ChainOpera AI's $4 Billion Valuation: What the Numbers Actually Say About Its Growth

The spectacular implosion of a financial asset is always instructive. But the case of ChainOpera AI’s token, COAI, which materialized on the market in late September, offers a particularly clean signal amidst the noise. In the span of about 17 days, the token executed a parabolic advance that defies conventional market logic, moving from a launch price near $0.14 to an intraday high of $44.9.

That’s a gain of over 30,000%—to be more exact, a 31,971% peak-to-trough move. This ascent briefly gave the project a fully diluted valuation between $35 and $45 billion, a figure that placed it, however briefly, in the same league as established crypto giants. Then, just as quickly, it collapsed. The token now trades around $2.3, a nearly 95% haircut from its peak.

The story being told, captured in headlines like The Secret Behind ChainOpera AI’s Explosive Success: Strategic Cycle Timing and a Fully Diluted Valuation Beyond $4 Billion, is one of strategic timing, superior technology, and riding the AI narrative wave. The data, however, suggests a different narrative. It points to a textbook case of a well-funded, technically credible project whose token launch was executed with the market dynamics of a highly speculative, and likely coordinated, pump.

The Anatomy of a Price Spike

Let's dissect the mechanics of the rally. COAI launched on September 25, 2025, and for its first week, trading was muted. The token hovered below $0.22. The catalyst for the explosion arrived on October 6th. Driven by new listings on exchanges like Bybit and Gate.io, coupled with sector-wide enthusiasm from an AMD-OpenAI partnership announcement, COAI ignited.

In a single 24-hour period, it surged over 600%. Trading volume ballooned from negligible levels to more than $400 million. This is the kind of velocity that attracts momentum traders and liquidates anyone betting against it. Open interest in its perpetual futures contract soared to $167 million, and short liquidations topped $17 million, adding fuel to the fire.

This is where the official story and the on-chain data begin to diverge. While the narrative credits "strong marketing" and "early user adoption," a report from the analytics firm Bubblemaps identified a far more direct driver: a cluster of 60 wallets executing synchronized trades. And this is where the data becomes difficult to reconcile with the 'organic growth' narrative. I've analyzed on-chain flows for years, and the synchronization reported by Bubblemaps is a textbook indicator of non-retail, coordinated activity. It’s the digital equivalent of seeing a small group of people in a room all stand up and cheer at the exact same moment. Is it possible they were all overcome with spontaneous emotion? Perhaps. Is it more likely they were following a signal? The data suggests the latter.

This wasn't a groundswell of retail interest. It was a liquidity event, likely engineered to capitalize on the exchange listings and the broader AI hype cycle. The question isn't whether the timing was strategic; it's whether the price action itself was manufactured.

A Project of Contradictions

What makes the COAI event so fascinating is the disconnect between its market behavior and its pedigree. This wasn't some anonymous memecoin project. ChainOpera AI was founded by Professor Salman Avestimehr of USC, an IEEE Fellow with over 18,000 research citations, and Dr. Aiden Chaoyang He, an AI specialist with a resume spanning Meta, Google, and AWS. The team is staffed with talent from MIT, Stanford, and Apple. Their work builds on FedML, a legitimate and widely used open-source framework for federated machine learning.

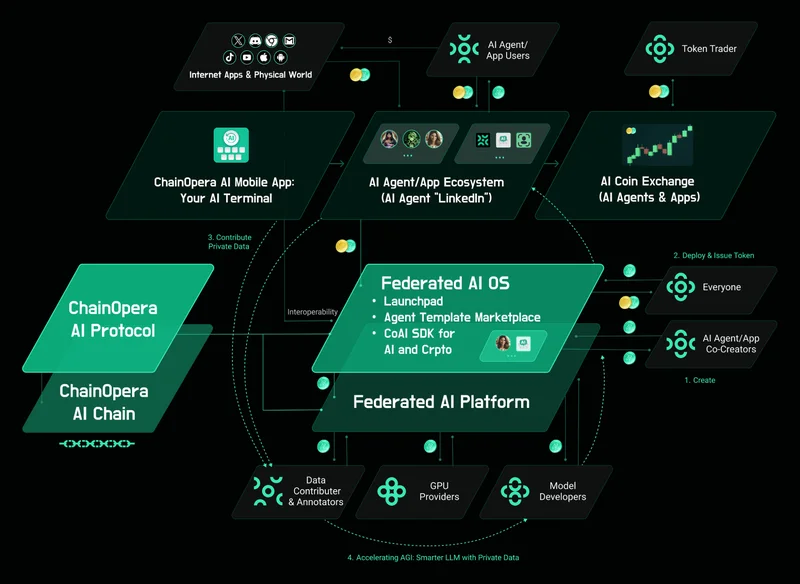

The project’s whitepaper describes a sophisticated four-layer architecture, a novel "Proof of Intelligence" consensus mechanism, and a vision for a decentralized AI ecosystem. On paper, it possesses the intellectual capital to be a serious contender in the Web3 space.

Yet, this technical credibility is completely at odds with the token's market structure. An audit from the analytics platform Kryll³ assigned COAI an "F" for cybersecurity and flagged a high concentration of supply among a small number of wallets (a classic risk factor for price manipulation). This is a massive red flag. When a large percentage of a token's supply is held by a few insiders, the market for that token ceases to be a fair playing field. It becomes a private table where the house has a decisive, unassailable edge.

So, which is the real ChainOpera AI? Is it the ambitious research project led by world-class academics, or is it the speculative vehicle whose price chart looks like an electrocardiogram during cardiac arrest? Can both be true?

The price predictions floating around—from questions like ChainOpera AI Price Prediction: Can COAI Reach $10? to calls for $160 or even $300 by 2030—seem entirely detached from the current reality. Such valuations are contingent on a healthy, functioning market. They assume that price is a reflection of adoption, utility, and technological progress. But the October rally wasn't about any of that. It was an exercise in pure, unadulterated speculation, amplified by what appears to be coordinated on-chain activity.

A Technically Sound Engine in a Compromised Vehicle

My analysis suggests ChainOpera AI is a paradox. The project has a legitimate technological foundation and is helmed by individuals with impeccable credentials. This is not a scam in the traditional sense of a project with no product and no team.

However, the market for its token is fundamentally broken. The on-chain data points not to organic growth but to a highly controlled, reflexive event designed to maximize hype and initial valuation. The extreme concentration of supply means that any future price action will be dictated by the decisions of a few large holders, not by the broader market or the project’s own progress.

The technology might be real, but the market is not. Until the supply is more widely distributed and the project can demonstrate a period of stable, organic price discovery, treating COAI as a long-term investment is illogical. It’s a trading instrument, and a dangerous one at that. The engine may be expertly designed, but it has been installed in a vehicle with no brakes, steered by a handful of drivers who control both the accelerator and the destination.

Related Articles

ChainOpera AI's 2,200% Surge: The Real Math Behind Its Explosive Growth and What Comes Next

The Anatomy of a Hype Cycle, or a Glimpse of the Future? There are moments in the market when an ass...

ChainOpera AI's Explosive Growth: The Secret Behind Its Success and What It Means for the Future

The Price of COAI Isn't the Story. The Revolution Is. Let’s be honest. You’re probably here because...