Cloud Investments: Reality vs. Hype and What We Know

Generated Title: Kyndryl's Cloud Bet: Savvy Move or Desperate Gamble?

Kyndryl, formerly IBM’s infrastructure services division, is making moves. The acquisition of Solvinity, a Dutch cloud services provider specializing in secure managed platforms, signals a clear intent: Kyndryl wants a bigger piece of the cloud pie. But is this a calculated step towards long-term growth, or a reactive play in an increasingly competitive market?

Parsing the Press Release

The press release is full of the usual corporate buzzwords. "Expanded services," "innovating," "stringent security," "evolving regulations" – it's a bingo card of IT clichés. Petra Goude, President of Kyndryl Strategic Markets, claims the acquisition will allow them to offer customers "expanded services in modernizing, innovating and securing sensitive and complex workloads." Okay, but how exactly? The release lacks specifics (a common problem with these announcements).

The key phrase is "private and hybrid sovereign cloud offerings." Solvinity's strength lies in providing secure cloud solutions, particularly for clients with strict data sovereignty requirements. This suggests Kyndryl is targeting a niche market: organizations that need cloud services but are wary of public cloud providers due to security or regulatory concerns. This is a smart move, as it avoids direct confrontation with AWS, Azure, and GCP.

The Grab Case Study: A Cautionary Tale?

A recent article highlighted how rideshare giant Grab ditched its cloudy Macs for on-premise hardware, saving a projected $2.4 million over three years. (That's about $800k a year for anyone counting). Grab found that renting cloud-based Macs was significantly more expensive than owning and operating their own infrastructure. Is this an isolated case, or a sign of a broader trend? Rideshare giant dumps 200 cloudy Macs, saves $2.4 million

Grab's situation highlights a critical point: cloud economics aren't always straightforward. While the cloud offers scalability and flexibility, it can also lead to runaway costs if not managed carefully. The 24-hour minimum billing increment for cloudy Macs was a major pain point for Grab, whose CI/CD pipeline had daily peaks and weekend lulls. This suggests a need for more granular pricing models from cloud providers.

Could Kyndryl be anticipating more companies like Grab looking to repatriate workloads from the cloud? The Solvinity acquisition could position them to offer hybrid solutions that combine the benefits of both cloud and on-premise infrastructure.

And this is the part that I find genuinely interesting. Kyndryl, a company built on managing traditional IT infrastructure, is now betting on the cloud. But they're not just blindly following the herd. They seem to be carving out a specific niche, focusing on security and data sovereignty.

The Security Angle: A Smart Play?

IDC's recent research highlights a major cloud security shift. Organizations are experiencing more cloud security incidents, and they're increasingly investing in cloud-native application protection platforms (CNAPPs). This suggests that security is becoming a top priority for cloud users.

The IDC report also points out that organizations are struggling with tool sprawl, using an average of 10 cloud security tools. This complexity creates blind spots and slows response times. The solution? Tool consolidation and a unified security platform.

Kyndryl's acquisition of Solvinity could be a way to address this need. By combining their existing services with Solvinity's secure cloud platform, they could offer customers a more integrated and streamlined security solution. The real question is whether they can execute on this vision. Can Kyndryl truly integrate Solvinity's technology and expertise into their existing portfolio? Details on how they plan to do this remain scarce, but the potential is there.

OpenAI's CEO, Sam Altman, has hinted at OpenAI becoming a cloud provider in its own right. "We are also looking at ways to more directly sell compute capacity to other companies (and people); we are pretty sure the world is going to need a lot of 'AI cloud', and we are excited to offer this," Altman wrote on X. This would put OpenAI in direct competition with the existing cloud giants. But unlike OpenAI, Kyndryl isn't building its own infrastructure from scratch. It's acquiring existing capabilities and integrating them into its existing business.

A Reality Check

Kyndryl's move is smart, but it's not a guaranteed win. The cloud market is fiercely competitive, and Kyndryl faces significant challenges in integrating Solvinity and scaling its secure cloud offerings. Success hinges on execution and a clear understanding of customer needs.

Related Articles

The Fed's Latest Rate Cut: What It *Really* Means for the Future of Innovation

The Federal Reserve is flying blind. That’s not my assessment. That’s the word on the street from ec...

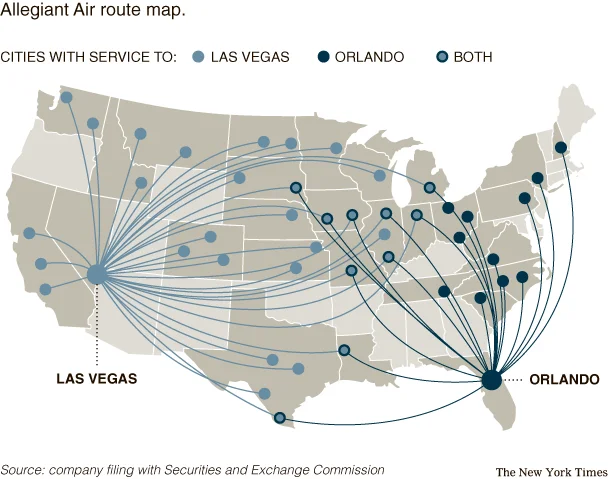

Allegiant Airlines Passenger Growth: What the 12.6% Surge Actually Means

More Passengers, Less Full Planes: Deconstructing Allegiant's Growth Paradox At first glance, news t...

Netflix Stock Split: What It Means for Earnings vs. Amazon

Netflix's 10-for-1 Split: A Masterclass in Financial Psychology or a Distraction? Netflix just annou...

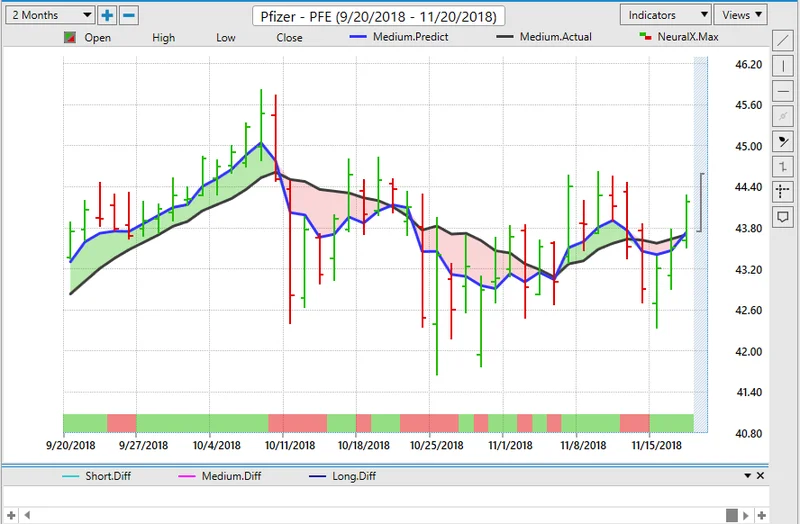

Pfizer's $10B Metsera Bet: The Strategic Rationale vs. the Market Reality

# Pfizer Didn't Outbid Novo Nordisk. It Outmaneuvered Them. The headline is simple: Pfizer wins $10...

GOOGL Stock: Unlocking Its Visionary Potential Among Tech Titans

Look around you. Everywhere you turn, there’s a hum of anticipation, a palpable energy in the air. W...

IBM's Q3 Earnings Beat: Deconstructing the Market's Negative Reaction

Generated Title: IBM Beat the Numbers, But Lost the Narrative. Here's Why. It’s a classic Wall Stree...