Microsoft's Latest Earnings: Why Their Spending Surge is a Glimpse into Our Future

Yesterday, the tech world was buzzing with a story that felt almost too perfect for the skeptics. Microsoft, the $4 trillion titan, saw its Azure cloud services and Office 365 suite sputter and go dark. On the very day of its massive earnings report, the engine of its future seemed to be failing. Pundits sharpened their knives, ready to carve into the narrative of an over-hyped, over-extended AI boom.

But when the dust settled and the numbers came in, the outage was little more than a footnote. Microsoft didn’t just meet expectations; it blew past them. Microsoft reports strong earnings as Azure hit by major outage. Revenue, profits, and most critically, the growth of its Azure cloud business—up a staggering 40%—all pointed to one undeniable fact. The story isn’t about a momentary glitch. The real story, the one hiding in plain sight within the dry columns of the earnings report, is about a company that can’t build the future fast enough to meet the demand that’s already here.

The Roar of an Unfed Engine

Let’s be clear. When we talk about the billions being poured into AI, the conversation is almost always tinged with anxiety about a bubble. We all remember the dot-com bust. We see the sky-high valuations and the breathless spending—a 74% increase in capital expenditures to nearly $35 billion this quarter alone for Microsoft—and it’s easy to get nervous. But what I saw in this report wasn’t the sign of a bubble. It was the complete opposite.

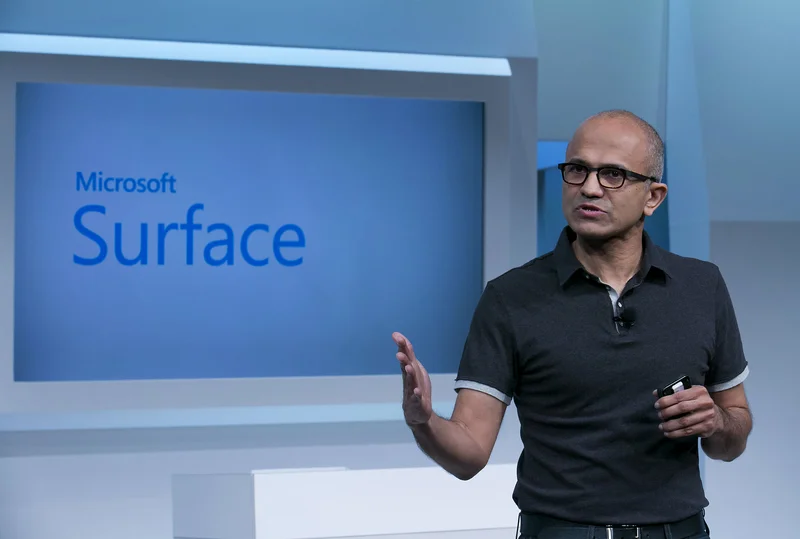

The most important words of the day didn’t come from CEO Satya Nadella’s soaring vision statement, but from CFO Amy Hood’s refreshingly blunt assessment on the earnings call. She explained that this massive spending spree is to meet demand that is already booked. She then delivered the line that, for me, changes everything: “I thought we were going to catch up but we are not,” she admitted. “Demand is increasing and usage is increasing very quickly. When you see these kinds of demand signals, and we know are behind, we need to spend.”

When I read Hood's comments, I honestly had to pause. This isn't the language of speculative finance; it's the language of wartime logistics, of a factory floor running 24/7 and still falling behind on orders. Microsoft, a company with more resources than many nations, is effectively telling the world that it is sold out of the future. The AI revolution isn’t a far-off promise they’re selling to investors; it's a tidal wave of customer demand that has already hit the shore, and they’re scrambling to build a sea wall high enough to handle it.

This spending—the CapEx, or capital expenditures, as they call it—isn't just a number on a spreadsheet. In simpler terms, it’s the physical act of creation. It's the concrete being poured for new data centers the size of aircraft carriers, the miles of fiber-optic cable being laid, and the millions of specialized chips from partners like Nvidia being installed. This is the frantic, global construction project to build the foundational infrastructure for the next era of human ingenuity. What does it truly mean when a company worth over $4 trillion essentially says it can’t keep up?

