Exxon's Earnings 'Beat' Is a Joke: Here's Why the Stock Is Actually Down

Exxon's Earnings, NBC's Cookies, and a Broken Webpage: My Brain Is Melting.

Let’s just get this out of the way: the internet is a firehose of nonsense pointed directly at your face, and today it’s turned up to eleven. I spent my morning trying to make sense of three completely unrelated pieces of digital flotsam that, when you mash them together, paint a perfect, miserable picture of our online lives. It’s a triptych of corporate spin, digital legalese, and sheer, unadulterated system failure.

First up, we have ExxonMobil. The oil giant proudly announced it beat earnings expectations. Pop the champagne, right? Adjusted earnings were $1.88 a share when the nerds on Wall Street only expected $1.82. Victory! Except… not really. Revenue missed by over a billion dollars. Profit fell by over a billion dollars compared to last year. The stock, predictably, slipped.

But this is where the magic happens. CEO Darren Woods, standing in the middle of a room where the floor is literally made of less money than before, declared they “delivered the highest earnings per share we’ve had compared to other quarters in a similar oil-price environment.” Read that again. It’s a masterpiece of misdirection. It’s like a kid coming home with a C- on his report card and proudly announcing it’s the highest grade he’s ever gotten on a Tuesday when the cafeteria was serving fish sticks. Who cares? Are we supposed to applaud the context while ignoring the result? It’s an insult to our intelligence.

This is just standard corporate behavior. No, 'bad' doesn't cover it—this is a five-alarm dumpster fire of PR spin. They’re betting on the fact that you’ll only read the headline—something like Exxon earnings beat as production in Guyana, Permian soar to records despite low oil prices—see the 'earnings beat,' and move on. They’re treating investors and the public like goldfish with three-second memories. But what happens when you actually stop and look at the numbers? You see a company pumping more oil than ever—4.77 million barrels a day—just to run in place while prices fall. Does anyone in that boardroom ever ask if maybe, just maybe, producing more of a cheaper thing isn't the genius move they think it is?

And Then They Want Your Data

After my brain finished short-circuiting from Exxon's financial gymnastics, I clicked a link and landed on a "Cookie Notice" from NBCUniversal. And I swear, it was longer than the Constitution. It’s a sprawling, multi-page legal document designed to look like transparency while functioning as a straitjacket.

They break it down for us simpletons: "Strictly Necessary Cookies," "Personalization Cookies," "Ad Selection and Delivery Cookies," "Social Media Cookies." It's a Cheesecake Factory menu of surveillance. Each one has a benign-sounding purpose, but we all know what it really means. It means they and their unnamed "partners" are building a voodoo doll of your digital self so they can sell you more crap you don't need. They want to know what you browse, what you watch, what you buy, what you think, and then bundle it all up for advertisers.

The best part is the illusion of control. They offer you a labyrinth of opt-out links. You can manage your "Browser Controls," use "Analytics Provider Opt-Outs," adjust your "Mobile Settings," and even tweak your "Connected Devices." You’re supposed to do this on every single device and browser you own. Who has the time or the will to navigate that? Offcourse, nobody does. It's a system designed for you to fail, to throw your hands up and just click "Accept All" so you can get back to watching cat videos. They give you a hundred ways to say no, knowing full well you’ll just say yes. They’re counting on your exhaustion. And it works.

They present this entire charade as a service, a courtesy. But what choice do we really have? You either agree to be tracked, or you can't use their services. It ain't a choice when one of the options is "get lost."

The Digital Brick Wall

So there I was, head spinning from financial doublespeak and drowning in a sea of cookie legalese, and I tried to click on one last article for the day. My reward? A stark, white page with a simple, soul-crushing message: "Access to this page has been denied."

The reason? "We believe you are using automation tools to browse the website." My ad blocker, apparently. Or maybe my browser doesn't "support cookies" enough for their liking. It’s the perfect end to the story. After being lied to by a CEO and strip-searched by a media conglomerate’s privacy policy, the final step is to be locked out entirely for having the audacity to protect yourself.

Notice the language. It’s my fault. My Javascript is disabled. My browser is the problem. The system is perfect; the user is flawed. The entire modern internet experience is built on this premise: the house always wins, and if you have a problem with the rules, you can’t even get in the front door.

Exxon, NBC, and this random error page aren't separate issues. They are three heads of the same hydra. One pumps out misinformation to protect its bottom line. The other extracts your personal data as the price of admission. And the third stands at the gate, ready to slam it in your face if you don't play along exactly as they demand. They want your money, your data, and your absolute compliance. And if you refuse, you just... disappear.

It's All Just Static

At the end of the day, what are we left with? A flood of information that’s either a lie, a trap, or a dead end. We’re being played from every angle by systems so vast and convoluted that fighting back feels pointless. They’re not building a better, more connected world. They're building a more profitable one, and our sanity is the resource they're mining. Maybe I'm the crazy one for even trying to make sense of it. Maybe the only winning move is not to play.

Related Articles

Netflix's 10-for-1 Stock Split: The Official Rationale vs. The Mathematical Reality

Netflix just announced a ten-for-one stock split, and the official press release reads like a corpor...

Halliburton's Stock Boost: So What?

[Generated Title]: Michael Burry's Halliburton Bet: Is He Actually Seeing Something, Or Just Rolling...

Comcast's Stock Is Finally Paying the Price: Why It's Tanking and the Corporate Excuses You're Supposed to Believe

A Confession, Not a Notice So, Comcast’s stock took a little dip the other day. Wall Street gets the...

MicroStrategy (MSTR) Stock: Analyzing the Bitcoin Correlation and Its Price Action

The recent price action in Strategy’s stock (MSTR) presents a fascinating case study in market perce...

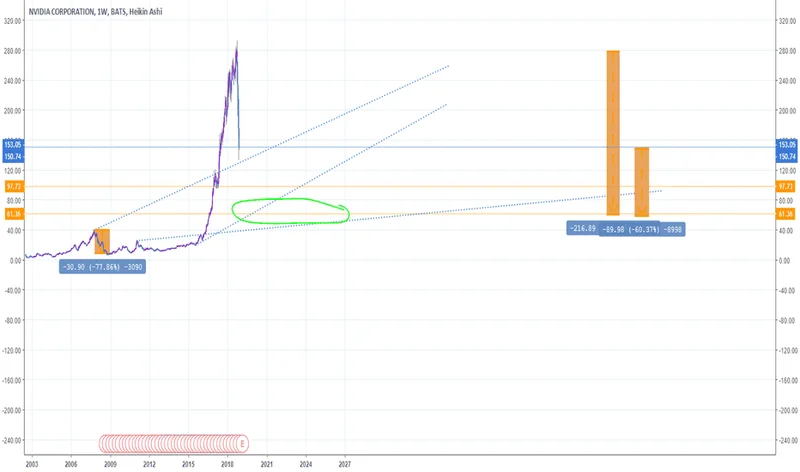

NVDA Stock Is Sinking: Why the Smart Money Is Running and What They're Not Telling You

So, the oracle has spoken. Stanley Druckenmiller, the investing world’s equivalent of a rock god, ha...

IRS Relief Payment 2025: The 'Direct Deposit' Reality Check

Uncle Sam's Shell Game: Don't Hold Your Breath for That November Windfall Alright, folks, let’s be r...