NVDA Stock Is Sinking: Why the Smart Money Is Running and What They're Not Telling You

So, the oracle has spoken. Stanley Druckenmiller, the investing world’s equivalent of a rock god, has decided the Nvidia party is over. He cashed out. Sold every last share. And the financial media is tripping over itself to tell you what he’s buying instead, as if it’s some secret map to El Dorado.

Let's be real. This isn't a treasure map. It’s a fire alarm.

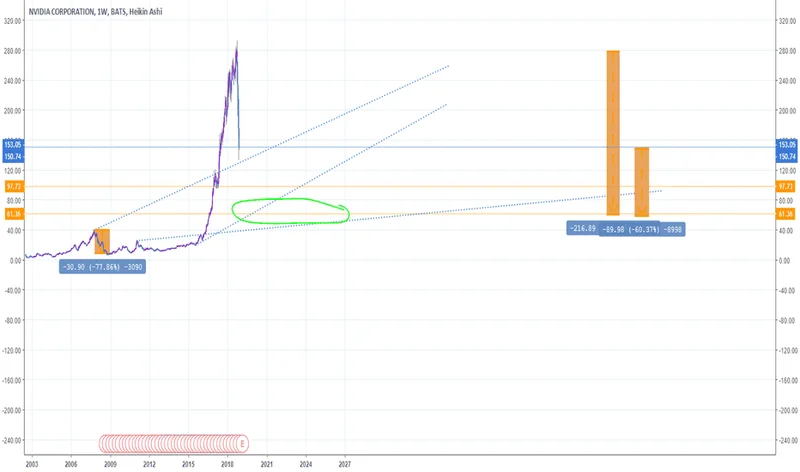

For the last two years, watching Nvidia’s stock chart has been like watching a SpaceX rocket launch on repeat. A relentless, physics-defying climb that made a handful of people disgustingly rich and convinced an army of retail traders that they, too, were financial geniuses. All you had to do was buy NVDA and shut up. But one of the guys who strapped himself to that rocket early just quietly unbuckled his seatbelt, grabbed a parachute, and jumped.

And he did it while the rocket is supposedly still going up.

You have to ask yourself: what does he know that we don’t? Or maybe, what is he seeing that the rest of the market is willfully ignoring?

The 'No Duh' Pivot to the Plumbers

Druckenmiller’s big, revolutionary move after selling the hottest stock on the planet was to… buy Microsoft and Taiwan Semiconductor Manufacturing (TSMC). Groundbreaking stuff. This is the investing equivalent of selling your waterfront mansion in Miami to buy two really nice houses in a gated community in the suburbs. It’s safer, it’s sensible, and it’s boring as hell.

And that’s the entire point.

TSMC is the company that actually builds the silicon wafers that Nvidia just designs. They’re the ones with the fabs, the clean rooms, the multi-billion dollar machines that turn sand into magic. To put it simply, TSMC is the guy selling picks and shovels to every single gold miner in the AI gold rush. Nvidia is just the most successful miner right now, but TSMC sells to Apple, to Broadcom, to everyone. If the AI boom is a high-stakes poker game, Druckenmiller just traded his seat at the final table—where he had a monster stack of chips—for a piece of the casino itself. The house always wins, right?

Then there's Microsoft. Good old, reliable Microsoft. They’re pouring a mind-numbing $80 billion into capital expenditures this year alone just to build out the data centers to run all this AI stuff. They’re a massive customer of Nvidia, but they’re also a platform. With their Azure cloud and their stake in OpenAI, they are the utility company of the AI age. They provide the electricity.

See the pattern here? He’s not betting on the star quarterback anymore. He's betting on the company that owns the stadium and the league that sells the broadcast rights. It’s a classic de-risking move. This isn't a bold new thesis on AI. No, 'bold' doesn't cover it—this is a five-alarm retreat to safety. He’s telling us, without saying a word, that the insane gains are probably in the rearview mirror and now it’s about capital preservation.

It’s just so painfully obvious that I can’t believe people are framing it as some kind of brilliant new strategy. It’s Strategy 101. Offcourse, it’s also easy for me to sit here and say that, I didn’t just make billions on the trade. But still…

The Canary in the $4.4 Trillion Coal Mine

While headlines like Billionaire Stanley Druckenmiller Sold 100% of Duquesne's Stake in Nvidia and Is Piling Into 2 Unstoppable Stocks scream about his new buys, the real story is the sell. Why get out of Nvidia now? The company just posted another monster quarter with 55.6% revenue growth. Wall Street analysts are practically falling over each other to raise their price targets to $220. The consensus is a resounding "Buy."

