That 700% BNB Attestation Service Pump: What Is It and Should You Even Care?

So, let me get this straight. There’s a token called BNB Attestation Service, or BAS, that went on an absolutely unhinged 700% tear. We’re talking about a move from a penny to over eleven cents, fueled by a couple of “whales” dropping millions of dollars on it. The trading volume spiked to $200 million in a day. It’s the kind of vertical chart that makes crypto bros on Twitter change their profile pics to laser eyes.

And what is this revolutionary product that’s changing the world and justifying this madness? A "Web3 identity passport."

A digital passport. That’s it. We’re in a speculative frenzy over on-chain identity verification. This is a bad idea. No, 'bad' doesn't cover it—this is a symptom of a market that has completely lost its mind. We’re not investing in companies building tangible things anymore; we’re placing multi-million dollar bets on the digital equivalent of a glorified driver's license.

The Whale in the Room

Let's be real about this rally. This ain't your grandma buying a few tokens on Coinbase. One report, titled BNB Attestation Service (BAS) posts price records after 700% rally week, lays it out plain as day: one whale spent over $2 million buying BAS, even at its all-time high. Another wallet, holding over $22 million in assets, was scooping it up at five cents. This isn't organic growth. This is a manufactured feeding frenzy.

The report even throws in a little warning, mentioning that the token supply is distributed to "small wallets, which are still interconnected and bundled." You don't need a PhD in blockchain analytics to translate that. It’s like watching a magician put a coin under one of three cups and shuffle them around. It looks like a lot of activity, but it’s all controlled by the same pair of hands. Who are these people, really? And why are they so convinced this digital passport is the next big thing? Or do they just know something we don't about an upcoming exchange listing?

And the project's own developer is just sitting on 1.29 million tokens, selling off tiny bits... I mean, you do the math. It’s the classic crypto playbook: build hype, get the big money in to pump the price, and hope the retail suckers follow. It’s a game as old as time, just with more complicated jargon.

Then again, maybe I'm the crazy one here. Maybe I’m just too cynical. But when I see this kind of coordinated buying on a project that hasn't even been fully launched, my alarm bells don't just ring; they scream.

A Passport to Nowhere?

So let's talk about the product itself. In September 2025—yes, you read that right, the press release is from the future—BAS is partnering with a company called Sumsub to "streamline Web3 identity verification," as announced in Sumsub Partners with Binance’s BNB Attestation Service to Streamline Web3 Identity Verification. Users can get pre-verified and receive "on-chain attestations" tied to their wallets.

Here’s the corporate-speak from Sumsub’s Chief Growth Officer, Ilya Brovin: "we will continue to lay the groundwork for a more open, trusted, and user-centric Web3 environment."

My translation? "We’ve found a way to attach your real-world government ID to your anonymous crypto wallet, and we’re marketing it as freedom." Give me a break. The whole initial promise of crypto was pseudonymity, a break from the system. Now the big-brain move is to... eagerly invite the system in?

This whole "Web3 passport" is like being sold a ridiculously expensive, diamond-encrusted key. The sellers tell you this key will unlock the doors to the glittering city of the future. But when you look around, the city hasn't been built yet. There are just empty lots and a few blueprints. Yet, people are bidding millions of dollars for the key, convinced it'll be worth a fortune someday. Right now, offcourse, it opens nothing.

And what problem is this even solving for the average person? I’ve got enough identity headaches with my dozen passwords for streaming services and email accounts. I don't need another layer of verification just to use some decentralized app that lets me trade pictures of cartoon cats. It feels less like a user-centric revolution and more like another layer of bureaucratic nonsense designed to make a few insiders rich.

Another Solution in Search of a Problem

Look, I get it. The Web3 space needs to mature. It needs better security, more accountability, and a way to filter out the scammers. But is this it? Financializing our very identity and handing the keys to a centralized verification provider, all while a handful of whales manipulate the token price in the background? It feels like we’re just rebuilding the same flawed systems we were trying to escape, only this time with more buzzwords and a token that can be pumped 700% in a week. The project is running airdrops and marketing campaigns, but the core question remains unanswered: who is this actually for, besides the people who got in at a penny? It ain’t for me.

Related Articles

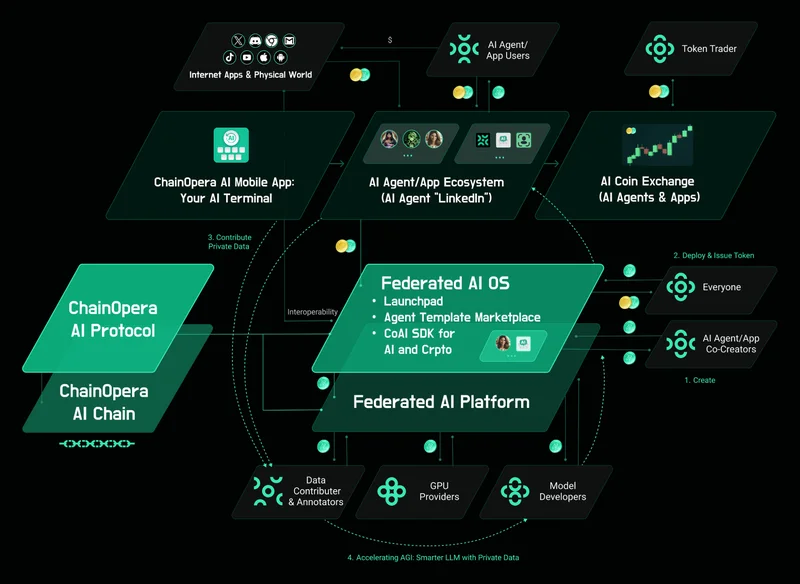

ChainOpera AI's $4 Billion Valuation: What the Numbers Actually Say About Its Growth

The spectacular implosion of a financial asset is always instructive. But the case of ChainOpera AI’...

TransUnion Data Breach: What Happened and How to Freeze Your Credit

The number, when it finally arrived, was 4.4 million. On August 28, TransUnion, one of the three pil...

The Latest Joshua Allen Death Hoax: What's True and Why This Garbage Keeps Spreading

So I’m trying to track down the details on this Joshua Allen story, and the first thing I hit is a b...

Xavien Howard's Abrupt Retirement: What the Stats, Contract, and Career Earnings Tell Us

In professional sports, as in financial markets, narratives are constructed to explain volatility. A...

MetaMask: What It Is, How to Get It, and Why the Hell You'd Bother – What Reddit's Actually Saying

Welcome to the Crypto Wild West: Google's Search Bar Edition Alright, let's cut the corporate BS. Wh...

ChainOpera AI's 2,200% Surge: The Real Math Behind Its Explosive Growth and What Comes Next

The Anatomy of a Hype Cycle, or a Glimpse of the Future? There are moments in the market when an ass...