Crypto ATMs: What They Are and Why They're a Total Scam

Your Neighborhood Bitcoin ATM is a Scam Magnet. Why Is Anyone Surprised?

So, California finally slapped a fine on another one of these crypto ATM outfits. The state’s Department of Financial Protection and Innovation (DFPI) hit Coinhub with a $675,000 penalty for a laundry list of violations, including overcharging customers. Let’s all pause for a round of polite, unenthusiastic applause.

Are we supposed to be impressed?

This is the fourth time the DFPI has gone after one of these operators. They’re making a big show of it, with the commissioner, KC Mohseni, puffing out his chest to say they’re going to “root out bad actors and scammers.” A noble sentiment, I’m sure. But fining these companies feels like trying to fix a burst dam with a roll of Scotch tape. It’s a performative gesture that does next to nothing to address the rotten core of the problem.

The fine includes $105,000 in restitution for customers who were fleeced. That’s great for them, I guess. But what about the fundamental nature of these machines? Let’s be real. What is a crypto ATM, really? It’s a box, usually tucked away in a sad corner of a gas station or liquor store, that invites you to trade your actual, government-backed money for a volatile digital token at an often-exorbitant fee. The entire premise feels designed to prey on the desperate or the uninformed.

The Whack-a-Mole Enforcement Game

This isn’t just happening in California. It’s a global game of regulatory whack-a-mole. In June, the DFPI fined another operator, Coinme, for $300,000. Down in Australia, AUSTRAC is getting in on the action, fining an operator called Cryptolink. Meanwhile, some places are just deciding to opt out of the whole circus. The city of Spokane, Washington, and the entire country of New Zealand have banned the kiosks outright, citing—surprise, surprise—their connection to scams and financial crime.

These fines, like the one against Coinhub, are just the cost of doing business. Coinhub was caught charging fees above the legal maximum, accepting cash transactions over the daily limit, and conveniently leaving key information off receipts. This isn't a simple mistake. This is a business model. How much do you think they raked in from all those “mistakes” before they got caught? I’m willing to bet it was a hell of a lot more than $675,000. So, they pay the fine, issue a non-apology, and the game continues.

It reminds me of those old arcade games where you could put in another quarter to continue. For these companies, the fines are just another quarter. They’re not a deterrent; they’re a line item on a spreadsheet. And while regulators pat themselves on the back, real people are getting their lives ruined.

A Machine Built for Scammers

Let’s talk about Diane Reynolds. A retiree from Maryland who got a pop-up on her computer telling her not to turn it off, that she’d been hacked. A voice on the phone, posing as tech support, convinced her that the only way to protect her money was to convert it all to Bitcoin. So she did what they said. She went to a nearby gas station, stood in front of a humming Athena Bitcoin ATM, and fed her entire bank account—$13,100—into the machine. I can just picture the scene: the smell of stale coffee and gasoline fumes, the indifferent cashier ringing up a pack of cigarettes, and Diane, terrified, pushing bill after bill into a machine she didn't understand, thinking she was saving her life's savings.

Her money, offcourse, was gone forever.

This ain't some isolated incident. The D.C. Attorney General is now suing Athena Bitcoin, alleging that a staggering 93% of all deposits made through their ATMs are linked to scams, a case that highlights how Bitcoin ATMs enable cryptocurrency scams, federal prosecutor alleges. Let me repeat that: ninety-three percent. And for facilitating this rampant fraud, Athena allegedly charges fees of up to 26% per transaction.

This is a bad business model. No, "bad" doesn't cover it—this is a five-alarm dumpster fire of predatory capitalism. These companies aren't just allowing fraud to happen; their profits seem to be directly dependent on it. They put up a few flimsy warnings on the screen, which everyone knows victims are coached by scammers to ignore, and then they wash their hands of it while collecting a fat percentage. And when they get sued, they release a statement saying they “strongly disagree with the allegations” and have “aggressive safety protocols.” Aggressive protocols that somehow let 93% of scam deposits go through? Give me a break.

I once had a regular bank ATM in a bodega eat my card, and the bank had it back to me in two days with a dozen apologies. That felt like a minor inconvenience. This crypto ATM business feels like a calculated mugging where the company that owns the alley gets a cut.

The scams are getting more creative, too. In Massachusetts, people are losing thousands to a "missed jury duty" scam. The FBI reported that elderly Americans lost nearly $3 billion to crypto fraud in 2024. These machines are the perfect weapon to aim at the most vulnerable people in our society. They create a sense of urgency and technological confusion that scammers exploit with brutal efficiency.

