Cathay's Big Green Stunt: What We Know and Why It's Probably BS

So, let me get this straight. Cathay Pacific and Airbus, two titans of an industry that basically runs on weaponized kerosene, held a big press conference to announce they’re throwing a combined $70 million at Sustainable Aviation Fuel (SAF). They stood on stage in Hong Kong, probably under some very bright, very energy-intensive lights, and told us this was the key to scaling up green fuel production.

Seventy. Million. Dollars.

I had to read that twice to make sure I wasn’t missing a few zeros. In the world of aviation, $70 million is what you find down the back of the sofa. It’s the catering budget for a few long-haul routes. It's the cost of maybe one-and-a-half fancy new engines for an A350. And this is their grand plan to decarbonize an entire sector?

This isn't an investment; it's a rounding error. It’s like trying to put out a California wildfire with a Super Soaker. It’s a purely performative act designed to generate headlines like Cathay Group & Airbus Invest $70M To Accelerate SAF Adoption, and it seems to be working. But what does it actually do? The details are, as always, buried in the jargon.

The PR-to-Reality Translator

Let’s pull out the corporate-to-English dictionary for a moment. The announcement says they’re going to "identify, evaluate, and fund commercially viable and technologically mature SAF projects." Translation: they don't have any specific projects yet. They’ve just created a slush fund to go shopping for them. This isn't a factory groundbreaking; it's a press release about maybe, possibly, one day building a factory if they can find a good spot.

Then you get the money quote from Airbus’s man in Asia, Anand Stanley: "The production and distribution of affordable SAF at scale requires an unprecedented cross-sectoral approach." You hear that? That’s the sound of a corporation absolving itself of responsibility before it’s even started. He’s not saying, "We're going to solve this." He's saying, "This problem is so huge that we can't possibly solve it alone, so don't blame us when this $70 million barely makes a dent." It’s a pre-written excuse.

The whole thing feels like a rich guy who, instead of paying his taxes, makes a big show of donating a used car to a local charity. Sure, it’s better than nothing—I guess? But does it fundamentally change anything about the systemic inequality he benefits from? Offcourse not. It just makes him look good at the annual gala.

And who, exactly, are they trying to convince with this? Are we, the flying public, supposed to feel better about our carbon footprint because two massive corporations wrote a check that, for them, is the equivalent of me buying a round of drinks?

Follow the Money, Not the Mission Statement

If you want to know what’s really going on, you have to ignore the green-tinted press release and look at the cold, hard business logic. This isn't about saving the planet. This is about saving their own skins.

For Cathay, this is a brilliant financial hedge. The fact sheet is surprisingly honest about it. They get "earlier and more reliable access to SAF," can "influence which plants get built," and can "lock in long-term procurement prices." This is a pre-emptive strike against a future where SAF is both mandatory and astronomically expensive. They're not buying fuel; they're buying a spot at the front of the line. It also gives them a shiny new talking point for their corporate clients, who are getting increasingly twitchy about the "S" in their ESG reports.

This is a bad deal. No, "bad" doesn't cover it—this is a cynical masterpiece of corporate maneuvering. They get potential equity in these new fuel projects, which means if SAF ever does take off, they’ll profit from the very crisis they helped create. It’s diabolical, and I almost have to respect the sheer audacity of it.

And Airbus? Their motivation is even more transparent. They don't operate airlines; they sell airplanes. Their entire business model depends on airlines being able to fly those planes. With European mandates for SAF usage getting tighter, Airbus needs to ensure there’s actually enough of the stuff to go around. If their customers can't get fuel, they stop buying planes. This investment isn't decarbonization; it’s market protection. It’s ensuring a future revenue stream. They’re not building a green future; they’re just greasing the wheels of their own sales pipeline.

They talk about a "repeatable co-investment model" for Asia. That’s consultant-speak for "we’re going to use this PR blueprint to get other airlines to chip in for our R&D." They throw these numbers around, and we're all supposed to be impressed, but when you actually peel back the layers...

So We're All Supposed to Applaud Now?

Give me a break. This isn't a bold step into a sustainable future. It's a calculated, self-interested business transaction wrapped in a green bow. It’s a pittance offered up to the gods of public relations to keep the regulators and the ESG investors happy for another quarter. It’s a distraction, a shiny object to look at while the planet continues to cook. I’m not buying it, and you shouldn’t either.

Related Articles

Fed's Latest Minutes: What the Data Reveals About Rate Cuts and Internal Disagreement

The Federal Open Market Committee just released the minutes from its September meeting, and if you w...

Forge Global Acquired: What Happened and Why?

Schwab's picking up Forge Global for $660 million. Let's be real, that's not an acquisition, it's a...

Applied Digital's Earnings Report: What to Expect and What It Signals for the Future of AI

Yesterday, for a few dizzying minutes after the market closed, it looked like the story might be a s...

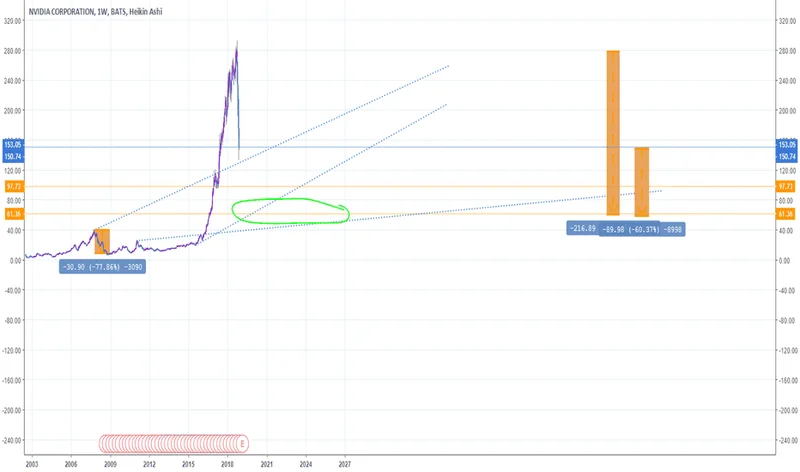

NVDA Stock Is Sinking: Why the Smart Money Is Running and What They're Not Telling You

So, the oracle has spoken. Stanley Druckenmiller, the investing world’s equivalent of a rock god, ha...

Southwest Airlines Overhauls Its Seating Policy: What This Means for Travelers and the Future of Flying

For decades, flying Southwest Airlines felt like stepping into a time capsule. The open seating, the...

The D-Wave (QBTS) Quantum Breakthrough: What This Surge *Really* Means for the Future

Of course. Here is the feature article, written from the persona of Dr. Aris Thorne. * You’ve seen t...