ChainOpera AI's Explosive Growth: The Secret Behind Its Success and What It Means for the Future

The Price of COAI Isn't the Story. The Revolution Is.

Let’s be honest. You’re probably here because you saw the chart.

You saw a digital asset named ChainOpera AI, ticker symbol COAI, materialize out of the ether in late September, do virtually nothing for a week, and then ignite. You can almost picture the glow of thousands of screens on October 12th, a mix of disbelief and euphoria as a token that cost pennies just days before screamed past forty dollars. A gain of over 13,500%. Then, just as quickly, you saw it plummet, shedding nearly 90% of its value in a chaotic, vertigo-inducing crash.

The crypto world, in its typical fashion, immediately split into two camps. One side screamed “paradigm shift,” the other, “top scam of October.” And if you’re only looking at that chart, that violent EKG of market mania, both conclusions seem plausible.

But I’m here to tell you that the price is a distraction. It’s the deafening noise that’s preventing us from hearing the signal. Because beneath the speculative frenzy lies one of the most audacious and important experiments happening in technology today: a credible attempt to build a powerful artificial intelligence not in a corporate silo, but in the open, owned and operated by its users.

A Blueprint for a Shared Brain

Before we get lost in the financial chaos, let’s talk about who is behind this. This isn’t some anonymous project launched from a basement. The co-founders are Professor Salman Avestimehr of USC, an IEEE Fellow with a U.S. Presidential award to his name, and Dr. Aiden Chaoyang He, a veteran of Meta, Google, and AWS. Their team hails from MIT, Stanford, and Apple. These are serious people who have been working on the underlying technology since 2019, long before the AI hype cycle hit its current fever pitch.

Their goal is something they call “Crypto AGI”—a decentralized artificial general intelligence. What does that even mean?

Imagine the world’s most powerful AIs today—they are built like cathedrals in the desert. They are owned by a handful of trillion-dollar companies, their architecture is secret, and their goals are dictated by a boardroom. We, the public, can visit them, but we can never own a stone in the foundation. ChainOpera is proposing something different. It’s not a cathedral; it’s a city. A city where anyone can build, anyone can contribute, and everyone can own a piece of what they create.

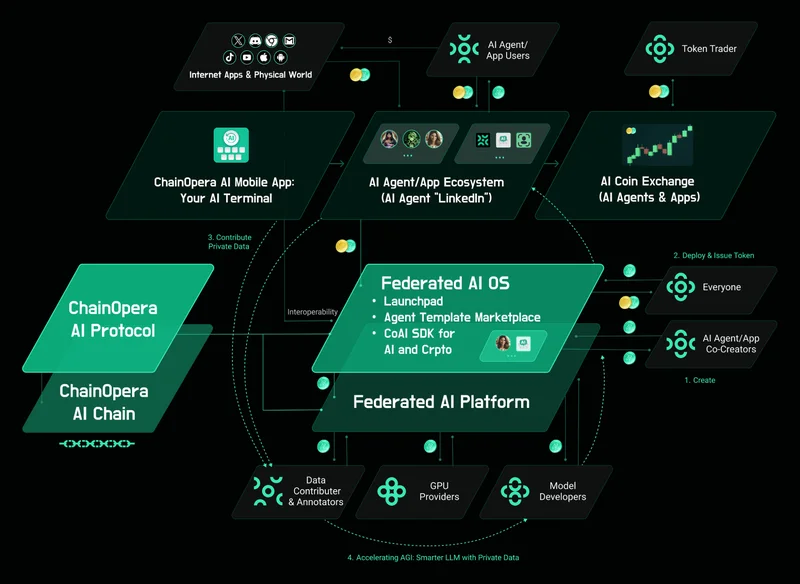

This is built on a few profound technological pillars. First is Federated Learning—in simpler terms, this allows the AI to learn from data on millions of devices without that data ever leaving your phone or computer, preserving privacy while building a collective intelligence. Then there’s their proprietary Proof of Intelligence mechanism, a system where every contribution is verified and rewarded on-chain, creating a transparent, decentralized, and community-powered engine for innovation that could fundamentally reshape how we create—it's just a breathtaking concept. This isn't just about who has the most computing power; it's a meritocracy of the mind.

When I first saw the architecture, I honestly just sat back in my chair, speechless. This is the kind of breakthrough that reminds me why I got into this field in the first place. It raises one of the most exciting questions of our time: What happens to the pace of human progress when the tools to build world-changing AI are no longer locked away in corporate vaults?

Decoding the Market's Fever Dream

So, if the technology is so revolutionary, why the catastrophic boom and bust? Why did one analyst label it a scam while technical charts from Bitget screamed “Strong Buy”?

Because the market has no framework for what it’s looking at. The price action wasn't a rational valuation; it was a seizure. It was the collective financial consciousness of the internet trying to process a new idea and short-circuiting in the process. The accusations of manipulation and over-centralized wallets are valid concerns for any new project, but to dismiss the entire endeavor because of them is to miss the forest for the trees.

This feels like a historical echo. Think back to the late 1990s. The internet was undeniably a world-changing technology, yet the market’s first attempt to price it gave us the dot-com bubble. We got Pets.com, a company that burned through hundreds of millions to sell dog food online and went bankrupt. The bubble bursting didn't mean the internet was a scam; it just meant the market’s initial understanding of it was immature and hysterical. For every Pets.com that vanished, an Amazon was quietly building the future.

The wild ride of COAI feels the same. The 13,500% spike wasn't about utility; it was about hype, with many trying to explain The Secret Behind ChainOpera AI’s Explosive Success: Strategic Cycle Timing and a Fully Diluted Valuation Beyond $4 Billion. The 90% crash wasn't about failure; it was a gravity check. We are watching, in real-time, the messy, violent birth of a new kind of economy. Of course, building a decentralized AGI comes with immense responsibility. How do we ensure it aligns with human values when it’s owned by everyone and no one? Are we judging a new form of collaborative creation by the outdated rules of speculative stock trading?

This Is About Power, Not Price

Forget the all-time high. Forget the crash. Zoom out. The real story of ChainOpera AI is not its price, but its premise. The idea that a global community can collaboratively build, train, and own a powerful intelligence is no longer science fiction. The blueprint is here. It’s being tested, and the market’s chaotic reaction is, in its own way, proof that something paradigm-shifting is happening. We are at the very beginning of a long, volatile, and profoundly important journey to democratize the single most powerful technology humanity has ever invented. And that’s a story worth far more than $44 a token.

Related Articles

ChainOpera AI's $4 Billion Valuation: What the Numbers Actually Say About Its Growth

The spectacular implosion of a financial asset is always instructive. But the case of ChainOpera AI’...

ChainOpera AI's 2,200% Surge: The Real Math Behind Its Explosive Growth and What Comes Next

The Anatomy of a Hype Cycle, or a Glimpse of the Future? There are moments in the market when an ass...