IRS Stimulus Checks 2025: What We Know

Another Stimulus Check? Don't Bet Your Bitcoin On It

The internet's buzzing again with rumors of another stimulus check, this time supposedly arriving via IRS direct deposit in October. Let's cut through the noise and look at the hard data: there's precisely zero evidence to support this claim.

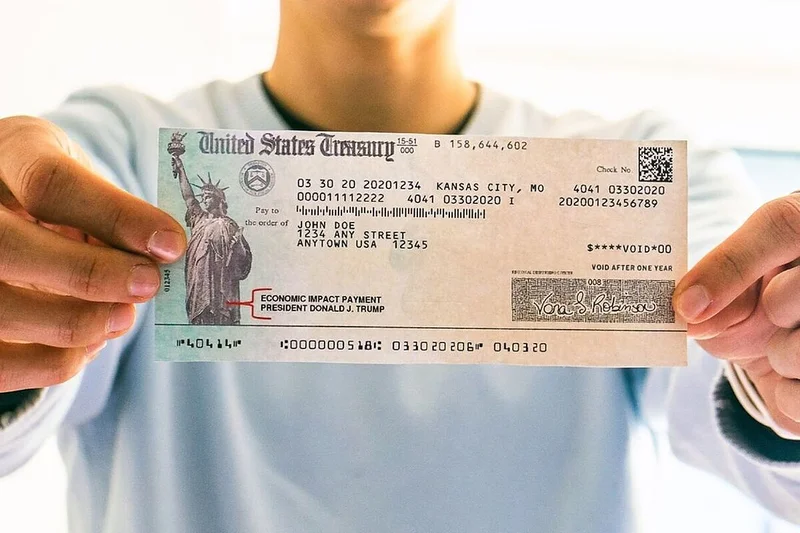

The Myth of the $1,702 Payment

The latest iteration of this rumor mill involves a supposed $1,702 payment. Digging a bit deeper, these claims seem to be misattributing Alaska's Permanent Fund Dividend to a federal stimulus program. (The Dividend, funded by state mineral revenues, is a yearly payment to eligible Alaskan residents.) This is a classic case of confusing state-level initiatives with federal policy. The actual stimulus payments are not happening.

The IRS has been battling these kinds of scams since the first stimulus checks went out. They've issued repeated warnings about phishing attempts, fake checks, and other tactics designed to steal personal information. Scammers are getting craftier, misusing official-sounding language and preying on people's hopes for financial relief.

Scam Spotting: A Data-Driven Approach

How can you tell a legitimate communication from a scam? The IRS highlights a few telltale signs: scammers often misuse terms like "stimulus check" instead of the official "economic impact payment." They might ask you to sign over your check or share banking details. And they might promise faster payments if you let them act on your behalf. Mailing fake checks is another common tactic.

I've looked at hundreds of fraud reports, and the pattern is always the same: an offer that sounds too good to be true, coupled with a demand for immediate action or personal information. The lack of official announcements from the IRS itself should be a major red flag. IRS direct deposit stimulus in October? Here’s what we know

The interesting part, though, is the psychology at play. These scams wouldn’t work if there wasn't an underlying desire, a hope, for another round of stimulus. It points to a broader economic anxiety, a feeling that the recovery hasn't reached everyone. While I cannot measure the exact level of anxiety, the frequency of these scams suggests a significant portion of the population are still vulnerable to such schemes.

The Signal-to-Noise Ratio is Off

The real takeaway here isn't just that these stimulus rumors are false—it's that they highlight the difficulty of discerning accurate information in the digital age. The signal-to-noise ratio is way off. Official sources are drowned out by viral posts and social media chatter.

And this is the part of the analysis that I find genuinely concerning. How do we improve the public's ability to identify misinformation? It's not just about debunking specific rumors; it's about fostering a more critical and data-driven mindset. Perhaps financial literacy programs should incorporate lessons on spotting online scams.

A Reality Check

The stimulus checks are not coming. Instead, focus on protecting yourself from scams and seeking out reliable financial information.

Related Articles

GMA's Deals and Steals: A Surprising Glimpse into the Future of Retail

I want you to look past the popcorn tins and the splatter guards for a moment. On October 11th, a se...

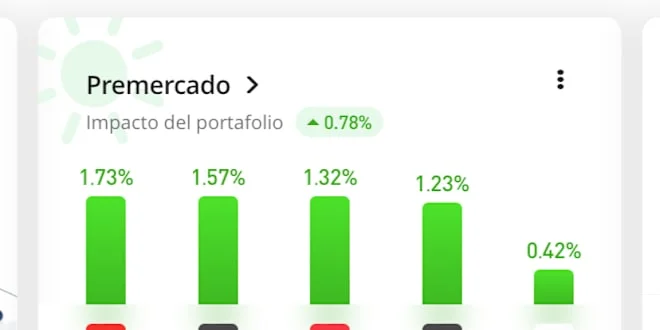

IonQ Stock Price: What's Driving the Volatility and Investor Reactions

So, IonQ's building a quantum network in Geneva. Big deal. Another press release filled with buzzwor...

Julie Andrews: Why Her Legacy Endures Beyond Her Iconic Voice

I spend my days analyzing systems. I look at code, at networks, at AI, searching for the elegant des...

Exxon's Earnings 'Beat' Is a Joke: Here's Why the Stock Is Actually Down

Exxon's Earnings, NBC's Cookies, and a Broken Webpage: My Brain Is Melting. Let’s just get this out...

Spotify's AI Music Initiative: The Strategy, Industry Impact, and What 'Responsible AI' Really Means

Spotify's AI Alliance Isn't About Ethics. It's About Building a Moat. The press releases read like a...

Beyond JNJ's Stock Price: The Breakthrough Science and Future Vision Everyone is Missing

It’s easy to get lost in the noise. On any given Monday, you can watch the digital ticker tape scrol...