The Fed's Big Rate Cut Promise: And the Mess It Made for Your Mortgage

So the Fed finally did it. They cut the interest rate. You can almost hear the champagne corks popping in the Beltway and on Wall Street. Jerome Powell stands at a podium, looking like a dad who’s just grounded the entire economy but is trying to explain it’s for our own good. The official line? They’re worried about a “weakening job market” and a government shutdown messing with their precious economic reports.

Give me a break.

Are we really supposed to believe that this quarter-point haircut is some masterstroke of economic stewardship? This is theater. It's a response to months of a former president screaming "Too Late Powell" on social media. It’s a signal to the markets that the adults are still willing to juice the system if it gets a little fussy. It ain't about your job or your ability to buy a house. It’s about managing perception.

The whole thing feels like a magic trick. The Fed waves its hands and announces a rate cut, hoping everyone looks at the shiny object and doesn't notice the real action happening offstage. But what is the real action? Is it the bond market, which actually dictates your mortgage? Is it the political pressure cooker? Or is it the simple fact that nobody, not even the guys with PhDs in economics, has any real clue what’s going on?

Your Mortgage Didn't Get the Memo

Here’s the part they whisper, the fine print at the bottom of the contract. The Fed’s rate cut and your 30-year fixed mortgage are, at best, distant cousins who see each other at Thanksgiving and don’t really talk. One expert, in a moment of shocking honesty, admitted there’s “not a one-to-one relationship.”

My translation: “We did a thing, but don’t call us asking why your mortgage payment didn’t drop.”

And the media reporting on this? It’s a complete circus. One headline tells me mortgage rates are at their lowest level in a year, a cool 6.19%. Another one screamed that Mortgage rates jump 20 basis points following Fed cut. This is just confusing. No, 'confusing' isn't the word—it's deliberate obfuscation. It’s designed to make your head spin so you just give up and trust the "experts."

Let's be real. The number you should be watching isn't coming from Powell's mouth. It's the yield on 10-year Treasury bonds. That’s the benchmark that mortgage lenders actually use to price their loans. Watching the Fed for mortgage news is like watching the pre-game show to find out who won the Super Bowl. You're in the wrong place, listening to the wrong people.

It reminds me of my cable bill. Every year it goes up for some vague reason like "broadcast fees" or "regional sports costs," and when I call to complain, they offer me a new bundle that saves me five bucks a month but locks me into a two-year contract for channels I don't watch. It's the same energy. A grand gesture that solves nothing and just makes everything more complicated.

Here Come the Vultures

And just as the dust settles, the "opportunity" narrative begins. You can set your watch to it. One top advisor is already out there, with a headline proclaiming, After the Fed cut interest rates, adjustable-rate mortgages may be ‘an underappreciated opportunity,’ top advisor says.

An underappreciated opportunity for who, exactly?

Another guru chimes in that this is “especially advantageous for real estate investors” and “sidelined foreign real-estate investors” who can now swoop in and buy properties at a discount. Oh, fantastic. So this whole economic maneuver is a dinner bell for the same private equity ghouls and foreign consortiums that have been turning single-family homes into rental empires for the past decade. They're selling this as a win for Main Street, but when you peel back the layers, its the same old story...

The average person trying to buy a first home is already getting crushed by inflation and insane home prices. Now they get to compete with cash-flush investors who just got a little green light from the federal government. Recommending ARMs right now feels like malpractice. Are we supposed to have forgotten the last time the entire global economy was set on fire by that exact financial product?

Then again, what do I know? I'm just a guy writing on the internet. Maybe this time it's different. Maybe this time the adjustable-rate mortgage is your ticket to the American Dream and not a trapdoor leading straight to foreclosure. Yeah, and maybe my internet provider will lower my bill out of the kindness of its heart.

So, Who Is This Really For?

Let's stop kidding ourselves. This rate cut was never for you. It wasn't for the family trying to figure out if they can afford a bigger place, or the recent grad staring down a mountain of student debt. It was a piece of performance art for Wall Street, a political concession, and a shot of adrenaline for the investor class. We're just the bystanders watching the parade, being told to cheer, while they're the ones on the floats throwing candy to each other. The whole system is a show, and you're not in the cast. You're just paying for the ticket.

Related Articles

IonQ Stock Price: What's Driving the Volatility and Investor Reactions

So, IonQ's building a quantum network in Geneva. Big deal. Another press release filled with buzzwor...

Bitcoin: Fed's $29.4B Injection – What the Hell Does It Mean?

Okay, so the Fed injected almost 30 billion bucks into the banking system last Friday. $29.4 billion...

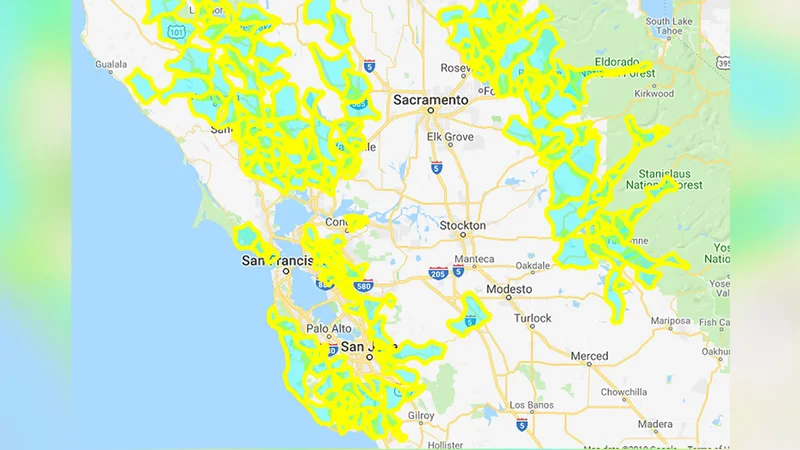

PGE's Landmark Solar Investment: What It Means for Europe's Green Future

Why a Small Polish Solar Project is a Glimpse of Our Real Energy Future You probably scrolled right...

Merrill Lynch's Wealth Playbook: Asset Growth vs. Refined Strategy

Title: Merrill Lynch's "Wealth" Redefinition: Is It Dilution or Democratization? The bull isn’t char...

Kimberly Clark's $48.7 Billion Deal: What It Means – What Reddit is Saying

Kimberly-Clark Swallows Kenvue: A $48.7 Billion Gamble Kimberly-Clark is betting big on a reunion. T...

Hood Stock: What's Next?

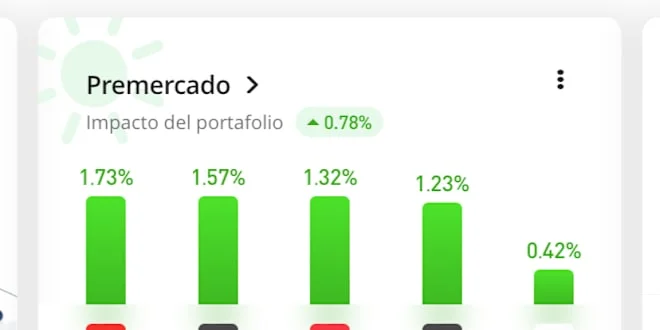

Okay, folks, buckle up. Because what's happening with Robinhood right now isn't just about a stock p...