Lisa Su: the 'expectations' driving AMD's stock pump

AMD's Billion-Dollar Dreams: Are We Really Buying This Hype?

Alright, folks, gather 'round. AMD had their big analyst day, and CEO Lisa Su, bless her heart, came out swinging with some numbers that’d make even the most jaded Wall Street types do a double-take. We’re talking 35% annual revenue growth, 80% per year for their AI accelerator business, and a cool trillion-dollar total addressable market for AI data center parts by 2030. A trillion. Let that sink in. The stock jumped almost 5% pre-market, AMD Stock Is Up Almost 5% As Lisa Su Expects Sales to Grow 35%Annually Over Five Years, like a puppy seeing a treat. But me? I'm sitting here in my usual coffee-stained hoodie, staring at these projections, and honestly... it feels less like a forecast and more like a fever dream.

They're painting a picture where AMD isn't just a player; they're the data center powerhouse. Su’s talking "double-digit" market share in AI chips, up from their current "low single-digit." That’s a hell of a leap, ain't it? They've got these shiny new MI450 chips and Helios rack-scale systems, all positioned as the Nvidia killers we've been promised for years. They even trotted out partnerships with OpenAI, Oracle, and Meta. OpenAI alone is supposedly locking in six gigawatts of AI infrastructure. Six gigawatts! That's enough to power, what, a small country? Or at least a very, very large server farm. It all sounds great on paper, doesn't it? You can practically hear the collective sigh of relief from investors who've been waiting for someone, anyone, to challenge the green team.

The Elephant in the Room (and Other Hurdles)

But let's be real for a second. This whole thing feels like a high-stakes poker game where AMD just pushed all their chips to the middle of the table, hoping nobody calls their bluff. Nvidia isn't just dominant; they're a colossus, a $4.6 trillion market cap monster with over 90% of the AI accelerator market. AMD, bless their cotton socks, is sitting at a mere $387 billion. That's not a fight; that's a plucky bantamweight trying to knock out a heavyweight champion. It's like bringing a very sharp butter knife to a nuclear war. You might look cool, but you're not winning.

The market, for all its pre-market enthusiasm, isn't entirely blind. There's a nervous twitch about the "execution risks." Can AMD actually convert these pipeline opportunities into cold, hard cash at the projected pace? CFO Jean Hu already hedged, saying margins could trend lower depending on how fast AI chip volumes ramp. And let's not forget the reliance on "a handful of hyperscalers." That's a fancy way of saying, "If OpenAI hiccups, we're all screwed." Speaking of OpenAI, their own funding situation is about as clear as mud. So, you're tying a significant chunk of your future to a startup whose financial stability is a bit of a question mark? Brilliant. No, wait — "brilliant" doesn't cover it. It's like building your dream house on a foundation of Jell-O.

Then there's the tech itself. The MI450 needs to ship on time, performing better than promised, and the software stack? Good luck closing that gap with Nvidia’s CUDA ecosystem. That's not just a gap; it’s a chasm. It's the Grand Canyon of software development, and AMD's trying to bridge it with a few planks and some optimistic thoughts. Plus, supply chain capacity for HBM memory and advanced packaging has to "materialize." That's corporate-speak for "we hope someone else figures it out." I've seen these kinds of promises before, sitting in those sterile conference rooms, the low hum of the projector trying to drown out the gnawing doubt in my gut...

I mean, I want to believe. I really do. Who doesn't love an underdog story? But sometimes, a dream is just a dream. We're talking about a company that needs to grow its AI business by 80% annually for years to hit these targets. That's not growth; that's a rocket launch, and most rockets tend to... well, you know. Then again, maybe I'm the crazy one here. Maybe Lisa Su has a magic wand I don't know about. But I'm definately not holding my breath.

My Take: A Trillion-Dollar Fairy Tale?

Look, AMD's got guts, I'll give 'em that. But these projections feel like a desperate attempt to capture market attention, not a sober assessment of reality. It's a grand vision, sure, but it's built on a mountain of "ifs" and a prayer that Nvidia suddenly forgets how to innovate. This ain't a sure thing; it's a long shot, and anyone betting big on it is either incredibly brave or incredibly naive.

Related Articles

Tesla's $56 Billion Crossroads: Why Robyn Denholm's Warning Is a Defining Moment for the Future of Tech

This isn't just a headline; it's a question about the very nature of the future. When I saw the news...

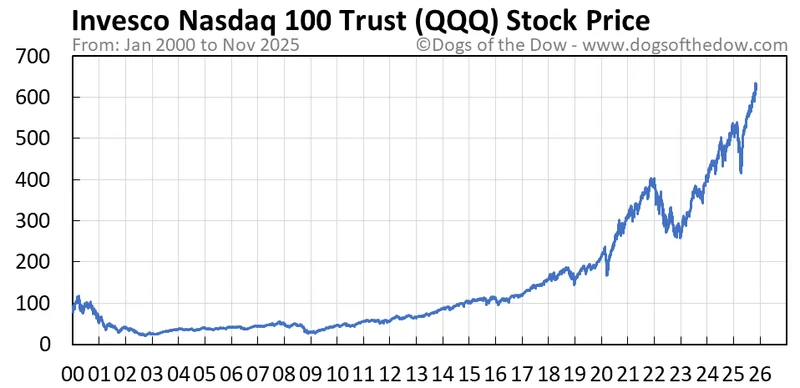

The QQQ ETF: A Clinical Look at Its Performance and Future Outlook

Is the 'Smartest AI ETF' Just a Tech Index in Disguise? There’s a headline making the rounds that’s...

The 10-Year Treasury Yield: Why It's the Real Thing Screwing With Your Mortgage, Not the Fed

So You Think the Fed Controls Your Mortgage Rate? Think Again. Let me guess. You saw the headlines i...

Adrena: What It Is, and Why It Represents a Paradigm Shift

I spend my days looking at data, searching for the patterns that signal our future. Usually, that me...

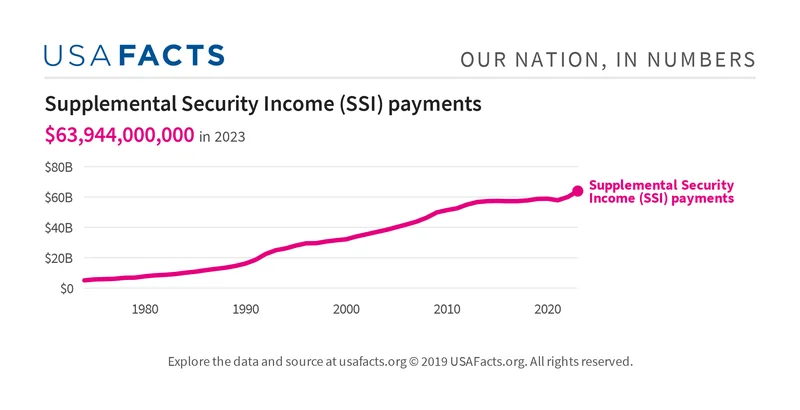

The Astonishing Resilience of SSI: Why Your November Payment is Secure and What It Means for the Future

The headlines are screaming again. Washington is at a standstill, a city of monuments frozen by argu...

QQQ's Cash Flow Crisis: What's Happening?

QQQ's Afternoon Hiccup: Is Allsopp Right About the Overvaluation? The Invesco QQQ Trust ETF (QQQ), a...