The VA Loan Myth: What Everyone Gets Wrong and Who to Actually Trust

Alright, let's cut the crap. Every year, the internet vomits up another "Best Of" list for everything from coffee makers to, apparently, the single largest financial decision a veteran will ever make. This time it's the "7 Best VA Loan Lenders of 2025," and it’s presented with all the slick, sterile confidence of a corporate PowerPoint presentation.

It's a neat little package, isn't it? loanDepot is "Best Overall." Rocket Mortgage is "Best for Refinancing." CrossCountry is for you fixer-upper types. They've got a box for everyone. You just pick your category, click the shiny "VISIT SITE" button, and boom, you're on your way to the American Dream.

Except it's not that simple, and these lists are, to put it mildly, a joke. They're a marketing funnel disguised as a public service.

This isn't like picking a brand of toothpaste. We're talking about a 30-year commitment, a benefit earned through service, sweat, and sacrifice. And we're supposed to trust a list that feels like it was put together by an algorithm designed to maximize affiliate clicks. I mean, they literally say "We may be compensated if you click this ad" right at the top. At least they're honest about that part.

The Glossy Brochure vs. The Grimy Reality

Here's where the whole thing falls apart for me. You have to dig into the fine print, into the "Other companies we considered" section, to get a whiff of the truth. It's the part they hope you'll skim.

They mention USAA, a name synonymous with the military, right? Then they casually drop that it has a 1.2-star rating on Trustpilot, with a staggering 88% of customers giving it one star. One star. How does a comapny even manage that? Then there's Navy Federal, the third-largest VA lender in the nation, which apparently has an 'F' rating with the Better Business Bureau for not handling customer complaints. An 'F'.

It's like looking at a dating profile. The main list is the curated, perfect photos from that one vacation five years ago. The "Why we didn't choose it" section is the tagged photos from their cousin's wedding where they're passed out in a bush. Which one tells you more about who you're really dealing with?

And even the "winners" have their issues. Regulatory actions, no advertised rates, higher-than-average interest costs. Veterans United is crowned "Best for Customer Service," which sounds fantastic until you read they also have the "Highest average interest rates on our list." So, they'll be really, really polite while they charge you more than anyone else? What kind of a choice is that? It ain't a choice; it's a trap.

This isn't just bad analysis. No, 'bad' doesn't cover it—this is a fundamentally dishonest way to frame a life-altering decision. They're selling the sizzle while hoping you don't notice the steak is rotten.

"Misconceptions" is Just a Nice Word for "Getting Screwed"

Then you get the PR spin. An article quoting a Navy Federal exec—the same Navy Federal with the 'F' rating, mind you—says veterans have "misconceptions" that prevent them from using their VA loan benefit. Another source claims "myths can discourage both buyers and real estate professionals."

Give me a break.

Maybe, just maybe, the problem isn't that veterans are misinformed. Maybe the problem is that the system is a confusing, predator-filled labyrinth. Maybe veterans are hesitant because they hear horror stories from their buddies about lenders who don't return calls, appraisers who lowball, and closing costs that mysteriously balloon at the last minute.

The VA itself talks about how this benefit is supposed to fulfill Lincoln's promise "To care for him who shall have borne the battle and for his widow, and his orphan." It's a sacred trust. They specifically mention its importance for Gold Star Spouses—as detailed in Surviving spouses and VA home loans—people who have already paid an unimaginable price. Are we really supposed to believe that these lenders with F ratings and a history of regulatory smackdowns are the best stewards of that trust?

They're counting on you being too overwhelmed by the process, too distracted by the jargon of IRRRLs and COEs, to ask the hard questions. They want you to believe the problem is your "knowledge gap," not their business model. They're counting on you to just click the button...

So, Who's Actually Serving Who?

Look, I'm not saying all these lenders are evil. But I am saying that these "Best Of" lists are worse than useless; they're dangerous. They create the illusion of a safe, vetted choice where one doesn't exist. The VA loan is an incredible benefit, a powerful tool earned in service to the country. But the tool is only as good as the hand that wields it, and the lenders are not your battle buddies. They're businesses. Their primary mission is their bottom line, not yours. Don't ever forget that. The only person who's truly going to look out for your best interests is you. So do the homework. Read the one-star reviews. Ask the uncomfortable questions. Trust your gut, not a sponsored listicle.

