Arcblock's 2000% Volume Surge: A Sober Look at the Trump Catalyst and Price Action

Generated Title: Arcblock's Volatility: Is It a Master of Adaptation or a Project Without a Core?

It’s a familiar rhythm in the crypto space. A token builds momentum, surges on a wave of social media euphoria, hits a multi-week high, and then, just as quickly, gravity reasserts itself. Arcblock (ABT) traced this exact pattern in late October, shedding nearly 9% just days after a 31% weekly rally. For short-term traders, this is just the cost of doing business. For anyone trying to build a fundamental thesis, however, the event is another data point in a much more interesting and complex story.

Arcblock’s chart isn’t just a measure of price; it’s a history of narratives. The project has demonstrated a remarkable—some might say uncanny—ability to align itself with whatever a particular market cycle finds most exciting. This chameleon-like quality has produced explosive, if short-lived, gains. But it also forces a critical question: Is this a sign of a versatile, forward-thinking protocol, or is Arcblock simply a project that’s very, very good at marketing?

The Anatomy of a Hype Cycle

To understand Arcblock’s present, you have to look back at its recent past. Let’s rewind to January 2025. The broader market was stagnant, yet ABT exploded, surging 45% in a single day. The catalyst wasn’t a product launch or a technical breakthrough. It was a story.

At the time, the narrative winds were blowing favorably for anything related to artificial intelligence, particularly projects with a "made in the USA" label. This was amplified by political tailwinds, including Donald Trump’s administration signaling a pro-crypto, pro-AI stance, a development that saw Arcblock (ABT) Trading Volume Surges 2000% After Trump AI Endorsement. Arcblock, an AI protocol based in the United States, fit the script perfectly. The market responded with a frenzy. Trading volume skyrocketed a monumental 2,110.79% in 24 hours, jumping from roughly $1.26 million to over $23 million.

This is the kind of outlier event that gets my attention. The price action was completely decoupled from any internal development. It was a purely external, narrative-driven event. The surge was powerful, but it was also brittle. The token hit a wall at the $2 resistance level, a ceiling it hadn’t broken since the previous summer, and failed to push through. The hype had a clear expiration date. What does it tell us when a token’s valuation is more sensitive to political announcements than to its own roadmap?

A Convenient Shift in Identity

Just a few months later, in May 2025, the market’s obsession shifted. The new "meta" was gasless transactions. And right on cue, Arcblock was there. The conversation around ABT pivoted. Suddenly, the project’s primary value proposition, at least according to the chatter, was that staking a single ABT token grants users gas-free transactions. The price responded accordingly, pumping over 200% in the preceding month and breaking through a key technical resistance level (the 200 smoothed moving average).

And this is the part of the analysis that I find genuinely puzzling. I’ve looked at hundreds of these project whitepapers and marketing plans, and this rapid pivot in public emphasis from "national AI champion" to "gasless transaction pioneer" is unusual. The technology for both narratives already existed within the project. The only thing that changed was which feature the project and its community chose to highlight.

This presents a methodological problem for any serious analyst. We see a clear correlation: a new market narrative emerges, Arcblock aligns with it, and the price pumps. But is the market reacting to genuine innovation, or is the project’s team just exceptionally adept at re-framing its existing features to capture the speculative zeitgeist? It’s a brilliant strategy for generating short-term trading volume, but it makes assessing a durable, long-term value proposition incredibly difficult. The project raised a significant amount of capital in its ICO (a reported $45 million), and it seems much of its ongoing activity is focused on generating token velocity rather than sticky, fundamental adoption.

The token remains far below its all-time high of $4.69, recorded back in May 2024. In fact, despite all these periodic surges, it remains down about 60% year-over-year—to be more exact, it's more than 86% below that peak. These pumps, while dramatic, have so far only served as temporary relief in a longer-term downtrend.

The AI Echo and an Uncertain Future

Which brings us back to today. The AI narrative has returned, and so has Arcblock’s focus on it. The late October rally was fueled by renewed excitement over its AIGNE (AI-Generated Node Engine) and deeper integration with Amazon Web Services. On social media, the slogan "AI is ArcBlock" went viral, and influencers were once again placing it on their "top altcoins to watch" lists. The subsequent correction looks like classic profit-taking from traders who have seen this movie before, a move that prompted the question, Why is Arcblock cryptocurrency down after hitting a two-month high?

