Major Candy Company Files for Chapter 11: The Real Reason Why and What the Filing Data Shows

The Bitter Math That Melted a Candy Empire

The announcement on October 24th was, on its surface, just another piece of business news: Candy Warehouse, a family-run online retailer, filed for Chapter 11 bankruptcy. For a company that has been a fixture of the niche candy market since 1998, the filing marks a somber end to a long chapter. But to see this as a simple story of a small business failing is to miss the point entirely.

This isn't a tale of mismanagement or a failure to adapt. It’s a clinical case study in how violent, external economic shocks can shatter a business model, no matter how well it’s run. When you strip away the branding and the colorful product photos, the collapse of Candy Warehouse was a predictable outcome dictated by unforgiving mathematics. The company was simply caught on the wrong side of a brutal equation.

The insolvency was the final result, but the variables that caused it have been accumulating for years. One is a slow-moving, cultural shift—a growing consumer preference for "health-conscious" treats. A 2023 study found that nearly half of consumers (47%, to be precise) are actively seeking out candy with lower sugar content. This represents a steady erosion of the core market for indulgent, novelty sweets. It’s a glacier, not an earthquake, but it was steadily carving away at the company's foundation.

But the event that triggered the collapse was far more sudden and far more severe. It was a textbook commodity shock.

A 178 Percent Perfect Storm

Let’s talk about cocoa. Poor harvests in Ghana and the Ivory Coast, which together supply about 60% of the world's crop, sent global cocoa costs into a terrifying upward spiral. In 2024, prices skyrocketed by 178%. This isn't a minor fluctuation; it's a cataclysmic event for any industry that relies on the ingredient.

The giants of the industry reacted as you’d expect. In July, a spokesperson for Hershey’s stated plainly that the company would raise prices to reflect "the reality of rising ingredient costs." And they did. The price of their variety packs jumped by 22%, while a classic like Reese's Peanut Butter Cups went up 8%. Even non-chocolate items felt the pressure, with Sour Patch Kids seeing a 9.4% increase. These corporations have the brand loyalty, scale, and negotiating power to pass a significant portion of that cost onto consumers.

Candy Warehouse did not. Their business model—selling a vast array of products from different manufacturers to a diverse clientele—is what I’d call a high-volume, low-leverage operation. They are an intermediary, a distributor. This model is brutally sensitive to input costs. I've looked at hundreds of these kinds of filings, and this particular vulnerability is a classic pattern. The company is stuck between the manufacturer raising wholesale prices and a consumer base that is already balking at paying more for less.

Think of it as a gear in a massive industrial machine. The big gears, like Hershey and Mars, are forged from thick steel; they can handle the friction of a sudden price shock. But a smaller, intermediary gear like Candy Warehouse gets shredded. It can't absorb a 178% cost increase on a key input, and it can't fully pass it on without seeing its sales volume collapse. The math simply doesn't work.

What were the conversations like inside their headquarters as these numbers came in? The bankruptcy filing, of course, doesn't provide a transcript of those meetings. It only shows the final, grim calculation: liabilities exceeded assets. We can only infer the series of impossible choices they faced as their margins evaporated, likely in a matter of months, not years. The company was solvent one quarter and functionally insolvent the next.

The Math Was Always Going to Win

This wasn't a failure of passion or a lack of understanding of the candy market. It was a failure to defy gravity. The story of Candy Warehouse is a warning shot for every specialty retailer, in any sector, that operates as an intermediary for goods tied to volatile commodities. The combination of a slow, generational shift in consumer taste and a rapid, violent spike in raw material costs created a scenario with no viable escape route. The company’s fate was sealed not in a boardroom, but on the commodities trading floors in London and New York. It’s a bitter lesson in the fact that, in the end, the numbers are the only things that matter.

Related Articles

Scott Bessent's 'Soybean Farmer' Routine: A Masterclass in Cringey, Insulting Pandering

Give me a break. I just read that Treasury Secretary Scott Bessent, a man whose net worth Forbes clo...

Sonder and Marriott Split: What Happened?

Marriott's Sonder Divorce: A Calculated Risk or a Costly Miscalculation? Marriott International's de...

GMA's Deals and Steals: A Surprising Glimpse into the Future of Retail

I want you to look past the popcorn tins and the splatter guards for a moment. On October 11th, a se...

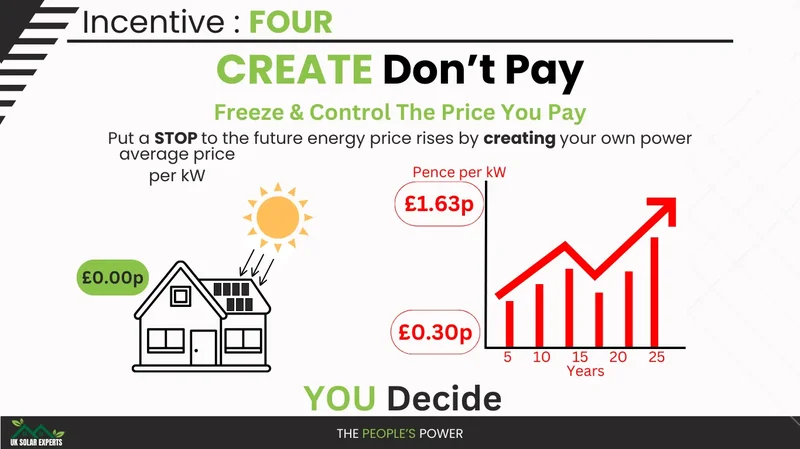

Solar Incentives: What's Next and Why It Matters

Hawaiʻi's Solar Crisis: A Make-or-Break Moment for Clean Energy Okay, folks, let's talk about someth...

primerica: What to Know – A Reality Check

Nvidia's AI Hype Train: Are We There Yet? Nvidia. The name is practically synonymous with the AI rev...

MicroStrategy (MSTR) Stock: Analyzing the Bitcoin Correlation and Its Price Action

The recent price action in Strategy’s stock (MSTR) presents a fascinating case study in market perce...