The GameStop (GME) Phenomenon Returns: Decoding the Price Surge and the Reddit Uprising

It’s October 2025, and if you’re feeling a strange sense of déjà vu, you’re not alone. The `GME ticker` is once again glowing an insistent green on screens across the world, social media is buzzing, and that familiar, chaotic energy is back in the air. The `GME stock price` is surging, and the old headlines are being dusted off. But I’m here to tell you this isn't just a sequel. This isn't a lazy Hollywood reboot of the 2021 short squeeze. What we are witnessing is something far more profound, something that has evolved.

When I first saw the Q2 2025 earnings report, I honestly just sat back in my chair, speechless. A quarterly net income of $168.6 million. Nearly $9 billion in cash and marketable securities. This isn't the dying brick-and-mortar retailer we all remember. The company that was once a punchline has quietly transformed itself while everyone was distracted. We’re no longer watching a meme; we're watching a case study in a new kind of corporate entity—one that has survived the fire and learned to use the flames as fuel.

The Phoenix with a Bitcoin Wallet

Let’s be clear: the GameStop of today bears almost no resemblance to the company that was teetering on the brink just a few years ago. The narrative then was simple: a struggling video game pawn shop being disrupted by digital downloads. The narrative now is infinitely more complex and, frankly, more exciting. The company has become a chimera—part high-margin collectibles business, part lean retail operator, and part crypto-heavy investment fund.

With a war chest of over $8.7 billion, a significant chunk of which is in `Bitcoin`, GameStop is no longer just playing defense. It’s playing a whole new game. The leadership team has used the capital injections—funded by the very retail investors who championed the stock—to build a fortress of a balance sheet. They’ve slashed costs, exited unprofitable markets, and pivoted toward what works. This isn't just a turnaround; it's a metamorphosis.

Think of it like this: the 2021 squeeze was the chrysalis. The company went into that chaotic event as one thing—a slow, predictable caterpillar—and has emerged as something entirely different. It’s a hybrid creature, a kind of financial butterfly with digital wings, powered by a decentralized community and a treasury that thinks more like a tech fund than a retailer. What does it even mean for a company’s identity when its balance sheet, and the strategic assets on it, become as important as its quarterly sales figures? Are we witnessing the birth of the "treasury-first" corporation, where capital allocation is the core product?

The Great Wall Street Disconnect

And yet, if you listen to the institutional analysts, you’d think none of this was happening. The consensus on Wall Street is an overwhelming "Sell," with an average price target hovering around a paltry $13.50—less than half of where the `GME stock` currently trades. One of the last major firms covering it, Wedbush, recently just gave up, dropping coverage entirely and telling investors their past ratings should "no longer be considered."

This isn't just a disagreement on valuation; it's a fundamental breakdown in understanding. I believe the analysts are using an old map to navigate a new world. Their models are built for predictable, industrial-era companies that follow a linear path. They're trying to measure a spaceship with a yardstick. They look at the company's legacy software sales, run their discounted cash flow models—in simpler terms, they’re trying to predict future profits based on the old business—and they come up empty.

But they're missing the point entirely. The real value isn't just in the current earnings, as impressive as they’ve become. The value is in the optionality. It’s in the $8.7 billion that can be deployed for acquisitions, investments, or a complete pivot into a new industry. It’s in the unwavering loyalty of a massive online community that acts as a permanent marketing department and a backstop against short sellers. How do you plug that into an Excel spreadsheet? You can't. And that's why they're so utterly lost.

Of course, this new model is built on a foundation of extreme volatility. This is a high-stakes experiment, and the energy of the crowd is a powerful but unpredictable force. For every person who makes a fortune, someone else gets burned chasing the peak. This isn't a safe, stable investment; it's a front-row seat to the future of finance being written in real-time, and that future is messy.

The Crowd-Sourced Engine

So what’s driving this latest surge? It’s a masterclass in modern corporate finance. The recent 11-for-10 stock split and the distribution of `GME warrants` are not just shareholder perks; they are brilliant pieces of financial engineering. This is a direct conversation between a company and its shareholder base conducted not through fawning press releases but through SEC filings and market mechanics—it’s a high-stakes, high-speed dialogue that completely bypasses the traditional gatekeepers of finance.