Related Articles

John Malkovich Cast as President Snow: An Analysis of the Casting and Its Implications

The announcement landed with the precision of a well-funded marketing campaign. The Hunger Games, a...

Tesla's $56 Billion Crossroads: Why Robyn Denholm's Warning Is a Defining Moment for the Future of Tech

This isn't just a headline; it's a question about the very nature of the future. When I saw the news...

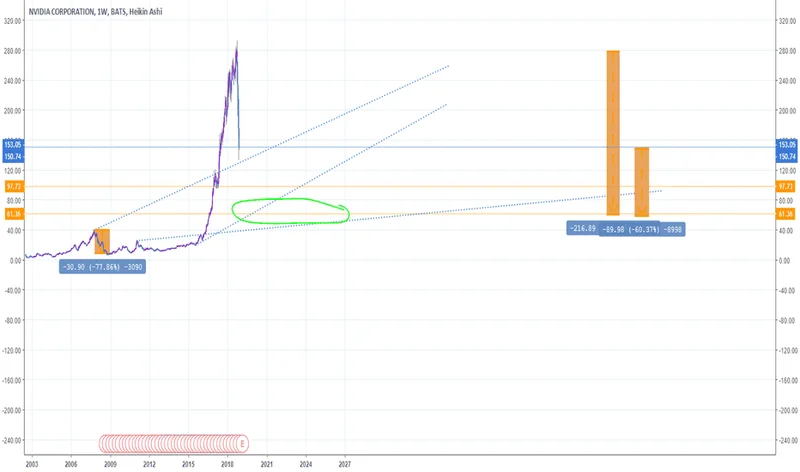

NVDA Stock Is Sinking: Why the Smart Money Is Running and What They're Not Telling You

So, the oracle has spoken. Stanley Druckenmiller, the investing world’s equivalent of a rock god, ha...

The 10-Year Treasury Yield: Why It's the Real Thing Screwing With Your Mortgage, Not the Fed

So You Think the Fed Controls Your Mortgage Rate? Think Again. Let me guess. You saw the headlines i...

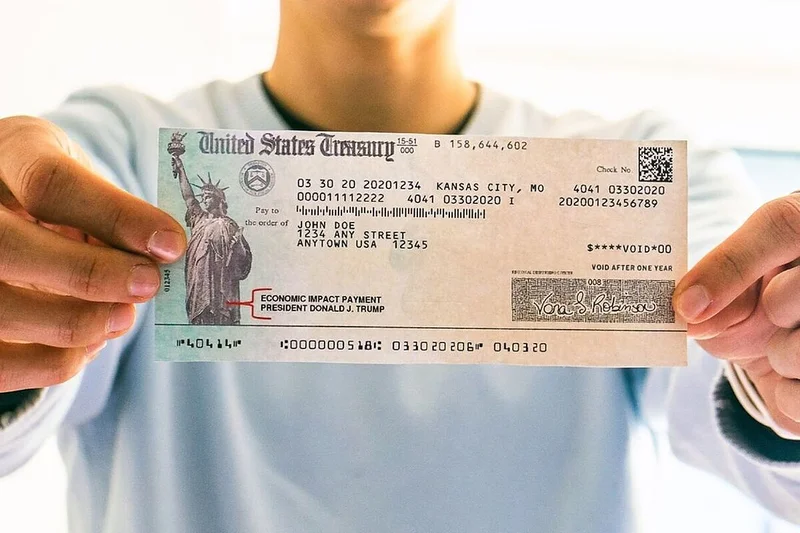

IRS Stimulus Checks 2025: What We Know

Another Stimulus Check? Don't Bet Your Bitcoin On It The internet's buzzing again with rumors of ano...

primerica: What to Know – A Reality Check

Nvidia's AI Hype Train: Are We There Yet? Nvidia. The name is practically synonymous with the AI rev...