Netflix Stock Split: What It Means for Earnings vs. Amazon

Netflix's 10-for-1 Split: A Masterclass in Financial Psychology or a Distraction?

Netflix just announced its third-ever stock split, a 10-for-1 affair that will take its roughly $1,100 stock and slice it into ten more palatable $110 pieces. The market, as it predictably does, reacted with a surge of interest. You can almost picture the push notifications lighting up phone screens, the sudden flurry of activity on retail trading apps as the news broke. The immediate narrative is one of accessibility and excitement.

But let’s be precise. A stock split is, in terms of fundamental value, a complete non-event. Owning one share at $1,100 is mathematically identical to owning ten shares at $110. It’s the financial equivalent of exchanging a ten-dollar bill for ten ones; you haven’t gotten any richer, you just have more paper in your wallet. So, if the action itself is neutral, the only thing worth analyzing is the motive behind it. Why orchestrate this elaborate piece of financial theater? The answer lies not in the numbers, but in the psychology that drives the market.

Deconstructing the Mechanics and the Message

The specifics are straightforward. Netflix's board has approved the split, which will be distributed to shareholders of record as of November 10th. By the market open on November 17th, the stock will begin trading at its new, adjusted price. The company’s official justification, tucked neatly into its press release, is to make the stock “more accessible to employees who participate in the Company’s stock option program.”

And this is the part of the report that I find genuinely puzzling—not because it’s untrue, but because it’s a beautifully crafted piece of corporate misdirection. I've looked at hundreds of these filings, and citing employee accessibility is standard playbook language. It’s clean, defensible, and it neatly sidesteps the messier, more interesting truth: this move is aimed squarely at the psychology of the retail investor.

A stock priced over $1,000 creates a psychological barrier. It feels expensive, exclusive, and out of reach for smaller portfolios, even with the prevalence of fractional shares. Dropping the price to $110 removes that friction. The stock now appears cheaper, more attainable. It’s a classic marketing strategy, akin to pricing a product at $9.99 instead of $10.00. The number itself changes perception, even if the underlying value remains identical. This isn't about helping employees as much as it is about reigniting a certain kind of market enthusiasm, inviting a new wave of capital that was previously sitting on the sidelines, intimidated by the four-digit price tag.

The real question, then, is why a company with a market cap of over $460 billion (to be more exact, $461 billion as of this writing) feels the need to play these psychological games. Is it a sign of supreme confidence, or a subtle admission that maintaining its extraordinary growth narrative requires a little help from the market’s behavioral quirks?

The Data vs. The Narrative

There is, of course, data to support the idea that splits are bullish. Research from Bank of America suggests that, on average, stocks that split go on to gain 25% in the following year, significantly outperforming the S&P 500’s average 12% gain. But this is where a critical eye is necessary. The most important question here is one of selection bias. Do splits cause outperformance, or do fundamentally strong companies that are already outperforming—and expect to continue doing so—simply choose to split their stock? It’s a classic correlation-versus-causation problem.

A stock split is like a car getting a new paint job and a set of shiny rims. It looks more appealing and might attract more attention on the dealership lot, but it does absolutely nothing to change the engine, the transmission, or its actual performance on the road. The real horsepower is under the hood.

And for Netflix, the engine is humming. The recent `netflix earnings` report shows a business with remarkable operating leverage. For the first nine months of 2025, revenue grew 15% year over year to $33.1 billion, while earnings per share climbed a more impressive 26%. The key metric, however, is the operating margin, which has expanded to 31.3%, up from 27.4% a year prior. This is the signal amidst the noise. It demonstrates that the company is converting more of its massive revenue into actual profit, a sign of a maturing and disciplined business—a level of scrutiny typically reserved for something like an `amazon earnings report`.

This financial strength is fueled by a content slate that continues to deliver, with the final season of Stranger Things and a new Knives Out mystery on the horizon. This is the substance. This is what will drive the stock’s value over the next decade. The split is merely the packaging. So if the fundamentals are this robust, why deploy the psychological tactic of a split at all? Does it betray a subtle anxiety about sustaining its valuation, or is it simply an opportunistic move to capitalize on a bullish market sentiment?

It's a Calculated Non-Event

Ultimately, the Netflix stock split is a financially meaningless but psychologically potent maneuver. It’s a masterstroke of narrative management. Buying the stock solely on this news is like buying a book because you admire the font; the real value is in the text, not the typography. The split changes nothing about the company’s competitive position, its content pipeline, or its impressive march toward greater profitability. It is, however, a powerful signal of management's confidence and a savvy tactic to keep the stock front and center in the market’s consciousness. It’s a non-event, but a brilliantly calculated one. The real story remains where it has always been: in the numbers on the income statement, not the price on the ticker.

Related Articles

IRS Direct Deposit Stimulus: The Truth About the October 2025 Payment

That $2,000 IRS Stimulus Check? It's Not Real, But The Rumor Itself Is Telling Let’s be clear, becau...

GMA's Deals and Steals: A Surprising Glimpse into the Future of Retail

I want you to look past the popcorn tins and the splatter guards for a moment. On October 11th, a se...

Cloud Investments: Reality vs. Hype and What We Know

Generated Title: Kyndryl's Cloud Bet: Savvy Move or Desperate Gamble? Kyndryl, formerly IBM’s infras...

Oklo's Next-Gen Nuclear Power: The Breakthrough Technology & Its Vision for the Future

I was listening to the financial news the other day—a habit I keep not for stock tips, but for cultu...

John Malkovich Cast as President Snow: An Analysis of the Casting and Its Implications

The announcement landed with the precision of a well-funded marketing campaign. The Hunger Games, a...

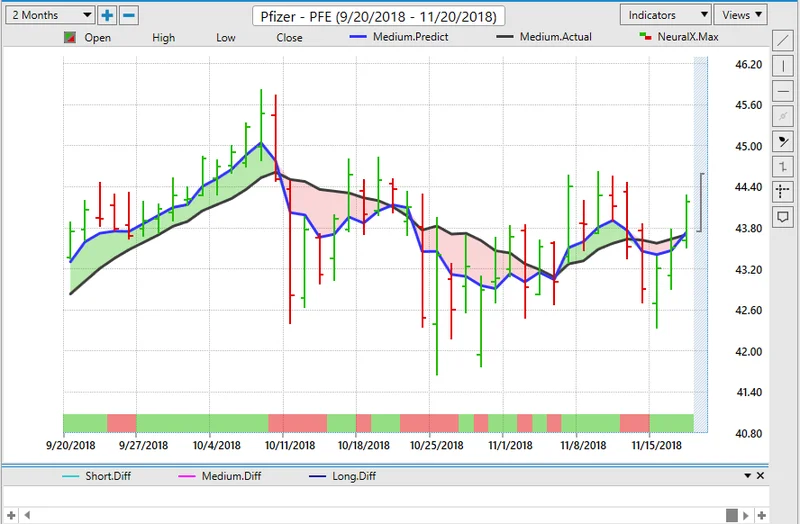

Pfizer's $10B Metsera Bet: The Strategic Rationale vs. the Market Reality

# Pfizer Didn't Outbid Novo Nordisk. It Outmaneuvered Them. The headline is simple: Pfizer wins $10...