The warrants, which give shareholders the right to buy more stock at a set price, are a particularly fascinating tool. They essentially invite the company's most ardent supporters to fuel the next phase of growth. It’s a system designed to turn retail enthusiasm directly into corporate capital. The community on `gme reddit` drives up the price and buzz, which makes exercising the warrants more attractive, which in turn injects more cash into GameStop’s war chest, which further strengthens the bull case for the community. It’s a self-perpetuating feedback loop.

This is a company that has learned to speak the language of its investors. It understands that in the 21st century, a loyal community can be a more valuable asset than a fleet of physical stores. The ~15% short interest still lingering on the stock only adds fuel to this engine, creating the constant threat of a squeeze that keeps the retail army engaged and the shorts on edge. So let me ask you this: if a company can successfully align its financial strategy with the collective will of a massive, decentralized online community, does it even need Wall Street’s approval to thrive?

This Isn't a Stock, It's a System Rewriting Itself

Let's stop pretending GameStop is just another company on the New York Stock Exchange. It's not. It has become a living laboratory for the future of corporate governance, decentralized finance, and community power. The stock price is no longer just a reflection of discounted future earnings; it's a real-time sentiment index for a global movement. Whether it soars to the moon or crashes back to earth, the experiment itself is the breakthrough. We are watching the source code of capitalism get forked and rewritten by a swarm of pseudonymous users on the internet, and the lessons we're learning will echo for decades. This, right here, is the story that matters.

Related Articles

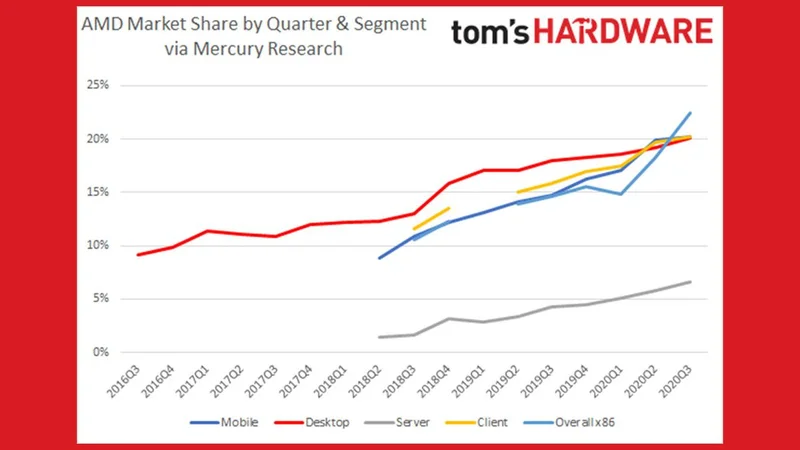

AMD's 58% Rally: Analyzing the Data vs. the Market Hype

The numbers flicker across the screen in an almost hypnotic shade of green. For anyone holding Advan...

The 10-Year Treasury Yield: Why It's the Real Thing Screwing With Your Mortgage, Not the Fed

So You Think the Fed Controls Your Mortgage Rate? Think Again. Let me guess. You saw the headlines i...

PLTR Stock: Cathie Wood Sells, But What's the Big Picture?

Dr. Thorne: Forget the Doubters—Palantir's AI Surge is Just the Beginning! Okay, friends, buckle up....

IBM's Q3 Earnings Beat: Deconstructing the Market's Negative Reaction

Generated Title: IBM Beat the Numbers, But Lost the Narrative. Here's Why. It’s a classic Wall Stree...

Plug Stock's Big Jump: What's Actually Happening and Why You Shouldn't Buy the Hype

So, Plug Power is back. Just when you thought the stock was destined to become a footnote in the ann...

PFE Stock: Guidance Up, Sales Down - What's the Catch?

Pfizer's "Strong EPS Performance"? More Like Smoke and Mirrors Pfizer's patting itself on the back f...