Bittensor's Breakthrough Moment: Why Its First ETP Changes Everything for Decentralized AI

While the crypto world was bleeding out, one green shoot was pushing through the concrete.

Imagine the scene last Friday. Screens across the globe flashing a violent, brutal red. Bitcoin, the king, tumbling 12% in the worst leverage wipeout the market had ever seen. A bloodbath. For most projects, it was a catastrophe. But amidst the carnage, a handful of assets held their ground. And one, Bittensor’s TAO, didn't just hold its ground—it soared. As DL News reported in Bittensor’s TAO jumps 32% as investors eye institutional adoption and first halving, the token climbed an astonishing 32% for the week.

When you see a signal that clear against a backdrop of pure chaos, you have to ask the most important question in technology: Why? Is it just random market noise, a fluke? Or are we witnessing the moment the market wakes up to a paradigm shift hiding in plain sight?

I’ve spent my career looking for these signals, these moments where the future sends us a postcard. And let me tell you, this isn't just another crypto token having a good week. This is the sound of a new kind of engine revving up, an engine designed to power the next generation of artificial intelligence. And now, the old world of finance is finally building a bridge to it.

The Global Brain Comes Online

So, what on earth is Bittensor? Forget what you think you know about crypto. This isn't about digital gold or monkey JPEGs. Bittensor is a radical, beautiful, and audacious attempt to build a global, decentralized brain.

Here’s the problem with AI today: it's being built in silos. You have OpenAI, you have Google, you have Anthropic—all brilliant, but all centralized fortresses. They are walled gardens of intelligence. Bittensor’s approach is fundamentally different. It’s like comparing a meticulously planned botanical garden to a wild, thriving rainforest.

The network operates through what it calls "subnets"—in simpler terms, you can think of them as specialized mini-AIs that compete to solve specific problems. One subnet might focus on generating code, another on analyzing medical images, a third on creating music. Anyone, anywhere in the world, can contribute their computing power or their own AI model to one of these subnets. If your model is good—if it contributes real value to the network—you are rewarded with TAO tokens. It’s a pure meritocracy of intelligence. This creates a relentless, evolutionary pressure for the entire network to get smarter, faster, and more efficient.

And it’s working. Some of these subnets are already putting up numbers that should make the giants of Silicon Valley very, very nervous. One subnet, Ridges, which focuses on creating autonomous software agents, recently hit 73% accuracy on benchmark coding tests. That’s nipping at the heels of Anthropic’s Claude 4.1 model, which scored 74%. When I first saw that data point, I honestly just sat back in my chair, speechless. A decentralized, global network of contributors is achieving near state-of-the-art performance against a multi-billion-dollar corporation. What does that tell you about where the future of innovation lies?

This isn’t just a theoretical project anymore. Karia Samaroo of xTAO points out that the top subnets are already generating what looks like over $20 million in annual recurring revenue. We’re seeing real products, real value, and a real, functioning economy for intelligence being born.

Wall Street Builds a Regulated Bridge to the Future

For a while now, this incredible ecosystem has been the domain of crypto-natives and forward-thinking tech insiders. But that’s all changing. The institutional world, the world of pension funds and asset managers, is notoriously slow to move. They don't do messy. They need regulated, insured, easy-to-understand products.

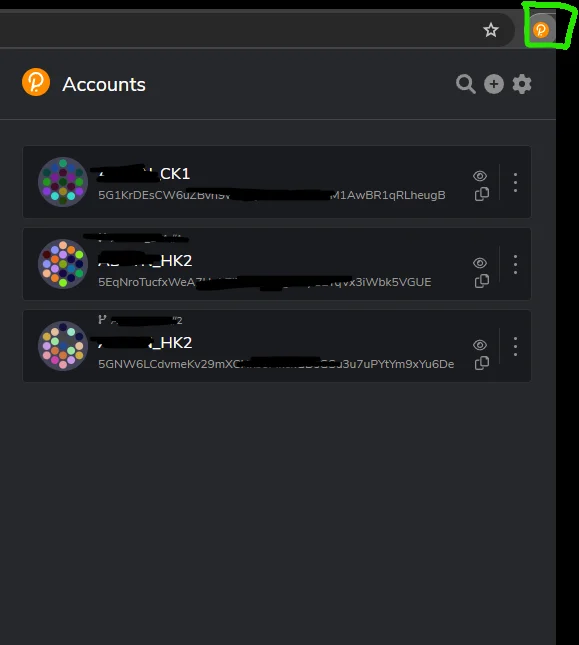

First came the tremors. Grayscale, a massive crypto asset manager, filed to create a Bittensor Trust. Barry Silbert, a giant in the space, announced a new fund focused on AI projects built on Bittensor. These were the early signs. But the main event just arrived: Deutsche Digital Assets and Safello launch Safello Bittensor Staked TAO ETP: STAO. That’s a lot of jargon, but what it means is world-changing. An ETP, or Exchange-Traded Product, is a vehicle that trades on a traditional stock exchange—in this case, the SIX Swiss Exchange. It allows any investor, from a massive institution to your grandmother, to get exposure to TAO without ever having to set up a crypto wallet or manage private keys. Even better, it's a "staked" ETP, meaning investors also earn the rewards generated by the network, which are reinvested back into the product.

This is the moment the abstract promise of decentralized AI gets a ticker symbol, a prospectus, and a seat at the big table—it means the radical innovation happening on the fringes is suddenly accessible to the very heart of the global financial system and that changes absolutely everything. This isn't just about making it easier for people to invest. It's a profound validation. It’s the financial equivalent of a formal declaration that decentralized AI is no longer a fringe experiment; it’s a serious, investable asset class.

What happens when the capital that funded the last century's industrial giants starts flowing into a network designed to decentralize intelligence itself? And what new breakthroughs become possible when the incentive to contribute to this global brain is available to anyone with a brokerage account?

We're Building a New Kind of Silicon Valley

Let's be clear. The launch of this ETP is not the destination. It's the starting gun. For years, we’ve been told that building world-class AI requires a centralized campus, billions in venture capital, and a small army of PhDs all working for one company. Bittensor offers a different vision. It suggests that the future of intelligence won't be built in a single valley in California, but across a global, permissionless network. It will be a Silicon Valley that exists on the internet, open to anyone with a good idea and a willingness to compete. This ETP is the first on-ramp for the rest of the world to join in building that future. We are witnessing the very first steps in the Cambrian explosion of decentralized intelligence. And it’s going to be spectacular.

Related Articles

Xavien Howard's Abrupt Retirement: What the Stats, Contract, and Career Earnings Tell Us

In professional sports, as in financial markets, narratives are constructed to explain volatility. A...

Pudgy Penguins: Unlocking Their Visionary Potential and the Exciting Ascent Ahead

The Roaring Return: Why Pudgy Penguins and Solana's New Guard Are Just Getting Started Friends, fell...

Zcash: The Data Behind the Price Surge and What Reddit Gets Wrong

The recent performance of the Zcash coin (ZEC) was, by any quantitative measure, an extreme outlier....

The Internet's Obsession With Julie Andrews: Why Everyone's Asking If She's Still Alive and What Her Legacy Really Is

So, Julie Andrews is 90. Is Julie Andrews still alive? Yeah, she is, and the internet is currently f...

The Truth About Allstate Insurance: Quotes vs. Claims and How They Stack Up to Competitors

So, let me get this straight. Allstate—the company whose entire business model is based on profiting...

Coinbase Stock's Sudden Rally: What's Behind the Jump and Why You Shouldn't Buy the Hype

Let’s get one thing straight. The war is over. Coinbase won. For years, we watched the SEC, led by i...