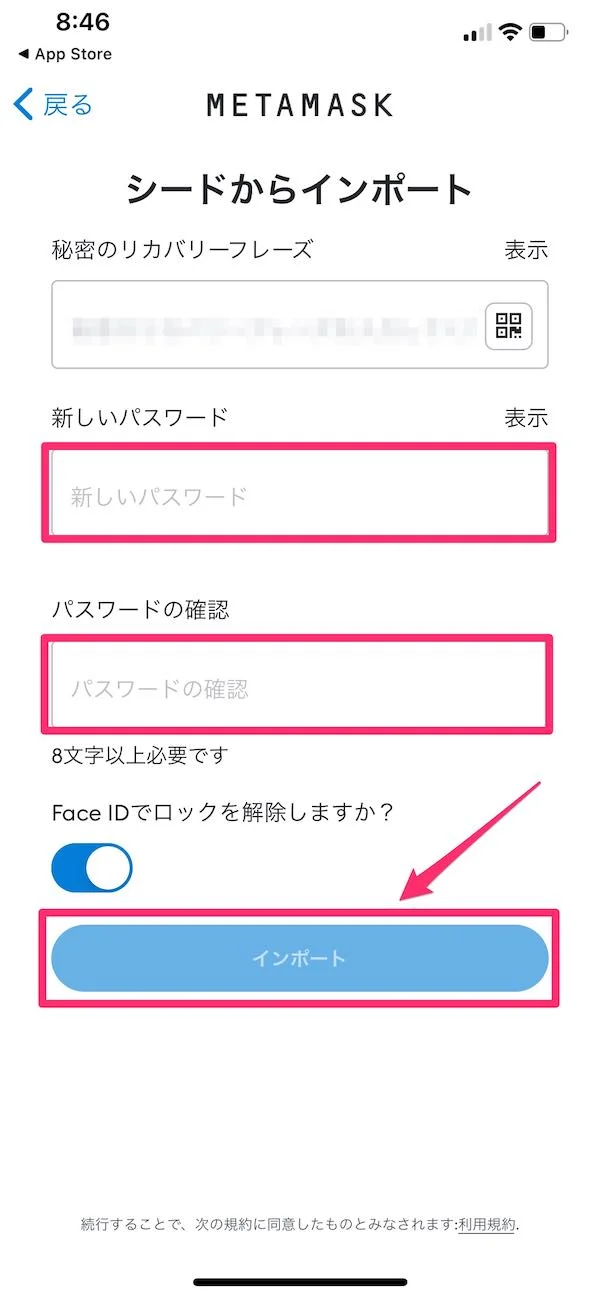

MetaMask: What It Is, How It Works, and Why It's Your Key to Web3

For years, we’ve thought of MetaMask as a key. A simple, indispensable tool. It’s the friendly fox i...