The Truth About Allstate Insurance: Quotes vs. Claims and How They Stack Up to Competitors

So, let me get this straight. Allstate—the company whose entire business model is based on profiting from your fear of disaster—had a good month. A really good month. And now Wall Street is throwing a party.

I’m looking at this press release, this little tidbit of corporate back-patting about their August numbers, and I can’t stop laughing. It’s that dark, humorless laugh you let out when you realize the joke is on you. Always on you.

They’re celebrating "lower-than-expected catastrophe losses."

Let’s translate that from PR-speak into English. It means fewer hurricanes tore through Florida than they’d budgeted for. It means the wildfires in California didn’t hit the specific multi-million dollar homes they insure. It means they got lucky. The weather was nice. That’s it. That’s the big victory. They didn’t have to pay out as much money as they thought they would because the universe happened to roll the dice in their favor for 31 days.

And for this stroke of meteorological luck, the wizards of finance at a firm called Piper Sandler decided to reiterate their "Overweight" rating and slap a $225 price target on Allstate stock. They even jacked up their 2025 earnings-per-share projection from around $21 to over $25.

This is a bad idea. No, 'bad' doesn't cover it—this is a five-alarm dumpster fire of perverse incentives. These guys are cheering because Allstate is getting better at its one true job: holding onto your money.

Winning Customers or Just Catching Refugees?

Growth for Them, Pain for You

The report also crows about how their "policies-in-force" are up. More people are signing up for an Allstate insurance quote and actually following through. Specifically, their auto insurance book has grown for the fourth month in a row.

The corporate narrative wants you to see this as a vote of confidence. A sign of a healthy, competitive company winning over customers. Give me a break.

I want to see the real numbers. I want to see the average percentage premium increase for a returning customer’s car insurance. I want to see the data on how many claims were denied, or how long it took for them to pay out on a legitimate home insurance claim. Because I’ll bet my last dollar that this "growth" ain't coming from a sudden surge in customer satisfaction.

It’s coming from a broken market. It’s coming from people whose rates at Progressive or State Farm just shot up 40% for no reason, so they desperately call the Allstate insurance number looking for an escape, only to find a slightly less-scalding frying pan. This isn't growth; it's a churn of desperation. People aren't choosing Allstate; they're just running out of other places to hide.

I had to deal with this nonsense myself last year. Not with Allstate, but with one of their soulless competitors. My renters insurance premium, which had been stable for years, suddenly doubled. When I called to ask why, the guy on the phone mumbled something about "regional risk adjustments" and "inflationary parts costs." It was a word salad designed to mean nothing. What he was really saying was, "Because we can." They have us over a barrel and they know it. I spent a week trying to get a straight answer, getting bounced between departments, and honestly...

These companies aren't your "good hands." They're a casino where the house has rigged every single game. And when they have a winning streak, they call it a business strategy.

A Permission Slip to Pick Your Pocket

The Wall Street Echo Chamber

And the worst part is the validation they get from the finance world. What does an "Overweight" rating even mean to a normal person? It’s an instruction. It tells big-money investors that this is a good horse to bet on. It says, "We, the experts, believe the Allstate Insurance Company is poised to extract even more cash from the general population than we previously anticipated."

Piper Sandler raising its earnings projection by almost 20% isn't a prediction. It's a permission slip. It's a signal to Allstate's board that squeezing its customers harder is the right move, the profitable move. It’s the market rewarding them not for innovation, not for better service, not for customer loyalty, but for favorable weather patterns and, presumably, aggressive rate hikes. Offcourse it is.

Are we really supposed to applaud this? Are we supposed to see a headline about Allstate’s stock and think, "Great, the company I pay a small fortune to every year is doing well for its shareholders"? What does that have to do with me, the guy just trying to make sure my family is covered if a tree falls on my roof?

Then again, maybe I'm the crazy one here. Maybe this is just capitalism in its purest form, and I'm just screaming into the void. This is the system working as designed. The money flows up, the risk flows down, and the people on Wall Street place their bets.

But I have to ask: when Piper Sandler projects Allstate will earn $25.28 per share, where do they think that money comes from? It doesn't materialize out of thin air. It comes from the single mom whose premium just went up by $30 a month. It comes from the family whose claim for a flooded basement gets tangled in red tape for six months. It comes from you.

That price target, that EPS projection—that's your money they're counting.

###

Congrats on the Lucky Weather, I Guess.

Look, at the end of the day, this isn't a story about smart business or a company on the rise. It's a story about a system that is fundamentally broken. We've allowed essential services like insurance to become just another chip in a high-stakes poker game played by people who will never have to worry about the cost of a new transmission. Allstate didn't win. They just didn't lose for a month, and the bookies are cheering. Don't let them fool you into thinking it's good news for anyone but them.

Reference article source:

Related Articles

The Latest Joshua Allen Death Hoax: What's True and Why This Garbage Keeps Spreading

So I’m trying to track down the details on this Joshua Allen story, and the first thing I hit is a b...