So, What's the Point of These Things, Anyway?

This brings me to the fundamental question I can’t shake: who are crypto ATMs actually for?

The sales pitch was always about financial inclusion, about “banking the unbanked.” What a load of crap. How are you “including” someone by charging them a 20% fee to turn their cash into a digital asset they probably don’t understand and can’t easily spend? It’s the opposite of inclusion. It’s a poverty trap with a slick, tech-bro veneer.

The real customers, it seems, are criminals and their victims. One group needs a way to receive and launder money with minimal oversight, and the other is coerced into using a system they can’t comprehend. The crypto ATM operator sits right in the middle, happily taking a piece from every fraudulent transaction.

Maybe I'm just getting old and cynical. Maybe there's some utopian, legitimate use case for these crypto atm machines that I'm just not seeing. Perhaps there’s a massive, untapped market of people who desperately want to buy Bitcoin at a gas station and are happy to pay a fee that would make a payday lender blush. But I doubt it. Then again, maybe I'm the crazy one here.

The truth is, these things exist in a gray area of regulation, and operators have exploited that for years. Now that regulators are finally waking up, their response is to levy fines that amount to little more than a slap on the wrist. It’s a signal that they see the problem, but they don’t have the guts—or perhaps the legal framework—to do what Spokane and New Zealand did. They won’t just pull the plug on the whole racket. And until they do, the stories like Diane Reynolds’ will just keep on coming.

It's Not a Bug, It's the Feature

Let's stop pretending. The scams, the insane fees, the exploitation of the elderly—these aren't unfortunate side effects of the Bitcoin ATM industry. They are the industry. The whole model is built on friction, confusion, and desperation. Fining these companies is like fining a casino because people lose money. It’s what the machine was designed to do. The grift is the entire point.

Related Articles

The Solana Price Charade: Why the Numbers Don't Add Up

Let me get this straight. The crypto world, in its infinite wisdom, has decided that the coin with a...

MetaMask: What It Is, How to Get It, and Why the Hell You'd Bother – What Reddit's Actually Saying

Welcome to the Crypto Wild West: Google's Search Bar Edition Alright, let's cut the corporate BS. Wh...

So, You Want to Go to Switzerland: The Real Deal on Flights, Weather, and What to Actually Expect

So let me get this straight. You can quit your cushy $390,000-a-year Google job, cash in your $1.5 m...

The Real Cost of Car Parts: A Data-Driven Breakdown of Online vs. Retail Pricing

An announcement crossed the wire on October 2nd. Renault has initiated the development of a new auto...

ChainOpera AI's $4 Billion Valuation: What the Numbers Actually Say About Its Growth

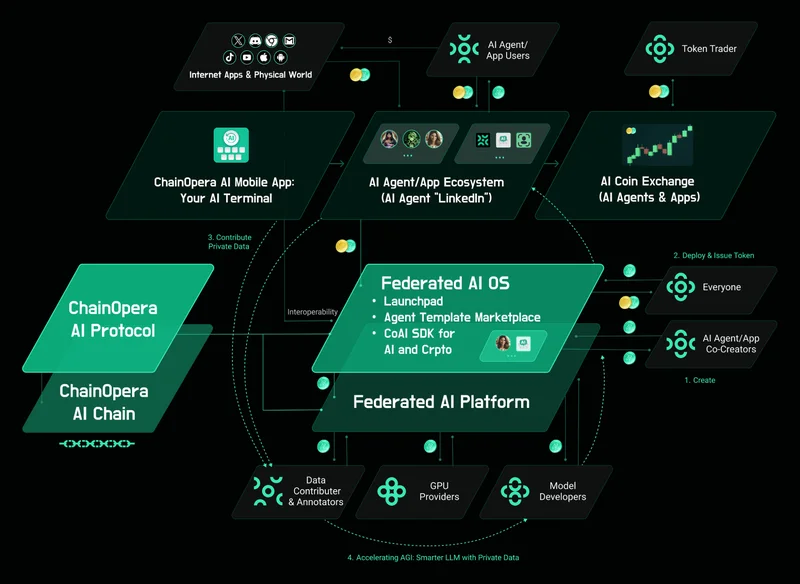

The spectacular implosion of a financial asset is always instructive. But the case of ChainOpera AI’...

ChainOpera AI's 2,200% Surge: The Real Math Behind Its Explosive Growth and What Comes Next

The Anatomy of a Hype Cycle, or a Glimpse of the Future? There are moments in the market when an ass...