And yet, the smart money is heading for the exits. It’s not just Druckenmiller. Look at the insider activity. CEO Jensen Huang sold $14 million worth of stock. CFO Colette Kress sold over $5 million. These aren’t huge percentages of their holdings, but it’s the optics. They’re selling. The guy who literally runs the company is taking cash off the table. Are we supposed to believe it’s just for "portfolio diversification"? Give me a break.

The whole thing reminds me of every other tech bubble I’ve ever seen. The narrative gets so powerful, so intoxicating, that nobody wants to admit the valuation makes absolutely no sense. Nvidia is trading at a P/E ratio of 51. Fifty-one! For a company with a market cap of $4.4 TRILLION. That's not just priced for perfection; that's priced for divine intervention. It assumes nothing can or will go wrong, ever. It assumes competitors won’t catch up, that geopolitical tensions with China (where TSMC is based, by the way) won't flare up, and that corporate demand for these ultra-expensive chips is infinite.

This is the kind of thinking that gets people wrecked. It's the same blind faith that powered the dot-com bust and every other speculative mania in history. What happens when the growth, while still amazing, slows from 55% to a "disappointing" 35%? What happens when the next earnings report is merely "great" instead of "biblical"? The air comes out of the balloon fast.

And I swear, if I have to read one more article about how "this time is different" because of AI, I'm going to lose my mind. That's what they always say. It ain't different. It's just a new product with the same old human greed and fear driving the cycle.

So, We're All Just Sheep Now?

Here’s my takeaway. Don’t follow Druckenmiller into TSMC and Microsoft because you think he’s found the next two Nvidias. That’s not what this is. Pay attention to the fact that one of the sharpest investors alive looked at the biggest winner in his portfolio, a stock everyone says is a can’t-lose ticket to the future, and decided, "I'm good. I’m out." He’s not chasing more upside; he’s protecting his downside. He rang the bell. The question is, is anyone else listening, or are they all too busy staring at the ticker, mesmerized by the flashing green lights?

Related Articles

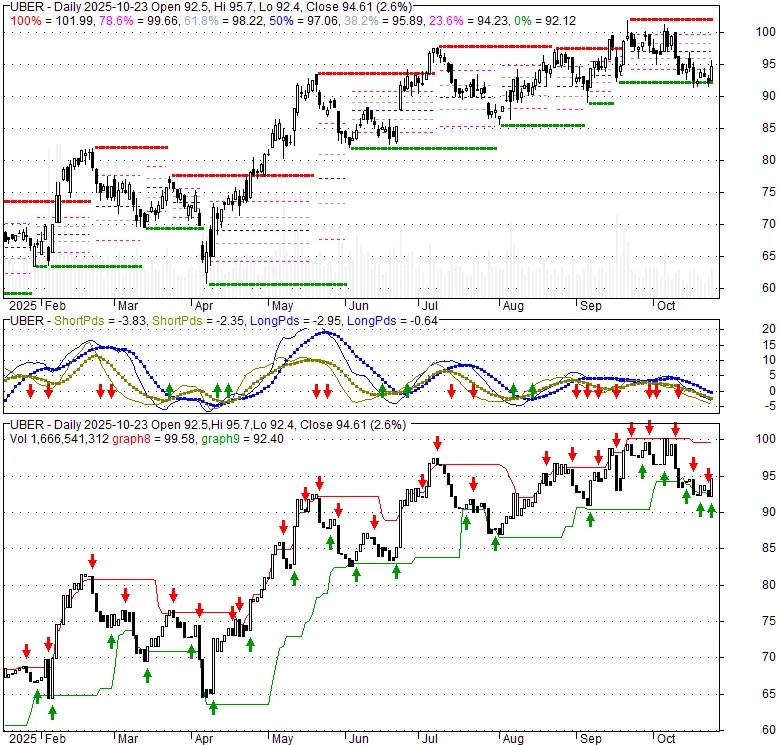

Uber's Stock Jump: The Nvidia Hype vs. the Lyft Reality

So, Uber's Tying the Knot With Nvidia. Don't Pop the Champagne Just Yet. Let’s get one thing straigh...

Netflix's 10-for-1 Stock Split: The Official Rationale vs. The Mathematical Reality

Netflix just announced a ten-for-one stock split, and the official press release reads like a corpor...

Fed's Latest Minutes: What the Data Reveals About Rate Cuts and Internal Disagreement

The Federal Open Market Committee just released the minutes from its September meeting, and if you w...

Dan Schulman Named New Verizon CEO: What His PayPal Past Means for Verizon's Future

Verizon’s New CEO Isn’t About 5G. It’s About a Quiet Panic. The market’s reaction to the news was, i...

```json

It's All Just Smoke and Mirrors Yum Brands, the parent company of Pizza Hut, is initiating a strateg...

PFE Stock: Guidance Up, Sales Down - What's the Catch?

Pfizer's "Strong EPS Performance"? More Like Smoke and Mirrors Pfizer's patting itself on the back f...