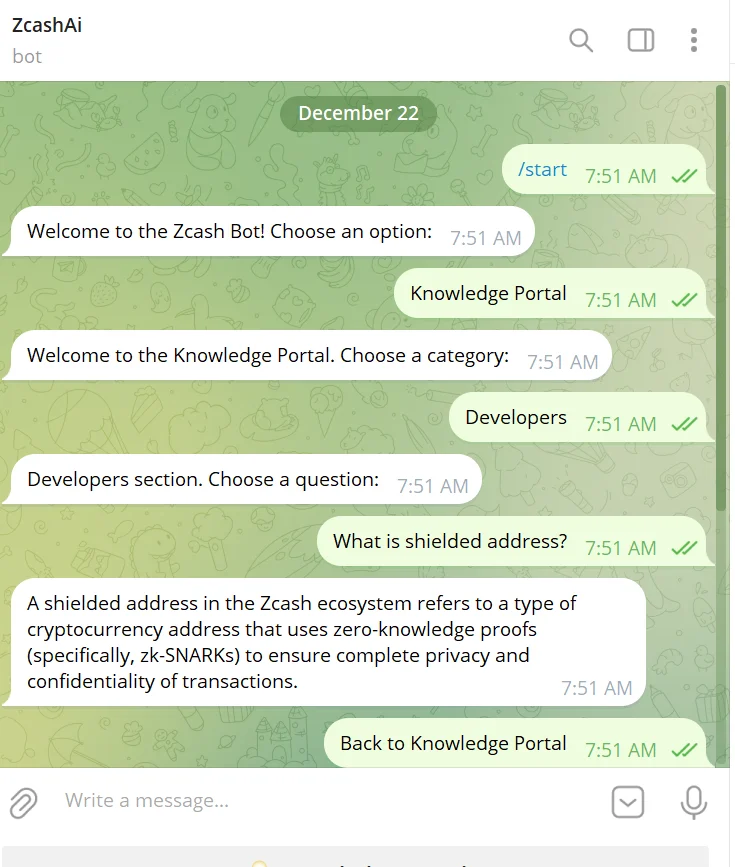

The Zcash 380% Rally: A Data-Driven Look at the 'Privacy Revival' Thesis

An asset left for dead doesn’t typically surge 380% in a month. Yet, here we are with Zcash (ZEC), a...

Aster Crypto: What It Is and a Clear-Eyed Price Analysis

An online search for "Aster" yields a peculiar mix of results. You find pages for the common fall as...

Monero's Privacy Push: Price Surge vs. Bitcoin and Zcash – What Reddit is Saying

The Privacy Coin Pump: An Anomaly or the New Normal? Monero (XMR) is up 15% today, hitting $418. Zca...

Zcash Hits New Highs: A Data-Driven Look at the 'Privacy Revival' Narrative

The recent price action in Zcash (ZEC) is a textbook case study in market dynamics, a near-perfect c...

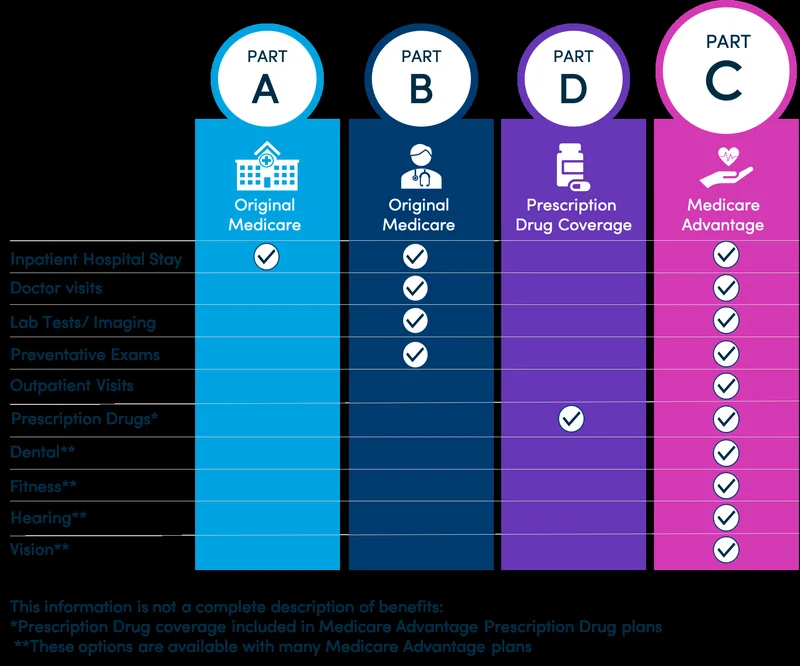

The UnitedHealthcare Medicare Advantage Mess: What's Happening to AARP Plans in 2026

So UnitedHealth, a company literally based here in Minnesota, just told a huge chunk of its Minnesot...