Robinhood's Grand Vision: What It Means for the Future of Your Money

Something fundamental shifted in Singapore last week. It wasn't an earthquake, but for the tectonic plates of global finance, it might as well have been. On a stage at the Token2049 conference, Robinhood CEO Vlad Tenev didn't just give a speech; he fired a starting pistol for a race most of the world doesn't even know has begun.

He called tokenization a "freight train," and I think that’s both a perfect and a profoundly understated analogy. A freight train doesn't ask for permission. It doesn’t swerve. It moves with an inexorable, earth-shaking momentum, and you have two choices: get on board, or get out of the way. What Tenev laid out wasn't just a new feature for a `robinhood app`; it was a vision for a future where the very distinction between traditional finance and the world of crypto simply ceases to exist.

"Everything will be on-chain in some form," he said, "and the distinction will disappear."

Let that sink in for a moment. Not just currencies like `bitcoin`. Not just digital art. Everything. He then announced Robinhood's next target, and it’s as real and tangible as it gets: real estate.

Now, when we hear "tokenization," our minds often jump to complex, abstract concepts. But the idea Tenev described is beautifully simple. It’s about creating a unique, verifiable digital representation of a real-world asset on a blockchain—in simpler terms, it’s like giving your house or a share in a startup a digital soul, a passport that allows it to travel and interact anywhere on the internet, 24/7. Imagine your home, not as an illiquid pile of bricks and mortar tied up in byzantine legal paperwork, but as a fluid asset you could borrow against instantly, or sell a 5% stake in to your cousin in another country to help fund a renovation.

This is the Big Idea that so many people are missing. This isn't just about making markets more efficient. This is a Gutenberg Press moment for ownership. For centuries, owning valuable things—property, art, a piece of a promising company—has been the privilege of the few, protected by moats of lawyers, brokers, and paperwork. The internet democratized information; tokenization is about to democratize value itself.

When I read Tenev's prediction that this will "eat the entire financial system," I didn't feel the dread some commentators did. I felt a jolt of recognition. This is the kind of breakthrough that reminds me why I got into this field in the first place.

html The Sound of the Future is the Panic of the Present

The Friction is a Feature, Not a Bug

Of course, the old guard is rattled. You see the headlines. OpenAI calls Robinhood's prior tokenization of its private shares "unauthorized." Crypto lawyers whisper about a "legal tightrope." These are the predictable antibodies of a system reacting to a foreign, transformative agent. They see risk; I see proof of disruption.

Tenev himself dismisses it, correctly in my view, as a "broader regulatory lag." The main hurdles, he argues, aren't technical; they're legal. This is a crucial point. The technology is already here. We have the tools. What we're witnessing is a societal and legal system sprinting to catch up with a technological reality that has already arrived.

He drew a brilliant comparison to high-speed trains. The U.S. doesn't have a sprawling network of them, not because we can't build them, but because the existing system of highways and air travel "works well enough." It’s the same with our financial plumbing. The ACH transfers and T+2 settlement times are good enough, so there’s no burning urgency to replace them. Until now. The freight train is coming, and "good enough" is no longer going to be good enough.

While the U.S. plays catch-up, Europe is already laying the track. Robinhood has already launched tokenized stocks there, creating a reality where, as Tenev puts it, on-chain assets will become the "default way for people outside the U.S. to get exposure to American equities." Think about the power of that. A student in Seoul or a programmer in Nairobi gaining direct, fractional ownership in American innovation without needing to navigate the labyrinthine corridors of `Schwab` or `Fidelity`. This isn't a small upgrade. It's a paradigm shift. It’s the idea that a farmer in Kenya could own a fraction of a skyscraper in Manhattan, or that a community could collectively fund and own a solar farm with dividends paid out instantly and transparently, all without the mountains of paperwork and gatekeepers that define the system today—that’s the future knocking on our door, and it’s not knocking politely.

