The Rise of 'Team Stock': What It Is and Why It's the Future of Innovation

ABSOLUTE DIRECTIVE: NARRATIVE STANCE ###

The event described in the [Structured Fact Sheet]—Everest Group's Q3 earnings report and subsequent stock drop—has a definitive "ending." The results were released, the market reacted, and analysts published their revisions. The article will be framed around this outcome, adopting a retrospective and analytical tone to uncover its deeper meaning.

*

You probably saw the headlines last week. One, titled Why Everest Group Stock Was Wilting This Week, detailed a post-earnings tumble of over 11%. It’s the kind of story that flashes across a trader’s screen for a moment before being replaced by the next market tremor. A miss on revenue, a sharp drop in operating income, a handful of analysts dutifully trimming their price targets.

But to dismiss this as just another bad quarter for an insurance company is to miss the point entirely. This isn't a story about stock prices or analyst consensus. It’s a flare in the dark, a signal that the fundamental operating system of our global economy is beginning to buckle under the weight of a new reality. When I saw the numbers, I didn't just see a spreadsheet; I saw a warning bell tolling for all of us. This is the kind of data point that reminds me why I left the lab—because the most profound revolutions aren't happening in a petri dish anymore. They're happening in the invisible, computational models that run our world.

The Canary in the Coal Mine

Let's get into the specifics for a moment, because the devil isn't just in the details; he's screaming from them. The key metric for any insurer is something called the "combined ratio." This isn't some arcane Wall Street jargon; it’s actually incredibly simple. It measures the money an insurer pays out in claims and expenses against the money it brings in from premiums. In simpler terms, it's their core profitability scorecard. A ratio below 100% means you’re making money on your policies. A ratio above 100% means you’re losing money.

Everest Group’s combined ratio jumped to 103.4%.

Let that sink in. For every dollar they collected, they paid out more than a dollar and three cents. This isn't just a slight miss; it's a fundamental breakdown in their ability to predict the future. Their models, the complex algorithms designed to price risk, were wrong. And they weren’t just a little wrong; they were catastrophically wrong, missing the average analyst profit estimate by nearly 50%.

Why? The official report will be filled with carefully chosen words, but the answer is all around us. We are living in an age of exponential, interconnected risk. Wildfires of unprecedented scale, "100-year" floods that now seem to arrive every few seasons, and cyberattacks that can cripple infrastructure in the blink of an eye. The stable, predictable world that these insurance models were built to underwrite is, frankly, gone. Using these old models to navigate our current reality is like trying to use a 17th-century sea chart to navigate the asteroid belt. The map is not just wrong; it’s describing a reality that no longer exists.

So, what does it mean when the people whose entire business is to price the future get it this wrong? Does it mean we’re doomed to a future of chaos and uncertainty?

Absolutely not. It means we are on the cusp of one of the greatest technological and economic opportunities of the 21st century.

Building the New Ark

The failure of old models is always, without exception, the catalyst for the creation of new ones. The invention of actuarial science in the 1600s didn't just create the insurance industry; it created the bedrock of certainty that allowed for global trade, massive infrastructure projects, and the entire concept of long-term investment. It was a paradigm shift in how humanity quantified the future.

We are standing at the threshold of another such shift. And this time, our tools are infinitely more powerful.

Imagine a new generation of insurance models—no, let's call them "reality models"—powered not by historical tables but by a live, torrential downpour of real-time data. We’re talking about a fusion of AI that can see patterns we can’t, satellite imagery that tracks soil moisture to predict crop failures before they happen, IoT sensors that monitor the structural integrity of a bridge during an earthquake, and climate models running on quantum-inspired hardware. This isn't science fiction; the components are all here, right now. The speed at which these data streams can be integrated and analyzed is just staggering—it means the gap between a disruptive event and our ability to understand and price its ripple effects is closing faster than we can even comprehend.