Now, the project is dropping hints of something bigger on the horizon. Its official Twitter account teased the "beginning of a new technological revolution" through a collaboration with a major Australian research institution, with findings to be published at a top academic conference. This suggests a layer of institutional seriousness that contrasts sharply with the purely speculative nature of its price rallies.

The community is speculating that the public launch of the AIGNE platform is imminent. This could be a pivotal moment. A successful launch that attracts real developers and users could finally provide the fundamental anchor the project has been lacking. It could validate the AI ambitions and create a sustainable value proposition that exists independently of market hype.

But the question remains. Will this next phase create a durable new price floor based on utility, or will it simply provide the fuel for the next, even more volatile, hype cycle? Can Arcblock finally convert its narrative momentum into genuine network adoption, or is its primary product destined to be the token itself, an instrument for speculating on stories?

A Masterclass in Narrative Arbitrage

My analysis suggests Arcblock isn't operating as a traditional tech project. Instead, it functions as a financial asset that excels at what I can only call "narrative arbitrage"—the practice of identifying the most profitable market story at any given moment and rapidly aligning its identity to capture the resulting capital flows. This is a remarkably effective strategy for generating volatility and trading volume. It is not, however, a strategy for building long-term, fundamental value. The data shows a project that can ride a wave better than almost any other, but it has yet to prove it can create a tide of its own.

Related Articles

Zcash's Breakthrough: Why It's Surging and What the Community Thinks Is Next

I have to be honest with you. For the past few years, watching the Zcash (ZEC) chart has felt like w...

Emma Stone's Plastic Surgery Speculation: An analysis of the photos and the data behind the rumors

The public appearance of a high-value asset always generates data. On September 30, 2025, that asset...

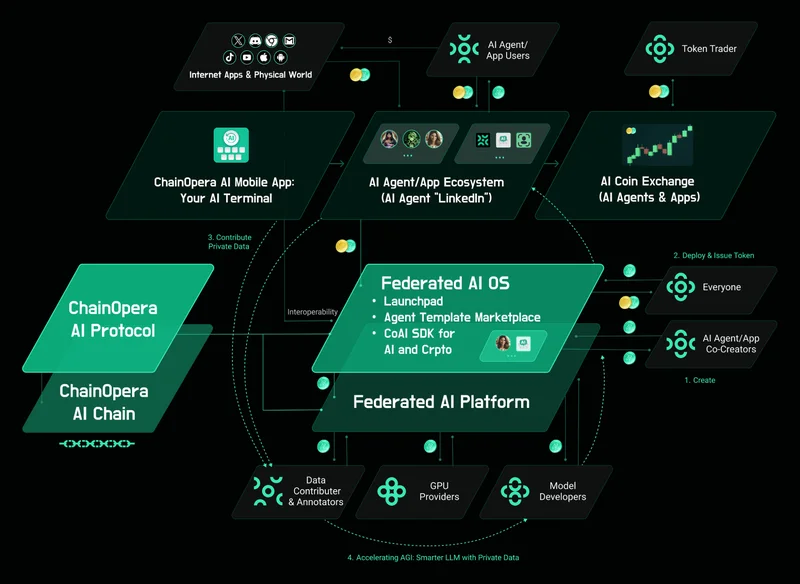

ChainOpera AI's 2,200% Surge: The Real Math Behind Its Explosive Growth and What Comes Next

The Anatomy of a Hype Cycle, or a Glimpse of the Future? There are moments in the market when an ass...

The Zcash 380% Rally: A Data-Driven Look at the 'Privacy Revival' Thesis

An asset left for dead doesn’t typically surge 380% in a month. Yet, here we are with Zcash (ZEC), a...

So, About That Binance Pardon: What It *Really* Means for Your Crypto

Of course, the President pardoned him. Were you expecting anything different? I woke up Thursday to...

FICO's Latest Scheme Sends Stock Soaring: What It Actually Means and Who Pays the Price

So, FICO is letting mortgage lenders buy its magic numbers directly now. The press release, offcours...