Tesla's $56 Billion Crossroads: Why Robyn Denholm's Warning Is a Defining Moment for the Future of Tech

This isn't just a headline; it's a question about the very nature of the future. When I saw the news flash across my screen—that Tesla’s board is asking shareholders to approve a pay package for Elon Musk that could be worth a trillion dollars—I knew immediately that most of the conversation would miss the point. People will get bogged down in the numbers, the politics, the sheer audacity of it all. But that’s like looking at the blueprints for a starship and only talking about the cost of the bolts.

What we’re actually witnessing is a high-stakes referendum on what we want Tesla to be. Is it a car company, even a revolutionary one? Or is it the vehicle—pun intended—for a fundamental paradigm shift in human capability, driven by artificial intelligence and robotics?

This proposed compensation plan isn't a salary. Let’s be perfectly clear on that. It's a series of what are essentially epic-level quests. Musk gets nothing unless he achieves milestones that sound like they were pulled from a science fiction novel: growing Tesla to an $8.5 trillion market capitalization, deploying millions of autonomous robotaxis, and building a fleet of humanoid robots. This is a performance-based incentive structure—in simpler terms, it's a treasure map where the treasure only appears if you literally build a new world to find it in.

When I first read through the sheer scale of these targets, I honestly just sat back in my chair, speechless. This is the kind of breakthrough thinking that reminds me why I got into this field in the first place. It’s a plan designed not to manage a company, but to catalyze a revolution.

The Price of a Paradigm Shift

The warning that Tesla risks losing CEO Musk if $1 trillion pay package isn’t approved, board chair says has been framed as a threat. I see it differently. I see it as a statement of profound clarity. You cannot ask a person whose mind is fixated on building a city on Mars to be satisfied with simply optimizing a factory floor in Fremont. The vision that drives someone like Musk is a unique and volatile resource. It needs to be focused. This package is the focusing lens.

The plan essentially binds Musk's own destiny to the most ambitious, world-altering path imaginable for Tesla for the next seven-and-a-half years. It’s a direct challenge to the forces of incrementalism and short-term thinking that so often strangle innovation in large corporations. The critics, including powerful proxy advisory firms, are looking at this through the dusty lens of 20th-century corporate governance. They’re running calculations on a spreadsheet that can’t possibly compute the value of a leader who can inspire millions and routinely defy the impossible.

But what is the real financial value of a person who can fundamentally alter the trajectory of a multi-trillion-dollar industry? How do you quantify the leadership required to pivot a car company into an AI robotics powerhouse? The truth is, you can’t. It’s like trying to calculate the ROI of the printing press in 1441. The old metrics simply don’t apply. The scale of the ambition here is just staggering—it means the gap between today and tomorrow is closing faster than we can even comprehend, and we're not just talking about better cars but about a fundamental restructuring of labor, transportation, and urban life itself.

Beyond the Balance Sheet

Of course, there’s pushback. There are websites and watchdog groups urging shareholders to vote no. But this opposition, while understandable from a traditionalist viewpoint, feels like it’s arguing about the seating arrangements on the Titanic while someone else is trying to invent a better engine.

The most telling indicator, for me, isn't the institutional skepticism but the "bullish" sentiment bubbling up from retail investors. These are the people who haven't just bought a stock; they’ve bought into a vision of the future. They understand that Tesla's value isn't just in the cars it sells today, but in the promise of the autonomous, AI-driven world it wants to build tomorrow. They see the Optimus robot not as a product, but as a promise. They see Full Self-Driving not as a feature, but as the dawn of a new age of mobility.

This is the central question shareholders face ahead of the November 6th vote. Are they owners of a car company looking for steady returns, or are they patrons of a 21st-century renaissance man, funding a project that could redefine our species' relationship with technology? There is, of course, immense risk. But the greatest breakthroughs in human history were never born from caution. They were born from audacious, borderline-insane bets on a future no one else could see.

This vote is one of those moments. It's a choice between the comfortable, predictable road and a launchpad pointed directly at the stars. Which one do you think gets us to a more interesting future?

The Real Vote Is On The Future Itself

Let's cut through all the noise. This isn't about one man's compensation. It's a collective decision about our own appetite for ambition. The vote on this pay package is a vote on whether Tesla should continue its journey as a hard-tech, world-changing anomaly, or if it should settle into the comfortable rhythm of being just another great, but ultimately conventional, company. The plan on the table is the fuel for the former. Approving it is a declaration that we believe in taking the giant leaps, not just the safe steps.

Related Articles

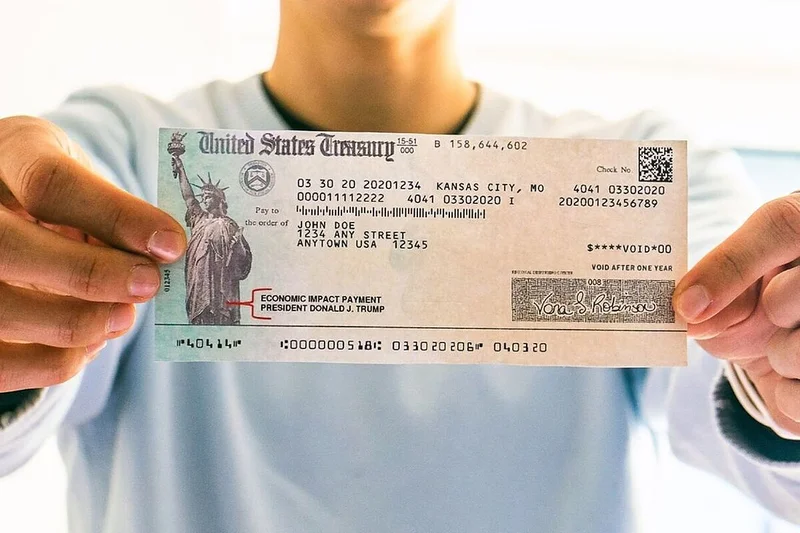

IRS Stimulus Checks 2025: What We Know

Another Stimulus Check? Don't Bet Your Bitcoin On It The internet's buzzing again with rumors of ano...

Bitcoin: Fed's $29.4B Injection – What the Hell Does It Mean?

Okay, so the Fed injected almost 30 billion bucks into the banking system last Friday. $29.4 billion...

Applied Digital's Earnings Report: What to Expect and What It Signals for the Future of AI

Yesterday, for a few dizzying minutes after the market closed, it looked like the story might be a s...

Wendy's Closing Hundreds of Restaurants: What We Know and Why I'm Not Surprised

Title: Wendy's Closures: "Project Fresh" or Just Another Fast-Food Apocalypse? Alright, so Wendy's i...

Hims Stock Surges 39%: A Data-Driven Look at the Surge

The ticker for Hims & Hers Health (HIMS) has been on a tear. A 39% surge in a single month is the ki...

macau: What's Really Going On

Alright, let's get this straight. Macau's diversifying? Oh, really? Give me a break. It's not divers...