Netflix's 10-for-1 Stock Split: The Official Rationale vs. The Mathematical Reality

Netflix just announced a ten-for-one stock split, and the official press release reads like a corporate Mad Libs of shareholder-friendly platitudes. The move, scheduled to take effect mid-November 2025, will slice the company's high-flying stock price into more digestible, bite-sized pieces. The stated purpose is to make shares "more accessible to employees who participate in the Company's stock option program," according to the official release, Netflix Announces Ten-For-One Stock Split.

On the surface, it’s a standard, almost boring, corporate action. A high share price is divided by ten; the number of shares outstanding is multiplied by ten. The total value of the company remains identical. It’s the financial equivalent of exchanging a $100 bill for ten $10 bills. You haven’t created any new wealth, you’ve just made the units smaller. Yet, the market often reacts to these events with a peculiar enthusiasm, and the corporate narrative accompanying them deserves a closer look. I've analyzed dozens of these announcements, and the rationale provided here feels particularly thin, a convenient justification for a decision likely driven by far more pragmatic, and psychological, factors.

The Anatomy of a Narrative

Let’s first address the official reason provided by Netflix. The idea that a stock split is necessary for employee stock options is an anachronism. In an era where fractional shares are ubiquitous and platforms can grant equity in dollar amounts rather than whole-share units, the argument that an employee can’t access a stock trading at, say, $800 but can at $80 is disingenuous. It’s a solution to a problem that technology solved years ago.

The real mechanism at play here isn't accessibility, but psychology. A lower nominal share price creates the illusion of affordability, particularly for retail investors who may be psychologically deterred by a triple-digit stock price. A stock trading for $80 feels cheaper and more attainable than one at $800, even if the underlying valuation is exactly the same. This isn't about helping employees; it’s about managing market perception and broadening the retail investor base.

The split is a tool of sentiment management. It’s a signal from the board that they believe the stock’s upward trajectory will continue, and they are preparing the ground for a new phase of growth. But does the underlying data support this implicit optimism? What is the actual state of the business this cosmetic change is meant to reflect?

Divorcing Perception from Valuation

To understand the context of this split, we have to look past the share price and examine the company's fundamentals. The latest earnings report from Q3 2025 provides a far more complex picture. On one hand, Netflix is demonstrating impressive strength. Sales in the US and Canada grew 3% sequentially (a 17% year-over-year jump), suggesting subscriber retention is stronger than anticipated after the massive influx in late 2024. More importantly, the advertising business is firing on all cylinders. The company hit record ad revenue and is on track to double ad sales in 2025 to an estimated $3 billion—to be more exact, that would be 6% to 7% of total sales. This isn't trivial. It's a powerful new revenue stream that validates a key pillar of the bull thesis.

Financially, Netflix is robust. It's sitting on $9.3 billion in cash against $14.5 billion in debt, with a net debt/EBITDA ratio under 1.0. The years of burning cash to fund content are over; the company is now a free cash flow machine, expected to generate around $9 billion in 2025 alone.

But the picture isn’t flawless. A surprise $619 million expense related to a Brazilian tax liability dating back to 2022 took a significant bite out of profits. Management downplayed its future impact, but Morningstar analysts estimate it could still represent a $200 million annual drag on operating margins. And this is the part of the analysis that I find genuinely puzzling: why execute a purely cosmetic stock split now, when the earnings report contains this kind of noise? Is it a way to shift the narrative away from unexpected tax liabilities and back toward a story of growth and accessibility?

The core tension for Netflix remains its valuation. This central question is explored in analysis from Morningstar, which asks, After Earnings, Is Netflix Stock a Buy, a Sell, or Fairly Valued?. The firm pegs its fair value estimate at $770, yet rates the stock as "moderately overvalued," implying the market price is already baking in a tremendous amount of future success. The company has a narrow economic moat, built on its first-mover advantage and massive subscriber base (now over 300 million paid memberships), but it faces a level of competition it has never seen before. The bear case is simple and potent: with the US market largely saturated, future growth relies on price hikes and fending off deep-pocketed rivals like Disney, Amazon, and Warner Bros. Discovery, all while spending more on content to stay ahead.

The stock split does absolutely nothing to address this fundamental debate. It doesn't secure new sports rights, it doesn't create the next Stranger Things, and it certainly doesn't make the service more appealing than Max or Disney+ in a household budget stretched thin. What it does is re-price the entry ticket for retail speculation.

A Calculated Distraction

Ultimately, the ten-for-one split is a sophisticated piece of financial theater. It’s a move designed to appeal to human psychology, not to alter corporate reality. By making the stock appear more accessible, Netflix is likely hoping to fuel retail investor demand, providing a tailwind for its share price as it navigates a fiercely competitive landscape. The underlying business is strong—generating immense cash flow and successfully building a new advertising engine—but it also faces legitimate questions about its premium valuation and long-term growth ceiling. This split is a sideshow, a calculated distraction from the much harder, more important questions that will actually determine the company's future.

Related Articles

The Delivery Economy: Who's Actually Winning and the Real Cost of Convenience

Generated Title: UPS Admits Defeat, Crawls Back to USPS After Botched Delivery Strategy It’s being f...

Halliburton's Automation Push: Shell's Agreement and Investor Shock – What Reddit is Saying

Halliburton's Wall Street Glow-Up: Smoke and Mirrors, or a Real Turnaround? Halliburton's been getti...

AMD's AI Leap: What Happened and the NVIDIA Rivalry

Intel's Loss, AMD's Gain: Is This the AI Tipping Point We've Been Waiting For? The news is rippling...

Nvidia News Today: Michael Burry's AI Stock Bet and What We Know

Generated Title: Burry's AI Short: Genius or Just a Gut Feeling? Here's What the Numbers Say The Big...

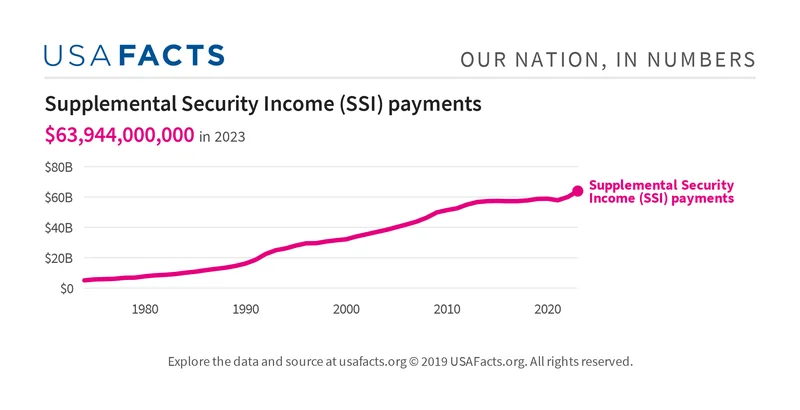

The Astonishing Resilience of SSI: Why Your November Payment is Secure and What It Means for the Future

The headlines are screaming again. Washington is at a standstill, a city of monuments frozen by argu...

Spotify's AI Music Initiative: The Strategy, Industry Impact, and What 'Responsible AI' Really Means

Spotify's AI Alliance Isn't About Ethics. It's About Building a Moat. The press releases read like a...