IonQ Stock Price: What's Driving the Volatility and Investor Reactions

So, IonQ's building a quantum network in Geneva. Big deal. Another press release filled with buzzwords like "world-class quantum infrastructure" and "accelerating research." Give me a break. It's the 2020s—everyone's got a "world-class" something-or-other.

Quantum Shenanigans in Switzerland

Let's be real: this whole thing smells like a giant marketing stunt. "Landmark public-private initiative," they call it. Translation: a bunch of rich companies and government agencies throwing money at a shiny new toy so they can pat themselves on the back.

They're "leveraging existing fiber optic infrastructure," according to IonQ's CEO. Oh, how generous of them to not reinvent the wheel! I mean, what did you expect? Did you think they were gonna lay down new fiber just for their quantum games?

Rolex is involved, providing "ultra-precise time signals." Of course they are. Because nothing says "cutting-edge quantum computing" like a luxury watchmaker. Are they gonna start selling limited-edition quantum watches now? I can see it now, "IonQ Edition Rolex, only $500,000!"

And CERN? Don't even get me started. They're using this network to distribute "ultra-precise time signals" using something called White Rabbit synchronization systems. Sounds like something out of a sci-fi movie. A sci-fi movie that's probably more entertaining than whatever they're actually doing.

The Hype is Real (the Profits, Not So Much)

Morgan Stanley's top analyst raised IonQ's price target, expecting a "solid revenue beat" and a "bullish outlook." This is what they always say. Analysts are paid to be optimistic, even when the underlying technology is about as practical as a chocolate teapot. He maintains his "Hold" rating, though. Which basically means "I don't think it's gonna go up a lot, but I don't wanna tell people to sell and look like an idiot if it does".

MS owns a 7% stake. Well, there's their motivation. Pump that stock!

IonQ, D-Wave Quantum (QBTS), Rigetti Computing (RGTI)—they're all "loss-making due to heavy investment in research and development." Translation: they're burning cash like it's going out of style. They're all chasing a dream, a future where quantum computers solve all our problems.

But let's be honest, when is that future actually arriving? 2030? 2040? Never? We've been hearing about the promise of quantum computing for decades, and all we've got to show for it is a bunch of overhyped companies and empty promises.

IonQ uses a "trapped-ion approach, which is more economical than the popular superconducting method because it operates at room temperature." Okay, great. So it's slightly less ridiculously expensive than the other ridiculously expensive methods. Still doesn't mean they're making any money.

I mean, seriously, analysts expect IonQ's revenue to grow at a CAGR of 94% to $315 million by 2027. But its adjusted EBITDA is expected to stay red. So they're gonna be making a lot more money but still losing money? That's some kind of financial wizardry right there.

Monster Stocks? More Like Monster Risks

Some idiot thinks IonQ, Nebius, and Chime are "3 Monster Stocks to Hold for the Next 3 Years." Nebius, formerly Yandex, the Russian search engine? And Chime, a fee-free banking app for poor people? What do these three companies even have in common, other than being massively overvalued?

Analysts expect IonQ's revenue to grow at a CAGR of 94% to $315 million by 2027, and they expect that metric to surge from 64-100 AQ in 2025 to 10,000 AQ in 2027. That's a lot of growth. But can they actually deliver? Or is it just another pie-in-the-sky projection designed to pump up the stock price?

66 times its projected sales for 2027! Are you kidding me? People are actually paying that much for a company that might be profitable in five years? Then again, maybe I'm the crazy one here. Maybe I just don't understand the genius of quantum computing. Maybe I'm too cynical to see the potential.

But let's be real, this whole thing still feels like a giant bubble waiting to burst. All this talk about algorithmic qubits and quantum networks and ultra-precise time signals...it's all just noise.

This is All One Giant Tulip Bulb

Quantum computing might be the future. But IonQ ain't it. All hype, no substance. Just another way for Silicon Valley to separate investors from their money. And offcourse, I'm sure somebody is gonna say "but you don't understand the technology!" Maybe. But I understand business, and this ain't it.

Related Articles

AMD's AI Leap: What Happened and the NVIDIA Rivalry

Intel's Loss, AMD's Gain: Is This the AI Tipping Point We've Been Waiting For? The news is rippling...

Wendy's Closing Hundreds of Restaurants: What We Know and Why I'm Not Surprised

Title: Wendy's Closures: "Project Fresh" or Just Another Fast-Food Apocalypse? Alright, so Wendy's i...

The Truth About Dominion Energy: Stock Price, Power Outages, and Finding a Damn Phone Number

So, let me get this straight. Dominion Energy, the company that sends me a bill every month that see...

Broadcom's OpenAI Sugar Rush: Why I'm Not Buying a Single Share

Another Monday, another multi-billion dollar AI deal that we're all supposed to applaud like trained...

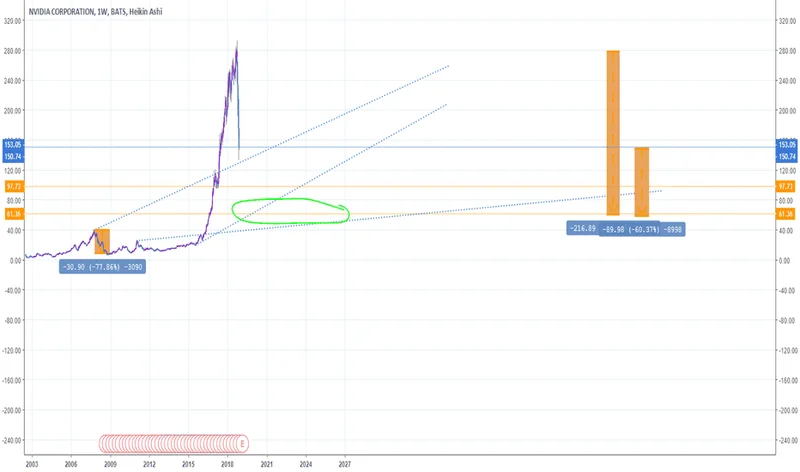

NVDA Stock Is Sinking: Why the Smart Money Is Running and What They're Not Telling You

So, the oracle has spoken. Stanley Druckenmiller, the investing world’s equivalent of a rock god, ha...

The D-Wave (QBTS) Quantum Breakthrough: What This Surge *Really* Means for the Future

Of course. Here is the feature article, written from the persona of Dr. Aris Thorne. * You’ve seen t...