We've Seen This Before

This moment feels less like 1999 and more like 1909. It’s not about speculating on which dot-com startup will survive; it’s about the race to build the national power grid. Back then, no one was asking if electricity was a fad. The demand was self-evident, from factories needing to power machinery to cities wanting to light their streets. The challenge wasn’t generating interest; it was generating and distributing the power itself. The massive investment in dams, power plants, and transmission lines wasn’t a bubble; it was the necessary, world-changing price of progress.

That’s what we’re seeing today. This spending isn't just for a few new features in Office or a smarter Xbox, it's for a fundamental rewiring of how information flows and how intelligence is generated and distributed across the planet—it’s the kind of shift that changes everything from how we discover new medicines to how we design our products to how we create our art. We are building the grid for intelligence itself.

Of course, this tectonic shift has a human cost. Microsoft’s announcement of 9,000 job cuts earlier this year, and reports of even more at other tech giants, is the difficult, painful side of this transformation. As managers are increasingly asked to justify a human hire when an AI could perform the role, we’re facing a profound societal question. This is our ethical responsibility—to ensure that as we build this incredible new world, we don’t leave humanity behind. We must architect new systems of work, education, and social support with the same fervor that we’re architecting new data centers.

But the fear of this disruption can't stop us from recognizing what’s happening. The demand signals are screaming. The builders are working overtime. The lights of the Azure data centers may have flickered for a moment, but the blueprint for the future is already approved, the contracts are signed, and the foundation is being poured right now, under our feet. The only question is, what will we all build on top of it?

The Foundation is Poured

Let’s put the bubble talk to rest. You don’t have a bubble when the chief problem is a shortage of supply for overwhelming, pre-paid demand. What we’re witnessing isn’t the inflation of a speculative asset. It’s the construction of a new utility—as essential as electricity, as transformative as the internet. The rocket isn't even on the launchpad yet; we're just watching them build the launchpad itself. And from the looks of it, it's going to be much, much bigger than any of us imagined.

Related Articles

Jack's Donuts and the End of an Era: Why It Happened and What It Means for All of Us

Of course. Here is the feature article written from the persona of Dr. Aris Thorne. * You might have...

Spotify's AI Music Initiative: The Strategy, Industry Impact, and What 'Responsible AI' Really Means

Spotify's AI Alliance Isn't About Ethics. It's About Building a Moat. The press releases read like a...

Cathay's Big Green Stunt: What We Know and Why It's Probably BS

So, let me get this straight. Cathay Pacific and Airbus, two titans of an industry that basically ru...

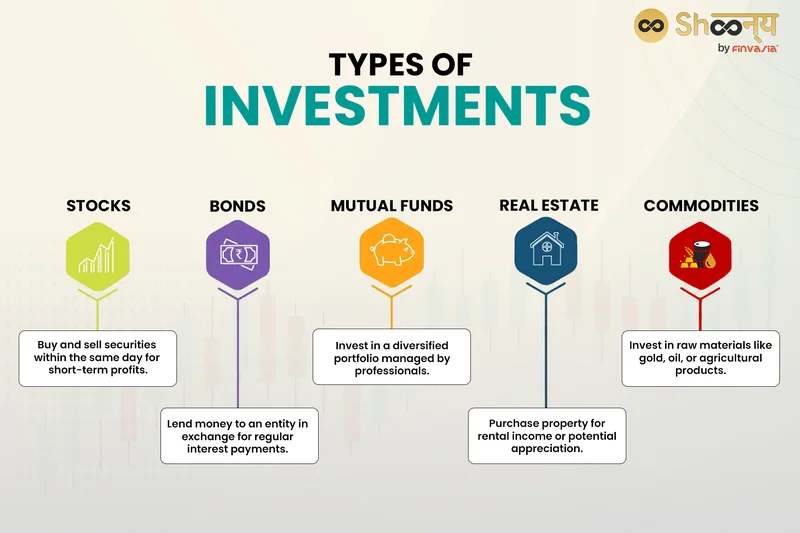

Analyzing 2025's Investment Landscape: What the Data Reveals About Top Asset Classes vs. Low-Risk Alternatives

There's a quiet, pervasive myth circulating among the baby boomer generation as they navigate retire...

The Surprising Tech of Orvis: Why Their Fly Rods, Jackets, and Dog Beds Endure

When I first saw the headlines about Orvis closing 31 of its stores, I didn't feel a pang of nostalg...

The GameStop (GME) Phenomenon Returns: Decoding the Price Surge and the Reddit Uprising

It’s October 2025, and if you’re feeling a strange sense of déjà vu, you’re not alone. The `GME tick...