ChainOpera AI's 2,200% Surge: The Real Math Behind Its Explosive Growth and What Comes Next

The Anatomy of a Hype Cycle, or a Glimpse of the Future?

There are moments in the market when an asset’s chart stops looking like a financial instrument and starts resembling an EKG reading during a cardiac event. ChainOpera AI (COAI) is currently that moment. Depending on the day, you’ll see reports of a 512% surge in 24 hours, a 30-day gain of over 2,200%—or to be more exact, 2,220%—and then a quiet mention of a prior 90% collapse.

The numbers are dizzying, designed to induce a potent mix of FOMO and vertigo. The project’s proponents will point to a Fully Diluted Valuation (FDV) that briefly surpassed $4 billion, a figure highlighted in reports like The Secret Behind ChainOpera AI’s Explosive Success: Strategic Cycle Timing and a Fully Diluted Valuation Beyond $4 Billion, hailing it as the top-valued project in the AI Agent space. They’ll talk about a flawless launch, strategic timing, and a genuine product ecosystem. Detractors, however, will point to the volatility and the technical charts screaming caution.

The question isn't whether COAI has had a successful launch; the data confirms it was explosive. The real question is whether we're witnessing the birth of a benchmark project or just the textbook anatomy of a speculative bubble, perfectly engineered for the current market.

A Masterclass in Market Entry

You have to give credit where it’s due: the team behind ChainOpera AI executed a launch strategy that could be studied in business schools. They didn't just release a token; they orchestrated a convergence of narratives.

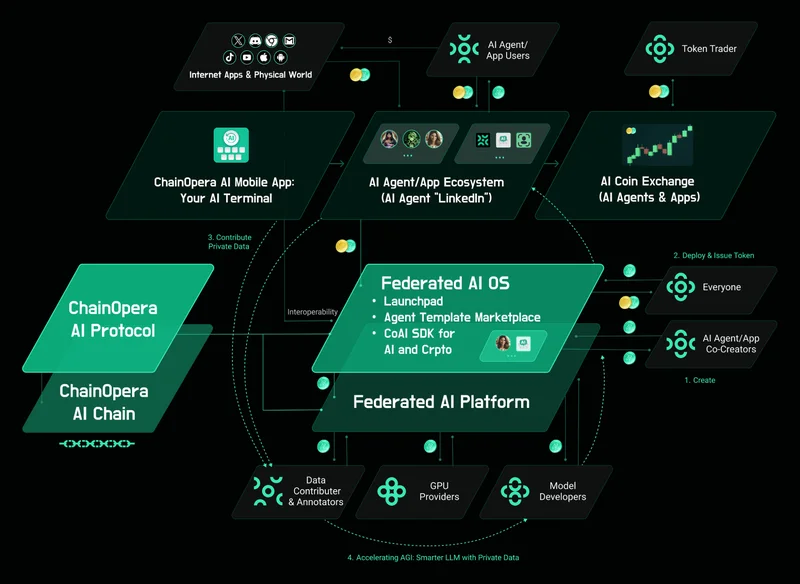

First, they surfed the AI wave, a sector supercharged by developments like OpenAI’s ChatGPT browser and the AMD supply deal. By positioning themselves as a "ChatGPT for crypto needs," they tapped directly into the market's most potent narrative. Second, they anchored themselves to the BNB Smart Chain (BSC) just as its ecosystem activity and on-chain fees were hitting new highs, effectively hitching their wagon to a freight train. The claim of converting 300,000 product users on BNB to 40,000 token holders is particularly interesting, as it suggests a solution to the classic Web3 problem of separating users from speculators.

Then came the tactical execution. They launched during a surge in perpetual futures trading, ensuring deep liquidity from day one. They even coordinated their listing with another stablecoin project, $XPL, creating a "bundle buy" phenomenon that amplified traffic for both. It was a textbook case of catalyst stacking.

But does perfect timing substitute for long-term utility? The project claims 3 million AI users, but the specifics of that metric remain opaque. How many of those are active, engaged participants versus transient accounts drawn in by the launch-week frenzy? Without granular data on user retention and platform activity, we're left to take their word for it. And in this market, that's a significant risk.

The Engine is Screaming

This brings me to the charts. And this is the part of the analysis that I find genuinely concerning. While the price has been putting on a brave face, the underlying technicals are telling a very different story. Think of it like a race car rocketing down the straightaway. The speedometer shows a record speed, but a glance at the dashboard reveals the oil pressure is plummeting and the engine temperature is deep in the red. The car is still moving fast, but the mechanics suggest it can’t last.

That’s what we’re seeing with COAI. Two key indicators, the Relative Strength Index (RSI) and the Money Flow Index (MFI), are flashing classic bearish divergences. Between mid and late October, while the COAI price was carving out higher highs, the RSI was printing lower highs. Translation: the buying momentum was fading with each new price peak. Simultaneously, the MFI showed that actual capital inflows were thinning out. When both of these indicators contradict the price action, it’s often an early warning that the rally is running on fumes, prompting analyses that the ChainOpera AI Price Turns Bearish As 50% Drop Risk Looms.

Compounding this is the social media data. A 1,300% spike in social mentions isn't a signal of sustainable interest; it’s a signal of speculative mania. It indicates that the marginal buyer is no longer a discerning investor but a trend-chaser piling in at the top. With a large portion of the token supply reportedly concentrated among a few wallets (a detail that is frustratingly hard to pin down with precision), this combination of weakening momentum and retail frenzy creates a dangerously fragile environment. What happens when the social media hype inevitably moves on to the next shiny object?

The Signal and The Noise

My analysis suggests we are observing two separate phenomena. The first is a brilliantly executed marketing and launch campaign that created enormous, albeit temporary, market momentum. The "noise" of this launch—the exchange listings, the narrative alignment, the coordinated volume—has been deafening and, for many traders, immensely profitable.

The second phenomenon is the underlying "signal" from the data. The weakening technicals, the reliance on speculative futures volume, and the social media frenzy all point to a valuation that has become decoupled from its fundamental base. The project may well have a promising future, but the current price action isn't a reflection of that future. It’s a reflection of a short-term, hype-driven mania. The risk now is that the noise dies down, leaving only the signal—and that signal is flashing a clear warning.

Related Articles

ChainOpera AI's Explosive Growth: The Secret Behind Its Success and What It Means for the Future

The Price of COAI Isn't the Story. The Revolution Is. Let’s be honest. You’re probably here because...

ChainOpera AI's $4 Billion Valuation: What the Numbers Actually Say About Its Growth

The spectacular implosion of a financial asset is always instructive. But the case of ChainOpera AI’...