This is the opportunity that the Everest Group’s "failure" illuminates. The multi-trillion-dollar insurance industry, and by extension the entire global financial system that relies on it, must be rebuilt from the ground up on a new technological foundation. We need to build a new Ark, a digital one, capable of navigating the turbulent waters of the 21st century.

Of course, this comes with immense responsibility. Wielding this kind of predictive power demands a new level of ethical oversight. Who owns the data? What biases are we building into these new models of reality? We can't just build a more efficient system; we have to build a more just and resilient one. The goal isn't just to predict the next disaster to protect capital, but to understand it so we can protect people. What if these models could tell a city not just that a flood is coming, but precisely which power substations are most vulnerable, allowing them to pre-emptively save a community from weeks of darkness?

That’s the future that gets me out of bed in the morning. A future where we don’t just react to risk, but get ahead of it, using technology not as a shield, but as a searchlight.

The Future Isn't Risky, It's Just Unmodeled

Let's be clear. The market sees Everest Group's bad quarter and punishes a single company. I see it and feel a profound sense of optimism. It’s the sound of an old world cracking open to make way for a new one. The challenge ahead of us isn’t that the world has become too dangerous; it’s that our tools for understanding it have become too dull. The innovators, the builders, the visionaries who create the next generation of predictive tools won’t just be creating a new industry; they’ll be providing the certainty and stability upon which the next century of human progress will be built. This is our moment to upgrade the map.

Related Articles

The Fed's Big Rate Cut Promise: And the Mess It Made for Your Mortgage

So the Fed finally did it. They cut the interest rate. You can almost hear the champagne corks poppi...

Scott Bessent vs. an 'Unhinged' Chinese Official: The Full Story and Why It's a Bigger Deal Than You Think

So, let me get this straight. The entire global economic system, the intricate web of supply chains...

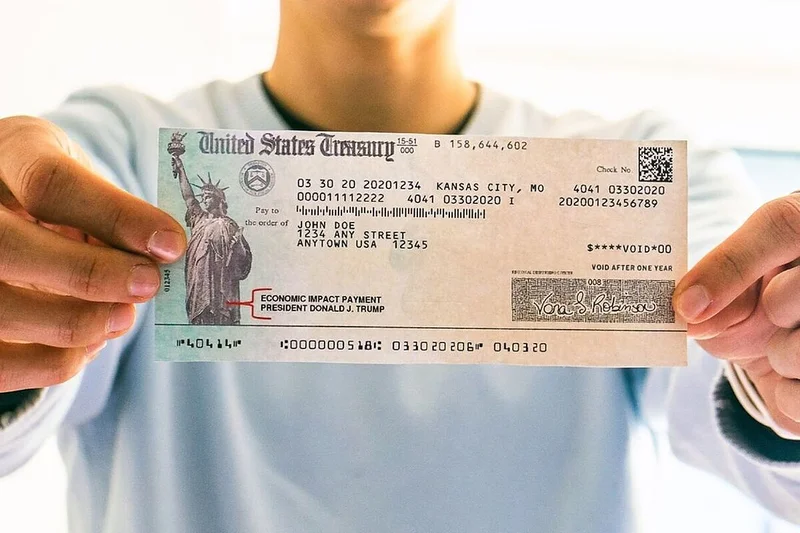

IRS Stimulus Checks 2025: What We Know

Another Stimulus Check? Don't Bet Your Bitcoin On It The internet's buzzing again with rumors of ano...

Bitcoin: Fed's $29.4B Injection – What the Hell Does It Mean?

Okay, so the Fed injected almost 30 billion bucks into the banking system last Friday. $29.4 billion...

guangzhou: What's Happening?

China's Flying Car Factory: The West Was Asleep at the Wheel (Again) So, we're all supposed to be wo...

US Approves Nvidia Sales to UAE: An Analysis of the G42 Deal and Its Geopolitical Implications

It’s a familiar ritual for anyone in this business. The pre-market hum, the first cup of coffee, and...