Forge Global Acquired: What Happened and Why?

Schwab's picking up Forge Global for $660 million. Let's be real, that's not an acquisition, it's a fire sale. Remember when Forge was a freakin' unicorn, prancing around with a $2 billion valuation after its SPAC debut in 2021? Now? Roadkill.

The Smell of Desperation

Forge Global, the "private shares marketplace," is basically being swallowed whole. CEO Kelly Rodriques is sticking around for the "integration process." Translation: he's got a golden parachute and a gag order. What happens after that? Who knows, and frankly, who cares?

This whole thing reeks of desperation. Did Forge run out of runway? Did their "innovative" platform turn out to be just another overhyped tech dud? No one's saying, offcourse. The silence is deafening.

And what about all the investors who bought into the hype? The poor saps who thought they were getting in on the ground floor of the next big thing? They're left holding the bag, while Schwab gets a bargain-basement deal.

I remember when everyone and their mother was starting a "marketplace" for something or other. It was the ultimate get-rich-quick scheme. Slap some AI on it, call it "disruptive," and watch the venture capital roll in. Forge Global drank that Kool-Aid, and now they're paying the price.

What Schwab Sees (Or Thinks It Sees)

Okay, okay, maybe I'm being too harsh. Maybe Schwab sees something I don't. Maybe they think they can turn Forge around, integrate it into their existing platform, and make a killing on private shares trading.

But let's be real. Schwab is a behemoth, a dinosaur in the financial world. Forge was supposed to be a nimble startup, a disruptor. Can these two cultures even coexist? It's like trying to mate an elephant with a squirrel.

And what's the point, anyway? Is there really that much demand for trading private shares? Or is this just another example of Wall Street trying to create a market where one doesn't really exist?

I mean, come on. They expect us to believe this is some brilliant strategic move, and honestly... I'm not buying it.

The Real Losers

The saddest part of this whole saga is the people who actually built Forge Global. The engineers, the marketers, the customer service reps who poured their hearts and souls into the company. They're the ones who are going to suffer the most. Layoffs are coming, you can bet your bottom dollar on that.

And for what? So some venture capitalists can make a quick buck? So a CEO can walk away with a fat bonus? It's the same old story, isn't it?

I used to think the tech world was different. I used to think it was about innovation, about creating something new and exciting. But it's not. It's just another game, and the only rule is to win at all costs.

Another One Bites the Dust

Look, I'm not saying Forge Global was a bad company. Maybe they just got caught in the wrong place at the wrong time. Maybe the market shifted, or maybe they made some bad decisions. But whatever the reason, they're gone now. Swallowed up by the corporate machine.

And honestly, I'm not even surprised.

This Was Always Going to End Badly

Related Articles

Target's Big Reset: The Hidden Signal for a Smarter Future of Retail

Imagine the silence. One moment, you’re a corporate employee at Target’s sprawling Minneapolis headq...

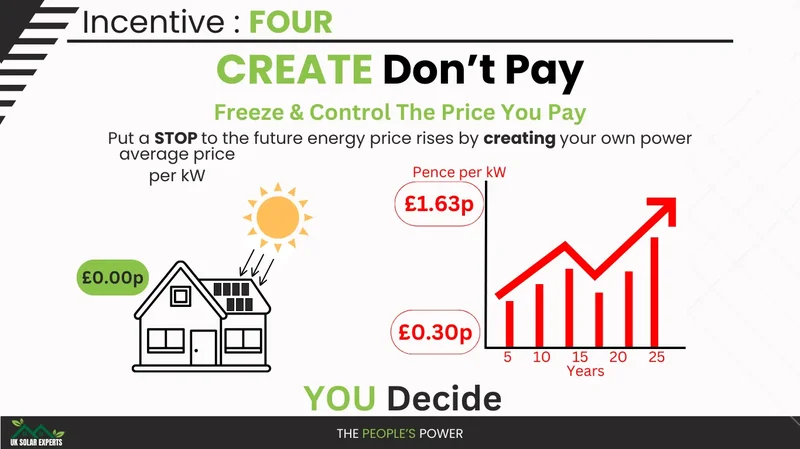

Solar Incentives: What's Next and Why It Matters

Hawaiʻi's Solar Crisis: A Make-or-Break Moment for Clean Energy Okay, folks, let's talk about someth...

Exxon's Earnings 'Beat' Is a Joke: Here's Why the Stock Is Actually Down

Exxon's Earnings, NBC's Cookies, and a Broken Webpage: My Brain Is Melting. Let’s just get this out...

Sonder and Marriott Split: What Happened?

Marriott's Sonder Divorce: A Calculated Risk or a Costly Miscalculation? Marriott International's de...

The Social Security 'Rule' 90% of Americans Break: A Data-Driven Look at the Financial Logic

The financial advisory world operates on a set of elegant, mathematically sound principles. One of i...

Nvidia's Strategic Partnership with Nokia: Why It's Happening and What It Means for the Future of Tech

Nvidia Didn't Just Buy Nokia Stock. It Bought a Blueprint for an AI-Powered World. When the news bro...