IBM's Q3 Earnings Beat: Deconstructing the Market's Negative Reaction

Generated Title: IBM Beat the Numbers, But Lost the Narrative. Here's Why.

It’s a classic Wall Street scene, one that plays out every three months in the digital ether of after-hours trading. The earnings report hits the wire, the algorithms parse it in microseconds, and the first trades paint a picture. For IBM on Wednesday, that picture was baffling.

The company delivered what, on its face, looked like a solid quarter. It beat analyst expectations on both revenue and earnings per share. It even raised its full-year guidance, a signal of management’s confidence. In a rational world, this is the trifecta that sends a stock climbing. Instead, IBM’s ticker started flashing a deep, insistent red. The stock fell around 5%—to be more exact, it was trading down 5.8% within the hour.

This is the kind of dislocation that sends financial TV into a frenzy and retail investors into a panic. The central contradiction was clear: IBM tops third-quarter estimates and lifts guidance, but stock drops. Was it an overreaction? A fat-finger trade? Or did the market, in its collective and often inscrutable wisdom, see something lurking beneath the surface of the headline numbers? The answer, as is usually the case, lies not in the numbers that were celebrated, but in the ones that were quietly ignored.

The Anatomy of a "Good" Quarter

Let's first establish the baseline. An earnings beat is, by definition, positive news. The consensus estimates from analysts are a known quantity, a target painted on the wall. IBM came in with adjusted earnings per share (reported at $2.45, a few cents above the street’s consensus) and revenue that edged out expectations by a respectable margin. This wasn't a blowout, but it was a clear win.

Adding the raised guidance should have been the accelerator. When a company tells the market it expects to do better than it previously thought for the remainder of the year, it’s signaling operational momentum. It’s telling investors that the business trends are favorable and that the ship is pointed in the right direction. For a legacy behemoth like IBM, a company perpetually in the midst of a turnaround narrative, this kind of signal is supposed to be potent. It’s meant to reassure shareholders that the transformation—the painful, multi-year pivot to cloud and AI—is finally bearing fruit.

So why the disconnect? Why did investors hear "things are good and getting better" and immediately hit the sell button? The phenomenon isn't unique to IBM, but it’s a perfect case study in a fundamental market truth: not all beats are created equal. The market is like a meticulous home inspector; it doesn’t care if the new coat of paint looks nice if it sees cracks in the foundation. The headline numbers were the fresh paint. The market saw the cracks.

The Story Behind the Spreadsheet

The problem with a company as sprawling as IBM is that its aggregate performance can easily mask underlying weakness. It’s a vast machine with countless moving parts, some sputtering and old, others supposedly new and high-powered. The market’s job is to figure out which parts are driving the machine forward and which are just along for the ride. I’ve looked at hundreds of these filings, and this particular kind of divergence between headline and reality is a recurring pattern for companies in transition.

Think of an earnings report as a student’s report card. The overall GPA—the headline EPS beat—might look decent. But if that GPA is propped up by an 'A' in an easy elective like "Cost Cutting 101" while the student is pulling a 'C-' in the advanced calculus class that determines their future, you don't reward them. You question their entire academic trajectory. For IBM, the "advanced calculus" is its hybrid cloud and AI business, specifically the performance of Red Hat. This is the segment that carries the entire weight of the company’s growth narrative.

While the fact sheet from the earnings call lacks granular detail on the segment-by-segment growth rates—a frustrating but common opacity—the market’s reaction strongly suggests the numbers from that key division were underwhelming. A beat driven by the legacy infrastructure or consulting business is a low-quality beat. It’s empty calories. It says nothing about the future. It only says that the declining part of the business declined a little slower than anticipated for one quarter. Is that truly a reason to bid up the stock? Or is it a signal that the growth engine itself is sputtering?

This also brings up a critical methodological question that analysts should be asking: how, precisely, is IBM defining and reporting its "AI revenue"? Is this revenue from new, innovative products, or is it a reclassification of existing consulting services now being branded under the AI umbrella? Without clear, consistent definitions, the numbers can become a marketing tool rather than a performance metric. The market’s skepticism suggests it isn’t buying the marketing.