This is what makes me so optimistic. On forums, away from the cynical headlines, you see the sparks of understanding. I saw one user on a finance subreddit put it perfectly: "People are stuck on this being about `robinhood trading` Tesla stock faster. They don't get it. This is about me and my four friends being able to buy and co-own the local coffee shop as easily as we can buy a pizza." Another wrote, "My dad's a real estate lawyer and he can't wrap his head around this. That's how you know it's the future."

They get it. They see the human-scale revolution embedded in the technology. They see a future of collaborative, fractional, and global ownership. What does it mean for you, for me, for all of us, when the line between owning a stock and owning a piece of the building you're sitting in blurs into nothing? The possibilities are breathtaking. Of course, with this great unlocking comes great responsibility. We will need to design new systems of governance, new forms of digital identity, and new ethical frameworks to ensure this power is wielded for creation, not chaos. But these are the challenges of progress, the very problems we should be thrilled to be solving.

The freight train is on the move. Its destination is a fully merged, on-chain world. It’s no longer a question of if, but when. And "when" is getting closer with every passing day.

The Great Unlocking

For our entire history, we have built walls around value. We put it in vaults, wrapped it in legal documents, and restricted its movement with fees, regulations, and borders. We made ownership difficult, slow, and exclusive. Tokenization is not a new wall; it is the universal key. It’s a force that will liquefy the solid world, transforming static assets into dynamic, programmable, and accessible streams of value. This isn't about making everything a stock to be traded on a `robinhood account`; it's about making everything a possibility to be owned. And that changes everything.

Reference article source:

Related Articles

TransUnion Data Breach: What Happened and How to Freeze Your Credit

The number, when it finally arrived, was 4.4 million. On August 28, TransUnion, one of the three pil...

The "Aster" Everyone is Suddenly Talking About: A Crypto Breakthrough, Not a Flower

I’ve been watching the digital asset space for a long time, and every so often, you see a moment tha...

The Solana Price Charade: Why the Numbers Don't Add Up

Let me get this straight. The crypto world, in its infinite wisdom, has decided that the coin with a...

Synthetix's Big DEX Gamble: The Price Hype vs. The Cold Hard Truth

So, a million bucks. That’s the magic number, apparently. The cure-all for a platform that’s been bl...

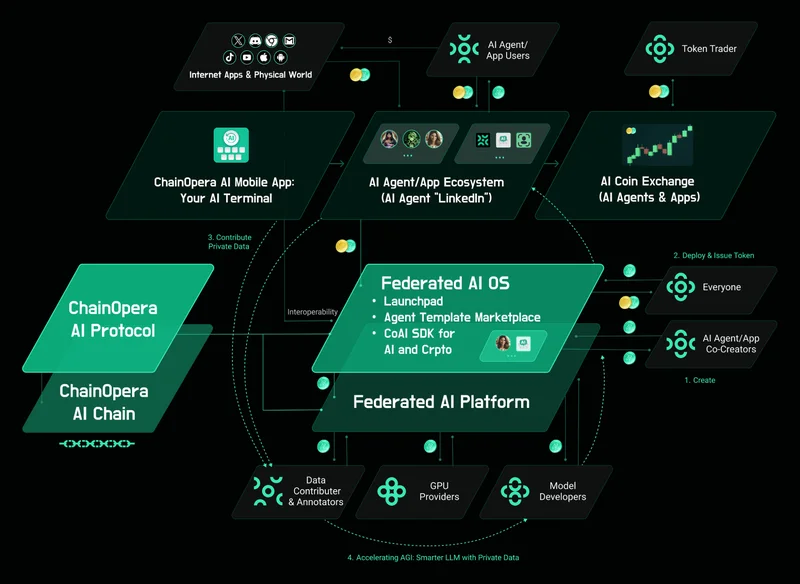

ChainOpera AI's 2,200% Surge: The Real Math Behind Its Explosive Growth and What Comes Next

The Anatomy of a Hype Cycle, or a Glimpse of the Future? There are moments in the market when an ass...

ChainOpera AI's $4 Billion Valuation: What the Numbers Actually Say About Its Growth

The spectacular implosion of a financial asset is always instructive. But the case of ChainOpera AI’...