The raised guidance, too, loses its power if the underlying growth drivers are weak. A modest guidance bump in the face of decelerating growth in your most important business segment is like proudly announcing you're on track to arrive at your destination ten minutes early, while ignoring the check engine light that just started flashing. The market didn't care about the ETA; it was staring at the dashboard.

The Market Weighed, Not Counted

In the end, the reaction to IBM’s earnings wasn’t irrational. It was a cold, logical act of weighing, not counting. The market counted the pennies of the EPS beat and found them wanting. It weighed the source of that beat and found it came from the wrong places. It looked at the promise of future growth and weighed it against the evidence of current momentum in the divisions that matter, and a discrepancy was found.

The stock didn't drop because the quarter was bad. It dropped because the quarter wasn't good enough in the ways that validate a long-term investment thesis. A beat is just a data point. The narrative is what gives it meaning. And on Wednesday, IBM won the data point but lost the narrative, and investors made it clear which one they value more.

Related Articles

Cross-Border Activity: What We Know – What Reddit is Saying

Alright, let's talk about cross-border investment platforms. The pitch is simple: one account, multi...

Outback Steakhouse Closing Restaurants: What Happened and Why?

Outback's Turnaround Plan: More Like a Slow-Motion Train Wreck Alright, so Outback Steakhouse is clo...

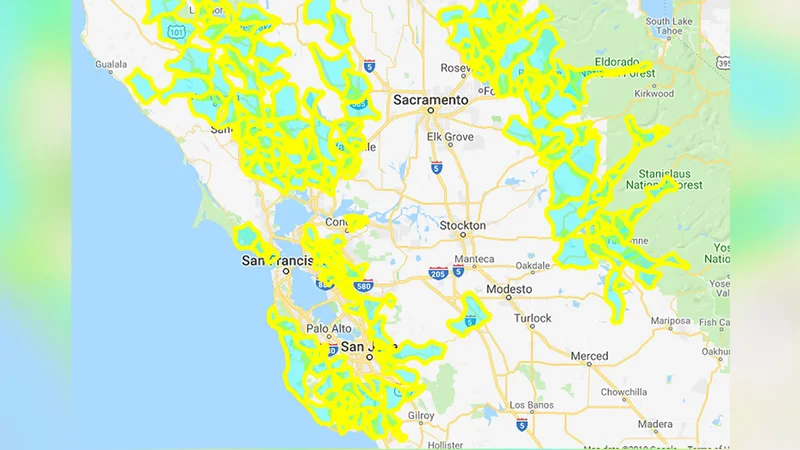

PGE's Landmark Solar Investment: What It Means for Europe's Green Future

Why a Small Polish Solar Project is a Glimpse of Our Real Energy Future You probably scrolled right...

The Fed's Big Rate Cut Promise: And the Mess It Made for Your Mortgage

So the Fed finally did it. They cut the interest rate. You can almost hear the champagne corks poppi...

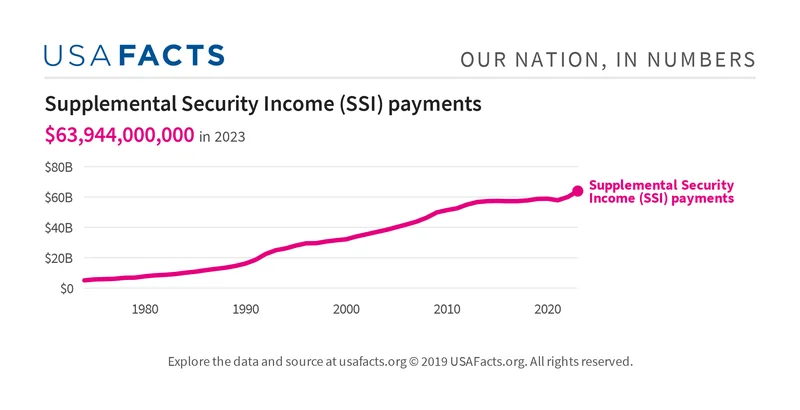

The Astonishing Resilience of SSI: Why Your November Payment is Secure and What It Means for the Future

The headlines are screaming again. Washington is at a standstill, a city of monuments frozen by argu...

Ergo's Expansion: A New Chapter Begins

Ergo's Global Vision: A Quantum Leap for Insurance? Okay, folks, buckle up! I just got off a call ou...